Royal Caribbean Cruise Lines 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

PART II

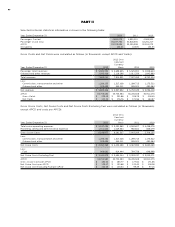

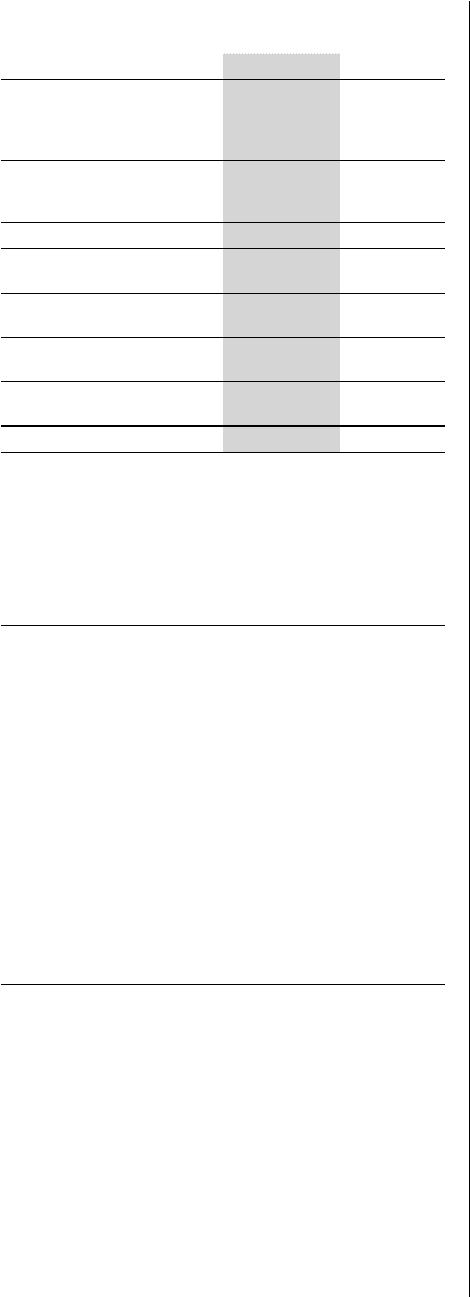

Net Debt-to-Capital was calculated as follows

(in thousands):

As of December 31,

Long-term debt, net of

current portion

Current portion of long-

term debt

Total debt

Less: Cash and cash

equivalents

Net Debt

Total shareholders’ equity

Total debt

Total debt and shareholders’

equity

Debt-to-Capital

Net Debt

Net Debt and shareholders’

equity

Net Debt-to-Capital

OUTLOOK

On February 4, 2013, we announced the following

initial first quarter and full year 2013 guidance:

Full Year 2013 AsReported

Constant

Currency

Net Yields to to

Net Cruise Costs per

APCD to Approx

Net Cruise Costs per

APCD, excluding Fuel Approx to

Capacity Increase

Depreciation and

Amortization tomillion

Interest Expense, net tomillion

Fuel Consumption

(metric tons)

Fuel Expenses million

Percent Hedged

(fwd consumption)

Impact of 10% change in

fuel prices million

EPS to

First Quarter 2013 AsReported

Constant

Currency

Net Yields Approx to

Net Cruise Costs per

APCD to to

Net Cruise Costs per

APCD, excluding Fuel Approx Approx

Capacity Increase

Depreciation and

Amortization tomillion

Interest Expense, net tomillion

Fuel Consumption

(metric tons)

Fuel Expenses million

Percent Hedged

(fwd consumption)

Impact of 10% change in

fuel prices million

EPS to

Since our earnings release on February 4, 2013, book-

ings have remained encouraging and consistent with

our previous expectations. Accordingly, our outlook

has remained essentially unchanged.

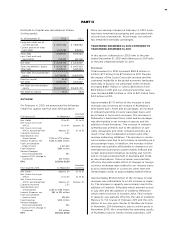

YEAR ENDED DECEMBER 31, 2012 COMPARED TO

YEAR ENDED DECEMBER 31, 2011

In this section, references to 2012 refer to the year

ended December 31, 2012 and references to 2011 refer

to the year ended December 31, 2011.

Revenues

Total revenues for 2012 increased $150.8 million or

2.0% to $7.7 billion from $7.5 billion in 2011. Despite

the impact of the Costa Concordia incident and the

continued instability in the global economic landscape,

especially in Europe, our passenger ticket revenues

increased $68.7 million or 1.2% to $5.6 billion from

$5.5 billion in 2011 and our onboard and other reve-

nues increased $82.1 million or 4.1% to $2.1 billion from

$2.0 billion in 2011.

Approximately $171.1 million of the increase in total

revenues was driven by an increase in Pullmantur’s

land-based tours, hotel and air packages, an increase

in onboard spending on a per passenger basis, and

an increase in concession revenues. The increase in

Pullmantur’s land-based tours, hotel and air packages

was attributable to an increase in guests and the

addition of new itineraries. The increase in onboard

spending was primarily due to the addition of spe-

cialty restaurants and other onboard activities as a

result of our ship revitalization projects and other

revenue enhancing initiatives. The increase in conces-

sion revenues was due to an increase in spending on a

per passenger basis. In addition, the increase in total

revenues was partially attributable to changes to our

international distribution system mainly in Brazil and

certain deployment initiatives including, but not lim-

ited to increased deployment in Australia and China

as described above. These increases were partially

offset by the unfavorable effect of changes in foreign

currency exchange rates related to our revenue trans-

actions denominated in currencies other than the

United States dollar of approximately $126.9 million.

Approximately $106.6 million of the increase in total

revenues was attributable to a 1.4% increase in capac-

ity. The increase in capacity was primarily due to the

addition of Celebrity Silhouette which entered service

in July 2011 and the addition of Celebrity Reflection

which entered service in October 2012. This increase

in capacity was partially offset by the sale of Celebrity

Mercury to TUI Cruises in February 2011 and the com-

pletion of our one-year charter of the Bleu de France

in November 2011 following its sale to a third party in

November 2010. We consolidate the operating results

of Pullmantur and its wholly-owned subsidiary, CDF