Royal Caribbean Cruise Lines 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

PART II

Croisières de France, on a two-month lag to allow for

more timely preparation of our consolidated financial

statements. (See Note 1. General to our consolidated

financial statements under Item 8. Financial State-

ments and Supplementary Data). The increase in

capacity was also partially offset by the delivery of

Ocean Dream to an unrelated third party in April 2012

as part of a six-year bareboat charter agreement.

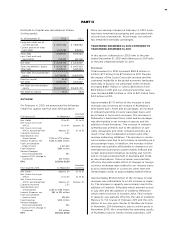

Cruise Operating Expenses

Total cruise operating expenses for 2012 increased

$214.8 million or 4.3% to $5.2 billion from $4.9 billion

for 2011. Approximately $219.4 million of this increase

was attributable to increases in fuel expenses, and

expenses related to Pullmantur’s land-based tours,

hotel and air packages. Fuel expenses, which are

net of the financial impact of fuel swap agreements

accounted for as hedges, increased 15.2% per metric

ton in 2012 as compared to 2011 primarily as a result

of increasing fuel prices. The increase in Pullmantur’s

land-based tours, hotel and air packages expenses was

primarily attributable to an increase in guests and the

addition of new itineraries. These increases were par-

tially offset by a decrease in commissions expenses

attributable to increased charter business and changes

in our distribution channels. In addition, $69.9 million of

the increase in cruise operating expenses was attrib-

utable to the 1.4% increase in capacity mentioned

above. These increases in cruise operating expenses

were partially offset by the favorable effect of changes

in foreign currency exchange rates related to our

cruise operating expenses denominated in currencies

other than the United States dollar of approximately

$74.5 million.

Marketing, Selling and Administrative Expenses

Marketing, selling and administrative expenses for

2012 increased $50.9 million or 5.3% to $1.0 billion

from $960.6 million for 2011. The increase was due to

an increase in costs associated with investments in

technology and to an increase in advertising expenses

related to our global expansion. These increases were

partially offset by the favorable effect of changes in

foreign currency exchange rates related to our mar-

keting, selling and administrative expenses denomi-

nated in currencies other than the United States dollar.

Depreciation and Amortization Expenses

Depreciation and amortization expenses for 2012

increased $28.1 million or 4.0% to $730.5 million

from $702.4 million for 2011. The increase was primar-

ily due to the addition of Celebrity Silhouette which

entered service in July 2011, the addition of Celebrity

Reflection which entered service in October 2012 and

to new shipboard additions associated with our ship

revitalization projects. This increase was partially off-

set by the sale of Celebrity Mercury to TUI Cruises in

February 2011.

Impairment of Pullmantur Related Assets

During 2012, we recognized an impairment charge

of $385.4 million to write down Pullmantur’s good-

will to its implied fair value and to write down trade-

marks and trade names and certain long-lived assets,

consisting of three aircraft owned and operated by

Pullmantur Air, to their fair value. (See Valuation of

Goodwill, Indefinite-Lived Intangible Assets and Long-

Lived Assets above for more information regarding

the impairment of these assets).

Other Income (Expense)

Interest expense, net of interest capitalized, decreased

to $355.8 million in 2012 from $382.4 million in 2011.

The decrease was due to lower interest rates and a

lower average debt level.

Other expense was $50.4 million in 2012 compared

to other income of $32.9 million in 2011 for a net

change of $83.3 million when comparing these peri-

ods. The change in other expense was primarily due

to the following:

• Deferred income tax expense of $33.7 million as a

result of a 100% valuation allowance recorded in

connection with Pullmantur’s deferred tax assets

that are no longer expected to be recovered prior

to their expiration;

• A reduction in deferred income tax expense of $5.2

million due to a reduction in Pullmantur’s deferred

tax liability related to the impairment charge of

Pullmantur’s trademarks and trade names;

• A loss of $5.7 million associated with changes in

the fair value of our fuel call options in 2012 as

compared to a gain of $18.9 million in 2011, for a

net change of $24.6 million;

• A loss of $2.7 million due to ineffectiveness on our

fuel swaps in 2012 as compared to a gain of $7.1

million in 2011, for a net change of $9.8 million;

• A loss of $7.5 million on the early extinguishment

of €255.0 million, or approximately $328.0 million

in aggregate principal amount of our outstanding

€1.0 billion unsecured senior notes due 2014 in

September 2012.

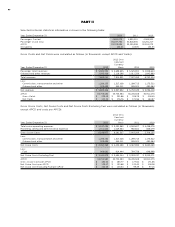

Net Yields

Net Yields increased 1.5% in 2012 compared to 2011

primarily due an increase in Pullmantur’s land-based

tours, hotel and air packages revenue and an increase

in onboard spending. In addition, the increase was

due to the changes in our international distribution

system mainly in Brazil and certain deployment initia-

tives. Net Yields increased 3.0% in 2012 compared to

2011 on a Constant Currency basis.