Royal Caribbean Cruise Lines 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

PART II

December 31, 2012. (See Note 13. Fair Value Meas-

urements and Derivative Instruments and Note 14.

Commitments and Contingencies to our consolidated

financial statements under Item 8. Financial State-

ments and Supplementary Data).

As of December 31, 2012, we anticipated overall capi-

tal expenditures will be approximately $0.7 billion

for 2013, $1.2 billion for 2014, $1.2 billion for 2015 and

$1.3 billion for 2016.

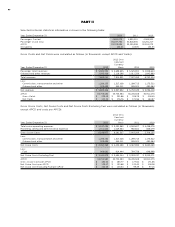

CONTRACTUAL OBLIGATIONS

As of December 31, 2012, our contractual obligations were as follows (in thousands):

Payments Due By Period

Total

Less Than

1 Year 1–3 Years 3–5 Years

More Than

5 Years

Operating Activities:

Operating lease obligations(1)(2)

Interest on long-term debt(3)

Other(4)

Investing Activities:

Ship purchase obligations(5) —

Financing Activities:

Long-term debt obligations(6)

Capital lease obligations(7)

Other(8)

Total

(1) We are obligated under noncancelable operating leases primarily for a ship, offices, warehouses and motor vehicles.

(2) Under the Brilliance of the Seas lease agreement, we may be required to make a termination payment of approximately £65.4 million, or approxi-

mately $106.3 million based on the exchange rate at December 31, 2012, if the lease is canceled in 2020. This amount is included in the more than

5 years column.

(3) Long-term debt obligations mature at various dates through fiscal year 2027 and bear interest at fixed and variable rates. Interest on variable-rate

debt is calculated based on forecasted debt balances, including interest swapped using the applicable rate at December 31, 2012. Debt denomi-

nated in other currencies is calculated based on the applicable exchange rate at December 31, 2012.

(4) Amounts represent future commitments with remaining terms in excess of one year to pay for our usage of certain port facilities, marine consum-

ables, services and maintenance contracts.

(5) Amounts represent contractual obligations with initial terms in excess of one year. Amounts include our third Oasis-class ship which was ordered

under a conditional agreement in December 2012 and is expected to become effective in the first quarter of 2013.

(6) Amounts represent debt obligations with initial terms in excess of one year.

(7) Amounts represent capital lease obligations with initial terms in excess of one year.

(8) Amounts represent fees payable to sovereign guarantors in connection with certain of our export credit debt facilities and facility fees on our

revolving credit facilities.

As a normal part of our business, depending on mar-

ket conditions, pricing and our overall growth strat-

egy, we continuously consider opportunities to enter

into contracts for the building of additional ships. We

may also consider the sale of ships or the purchase

of existing ships. We continuously consider potential

acquisitions and strategic alliances. If any of these

were to occur, they would be financed through the

incurrence of additional indebtedness, the issuance

of additional shares of equity securities or through

cash flows from operations.

OFF-BALANCE SHEET ARRANGEMENTS

In July 2002, we entered into an operating lease

denominated in British pound sterling for the Brilliance

of the Seas. The lease payments vary based on sterling

LIBOR. The lease has a contractual life of 25 years;

however, both the lessor and we have certain rights to

cancel the lease at year 18 (i.e. 2020) upon advance

notice given approximately one year prior to cancel-

lation. In the event of early termination at year 18,

we have the option to cause the sale of the vessel at

its fair value and to use the proceeds towards the

applicable termination payment. Alternatively, we

could opt at such time to make a termination payment

of approximately £65.4 million, or approximately $106.3

million based on the exchange rate at December 31,

2012 and relinquish our right to cause the sale of the

vessel. Under current circumstances we do not believe

early termination of this lease is probable.

Under the Brilliance of the Seas operating lease, we

have agreed to indemnify the lessor to the extent

its after-tax return is negatively impacted by unfavor-

able changes in corporate tax rates, capital allowance

deductions and certain unfavorable determinations

which may be made by United Kingdom tax authori-

ties. These indemnifications could result in an increase

in our lease payments. We are unable to estimate the

maximum potential increase in our lease payments due

to the various circumstances, timing or a combination

of events that could trigger such indemnifications.

The United Kingdom tax authorities are disputing the

lessor’s accounting treatment of the lease and the

lessor and tax authorities are in discussions on the

matter. If the characterization of the lease is ultimately

determined to be incorrect, we could be required to