Royal Caribbean Cruise Lines 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

PART II

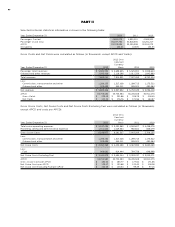

Net Cruise Costs

Net Cruise Costs increased 6.9% in 2012 compared to

2011 due to the 1.4% increase in capacity and a 5.4%

increase in Net Cruise Cost per APCD. The increase

in Net Cruise Costs per APCD was primarily due to

an increase in fuel and Pullmantur’s land-based tours,

hotel and air packages expenses as discussed above.

In addition, the increase in Net Cruise Cost per APCD

was due to the changes in our international distribu-

tion system mainly in Brazil and certain deployment

initiatives. Net Cruise Costs per APCD increased 6.8%

in 2012 compared to 2011 on a Constant Currency basis.

Net Cruise Costs Excluding Fuel per APCD increased

2.7% in 2012 compared to 2011. Net Cruise Costs

Excluding Fuel per APCD increased 4.2% in 2012 com-

pared to 2011 on a Constant Currency basis.

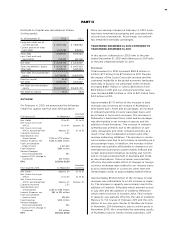

YEAR ENDED DECEMBER 31, 2011 COMPARED TO

YEAR ENDED DECEMBER 31, 2010

In this section, references to 2011 refer to the year

ended December 31, 2011 and references to 2010 refer

to the year ended December 31, 2010.

Revenues

Total revenues for 2011 increased $784.8 million or

11.6% to $7.5 billion from $6.8 billion in 2010. Approxi-

mately $507.8 million of this increase was attributable

to a 7.5% increase in capacity. The increase in capac-

ity was primarily due to a full year of revenue gener-

ated by Allure of the Seas which entered service in

December 2010, the addition of Celebrity Silhouette

which entered service in July 2011, and a full year of

Celebrity Eclipse which entered service in April 2010.

This increase in capacity was partially offset by the

sale of Celebrity Mercury to TUI Cruises in February

2011. In addition, approximately $277.0 million of the

increase in revenue was driven by an increase in ticket

prices and the favorable effect of changes in foreign

currency exchange rates related to our revenue trans-

actions denominated in currencies other than the

United States dollar. These increases were partially

mitigated by the impact of geopolitical events includ-

ing the political unrest in the Eastern Mediterranean

and Northern Africa and the earthquake and related

events in Japan which offset pricing improvements in

other regions. These events resulted in deployment

changes to avoid calling on ports in those areas and

pricing reductions to stimulate demand in other areas.

Onboard and other revenues included concession rev-

enues of $273.4 million in 2011 compared to $237.0

million for the same period in 2010. The increase in

concession revenues was due to an increase in spend-

ing on a per passenger basis and the increase in

capacity mentioned above.

Cruise Operating Expenses

Total cruise operating expenses for 2011 increased

$484.5 million or 10.9% to $4.9 billion from $4.5 bil-

lion for 2010. Approximately $335.2 million of the

increase was attributable to the 7.5% increase in

capacity mentioned above. Other significant drivers

of the increase include an increase in fuel, air and

other hotel and vessel expenses and head taxes, as

well as the unfavorable effect of changes in foreign

currency exchange rates related to our cruise oper-

ating expenses denominated in currencies other than

the United States dollar. Fuel expenses, which are

net of the financial impact of fuel swap agreements,

increased 18.4% per metric ton in 2011 as compared

to 2010 primarily as a result of increasing fuel prices.

The increase in air and other hotel and vessel

expenses and head taxes were primarily due to

deployment changes.

Marketing, Selling and Administrative Expenses

Marketing, selling and administrative expenses for 2011

increased $112.5 million or 13.3% to $960.6 million

from $848.1 million for 2010. The increase was due to

an increase in marketing, selling and payroll expenses

primarily associated with our international expansion

and, to a much lesser extent, an increase in expenses

associated with technological innovations.

Depreciation and Amortization Expenses

Depreciation and amortization expenses for 2011

increased $58.7 million or 9.1% to $702.4 million from

$643.7 million for 2010. The increase is primarily

due to a full year of Allure of the Seas which entered

service in December 2010, the addition of Celebrity

Silhouette which entered service in July 2011, and a

full year of Celebrity Eclipse which entered service in

April 2010. These increases were partially offset by

the sale of Celebrity Mercury to TUI Cruises and the

sale of Bleu de France.

Other Income (Expense)

Interest expense, net of interest capitalized, increased

to $382.4 million in 2011 from $371.2 million in 2010.

The increase was due to a reduction in interest capi-

talized for ships under construction. Interest capital-

ized decreased to $14.0 million in 2011 from $28.1

million in 2010 primarily due to a lower average level

of investment in ships under construction. Gross inter-

est expense decreased to $396.4 million from $399.3

million in 2010. The decrease was primarily due to

lower interest rates partially offset by a higher aver-

age debt level.

Other income decreased to $32.9 million in 2011 from

$75.0 million in 2010. The $42.1 million decrease in

other income was due primarily to an $89.0 million

gain recorded from a litigation settlement during 2010

that did not recur in 2011, which was partially offset by: