Royal Caribbean Cruise Lines 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

PART II

million. Subsequent to the termination, neither the

original nor the offsetting fuel call options were

designated as hedging instruments and changes in

their fair value were recognized in earnings immedi-

ately and were reported in other income (expense)

in our consolidated statements of comprehensive

income (loss).

As of December 31, 2012, we had fuel swap agree-

ments to pay fixed prices for fuel with an aggregate

notional amount of approximately $1.1 billion, matur-

ing through 2016. The fuel swap agreements repre-

sent 55% of our projected 2013 fuel requirements,

45% of our projected 2014 fuel requirements, 25%

of our projected 2015 fuel requirements and 7% of

our projected 2016 fuel requirements. The estimated

fair value of these contracts at December 31, 2012

was estimated to be an asset of $48.6 million. We

estimate that a hypothetical 10% increase in our

weighted-average fuel price from that experienced

during the year ended December 31, 2012 would

increase our forecasted 2013 fuel cost by approxi-

mately $35.8 million, net of the impact of fuel swap

agreements.

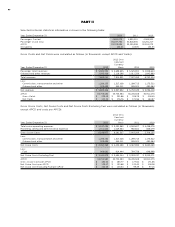

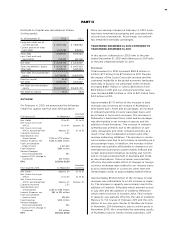

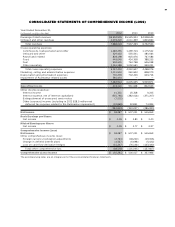

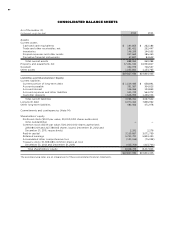

ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA

Our Consolidated Financial Statements and Quarterly

Selected Financial Data are included beginning on

page 65 of this report.

ITEM 9. CHANGES IN AND DISAGREEMENTS

WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

EVALUATION OF DISCLOSURE CONTROLS

AND PROCEDURES

Our management, with the participation of our Chair-

man and Chief Executive Officer and Vice Chairman

and Chief Financial Officer, conducted an evaluation

of the effectiveness of our disclosure controls and

procedures, as such term is defined in Exchange Act

Rule 13a-15(e), as of the end of the period covered by

this report. Based upon such evaluation, our Chairman

and Chief Executive Officer and Vice Chairman and

Chief Financial Officer concluded that those controls

and procedures are effective to provide reasonable

assurance that information required to be disclosed

by us in the reports that we file or submit under the

Exchange Act is accumulated and communicated

to management, including our Chairman and Chief

Executive Officer and our Vice Chairman and Chief

Financial Officer, as appropriate, to allow timely

decisions regarding required disclosure and are

effective to provide reasonable assurance that such

information is recorded, processed, summarized and

reported within the time periods specified by the

SEC’s rules and forms.

MANAGEMENT’S REPORT ON INTERNAL CONTROL

OVER FINANCIAL REPORTING

Our management is responsible for establishing and

maintaining adequate internal control over financial

reporting, as such term is defined in Exchange Act

Rule 13a-15(f). Our management, with the participa-

tion of our Chairman and Chief Executive Officer

and our Vice Chairman and Chief Financial Officer,

conducted an evaluation of the effectiveness of our

internal control over financial reporting based on the

framework in Internal Control—Integrated Framework

issued by the Committee of Sponsoring Organizations

of the Treadway Commission. Based on this evalua-

tion, management concluded that our internal control

over financial reporting was effective as of December

31, 2012. The effectiveness of our internal control over

financial reporting as of December 31, 2012 has been

audited by PricewaterhouseCoopers LLP, the inde-

pendent registered certified public accounting firm

that audited our consolidated financial statements

included in this Annual Report on Form 10-K, as stated

in its report, which is included herein on page 66.

CHANGES IN INTERNAL CONTROLS OVER

FINANCIAL REPORTING

There were no changes in our internal control over

financial reporting identified in connection with the

evaluation required by paragraph (d) of Exchange Act

Rules 13a-15 during the quarter ended December 31,

2012 that have materially affected, or are reasonably

likely to materially affect, our internal control over

financial reporting.

INHERENT LIMITATIONS ON EFFECTIVENESS

OF CONTROLS

It should be noted that any system of controls, how-

ever well designed and operated, can provide only

reasonable, and not absolute, assurance that the

objectives of the system will be met. In addition, the

design of any control system is based in part upon

certain assumptions about the likelihood of future

events. Because of these and other inherent limita-

tions of control systems, there is only the reasonable

assurance that our controls will succeed in achieving

their goals under all potential future conditions.

ITEM 9B. OTHER INFORMATION

None.