Royal Caribbean Cruise Lines 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

on certain markets. The Spanish economy was more

severely impacted than many other economies around

the world where we operate and there is significant

uncertainty as to when it will recover. In addition, the

impact of the Costa Concordia incident has had a

more lingering effect than expected and the impact

in future years is uncertain. Please refer to Note 3.

Goodwill for further information.

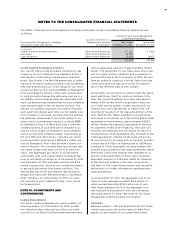

During the fourth quarter of 2012, we updated our

deferred tax asset recoverability analysis for projec-

tions included within the goodwill valuation model.

These projections, including the impact of recently

enacted laws regarding net operating loss utilization,

and the review of our tax planning strategies show

that it is no longer more-likely-than-not that we will

recover the deferred tax assets prior to their expi-

ration. As such, we have determined that a 100%

valuation allowance of our deferred tax assets was

required resulting in a deferred income tax expense of

$33.7 million. In addition, Pullmantur has a deferred

tax liability that was recorded at the time of acquisi-

tion. This liability represents the tax effect of the basis

difference between the tax and book values of the

trademarks and trade names that were acquired at

the time of the acquisition. Due to the impairment

charge related to these intangible assets, we reduced

the deferred tax liability by $5.2 million to $61.5 million.

The net $28.5 million impact of these adjustments

was recognized in earnings during the fourth quarter

of 2012 and is reported within Other (expense) income

in our statements of comprehensive income (loss).

Deferred tax assets, related valuation allowances and

deferred tax liabilities related to our operations are

not material as of December 31, 2012 and 2011.

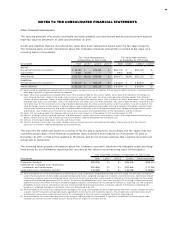

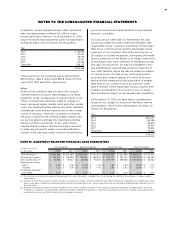

NOTE 13. FAIR VALUE MEASUREMENTS AND DERIVATIVE INSTRUMENTS

FAIR VALUE MEASUREMENTS

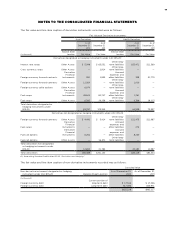

The estimated fair value of our financial instruments that are not measured at fair value on a recurring basis,

categorized based upon the fair value hierarchy, are as follows (in thousands):

Fair Value Measurements

at December 31, 2012 Using

Fair Value Measurements

at December 31, 2011 Using

Description Total Level 11Level 22Level 33Total Level 11Level 22Level 33

Assets:

Cash and cash equivalents4 — — — —

Total Assets — — — —

Liabilities:

Long-term debt (including

current portion of long-

term debt)5 — —

Total Liabilities — —

() Inputs based on quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access. Valuation of these

items does not entail a significant amount of judgment.

() Inputs other than quoted prices included within Level 1 that are observable for the liability, either directly or indirectly. For unsecured revolving

credit facilities and unsecured term loans, fair value is determined utilizing the income valuation approach. This valuation model takes into account

the contract terms of our debt such as the debt maturity and the interest rate on the debt. The valuation model also takes into account our credit-

worthiness based on publicly available credit default swap rates.

() Inputs that are unobservable. The Company did not use any Level 3 inputs as of December 31, 2012 and December 31, 2011.

() Consists of cash and marketable securities with original maturities of less than 90 days.

() Consists of unsecured revolving credit facilities, unsecured senior notes, senior debentures and unsecured term loans. Does not include our capital

lease obligations.