Royal Caribbean Cruise Lines 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

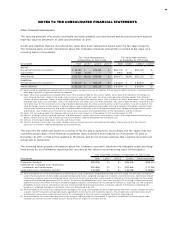

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

repairs as may be required. We have determined we

are not the primary beneficiary of this facility, as we

do not have the power to direct the activities that

most significantly impact the facility’s economic per-

formance. Accordingly, we do not consolidate this

entity and we account for this investment under the

equity method of accounting. As of December 31,

2012 and December 31, 2011, the net book value of

our investment in Grand Bahama, including equity

and loans, was approximately $59.3 million and $61.4

million, respectively, which is also our maximum expo-

sure to loss as we are not contractually required to

provide any financial or other support to the facility.

The majority of our loans to Grand Bahama are in

non-accrual status and the majority of this amount

was included within other assets in our consolidated

balance sheets. We received approximately $5.5 mil-

lion and $10.8 million in principal and interest payments

related to loans that are in accrual status from Grand

Bahama in 2012 and 2011, respectively, and recorded

income associated with our investment in Grand

Bahama. We monitor credit risk associated with these

loans through our participation on the Grand Bahama’s

board of directors along with our review of the Grand

Bahama’s financial statements and projected cash

flows. Based on this review, we believe the risk of loss

associated with these loans was not probable as of

December 31, 2012.

In conjunction with our acquisition of Pullmantur in

2006, we obtained a 49% noncontrolling interest

in Pullmantur Air, S.A. (“Pullmantur Air”), a small

air business that operates four aircraft in support

of Pullmantur’s operations. We have determined

Pullmantur Air is a VIE for which we are the primary

beneficiary as we have the power to direct the activi-

ties that most significantly impact its economic per-

formance and we are obligated to absorb its losses.

In accordance with authoritative guidance, we have

consolidated the assets and liabilities of Pullmantur

Air. We do not separately disclose the assets and

liabilities of Pullmantur Air as they are immaterial

to our December 31, 2012 and December 31, 2011

consolidated financial statements.

We have determined that TUI Cruises GmbH, our

50%-owned joint venture which operates the brand

TUI Cruises, is a VIE. As of December 31, 2012 and

December 31, 2011, our investment in TUI Cruises,

including equity and loans, was approximately $287.0

million and $282.0 million, respectively, and the

majority of this amount was included within other

assets in our consolidated balance sheets. In addition,

in conjunction with our sale of Celebrity Mercury to

TUI Cruises in 2011, we and TUI AG each guaranteed

the repayment of 50% of an €180.0 million 5-year bank

loan provided to TUI Cruises (refer to further details

below). This investment amount and the potential

obligations under this guarantee are substantially our

maximum exposure to loss. We have determined that

we are not the primary beneficiary of TUI Cruises.

We believe that the power to direct the activities that

most significantly impact TUI Cruises’ economic per-

formance are shared between ourselves and our joint

venture partner, TUI AG. All the significant operating

and financial decisions of TUI Cruises require the con-

sent of both parties which we believe creates shared

power over TUI Cruises. Accordingly, we do not con-

solidate this entity and account for this investment

under the equity method of accounting.

In connection with our sale of Celebrity Mercury

to TUI Cruises in 2011, we provided a debt facility

to TUI Cruises in the amount of up to €90.0 million.

The outstanding principal amount of the facility as

of December 31, 2012 was €68.6 million, or approxi-

mately $90.4 million based on the exchange rate at

December 31, 2012. The loan bears interest at the rate

of 9.54% per annum, is payable over seven years, is

50% guaranteed by TUI AG (our joint venture partner)

and is secured by second mortgages on both of TUI

Cruises’ ships, Mein Schiff 1 and Mein Schiff 2. In addi-

tion, we and TUI AG each guaranteed the repayment

of 50% of an €180.0 million 5-year bank loan provided

to TUI Cruises, of which €153.0 million, or approxi-

mately $201.7 million based on the exchange rate at

December 31, 2012, remains outstanding as of Decem-

ber 31, 2012, in connection with the sale of the ship.

The bank loan amortizes quarterly and is secured

by first mortgages on both Mein Schiff 1 and Mein

Schiff 2. Based on current facts and circumstances,

we do not believe potential obligations under this

guarantee are probable.

During 2011, TUI Cruises entered into a construction

agreement with STX Finland to build its first newbuild

ship, scheduled for delivery in the second quarter of

2014. TUI Cruises has entered into a credit agreement

for financing of up to 80% of the contract price of the

ship. The remaining portion of the contract price of

the ship will be funded through either TUI Cruises’

cash flows from operations or loans and/or equity

contributions from us and TUI AG. The construction

agreement includes certain restrictions on each of

our and TUI AG’s ability to reduce our current owner-

ship interest in TUI Cruises below 37.5% through the

construction period. In addition, the credit agreement

extends this restriction through 2019. In 2012, TUI

Cruises exercised their option under the agreement

with STX Finland to construct their second newbuild

ship, scheduled for delivery in the second quarter of

2015. TUI Cruises has secured a bank financing com-

mitment for 80% of the contract price of the second