Royal Caribbean Cruise Lines 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

ship as well as a conditional guarantee commitment

from Finnvera, the official export agency of Finland,

for 95% of the bank loan facility. The remaining por-

tion of the contract price of the ship will be funded

through either TUI Cruises’ cash flows from opera-

tions or loans and/or equity contributions from us and

TUI AG.

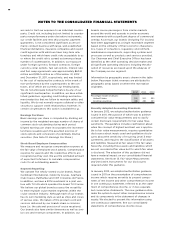

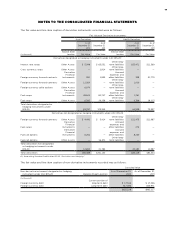

NOTE 7. LONG-TERM DEBT

Long-term debt consists of the following (in thousands):

$1.1 billion unsecured revolving credit facility, LIBOR plus 1.75%, currently 1.96% and a facility

fee of 0.3675%, due 2016

$525.0 million unsecured revolving credit facility, LIBOR plus 2.50%, currently 2.71% and a

facility fee of 0.625%, due 2014

Unsecured senior notes and senior debentures, 5.25% to 11.88%, due 2013 through 2016, 2018,

2022 and 2027

€745.0 million unsecured senior notes, 5.63%, due 2014

Unsecured term loans, LIBOR plus 2.75%, due 2013 —

$225 million unsecured term loan, LIBOR plus 1.25%, due 2012 —

$570 million unsecured term loan, 4.02%, due through 2013

$589 million unsecured term loan, 4.39%, due through 2014

$530 million unsecured term loan, LIBOR plus 0.62%, currently 1.21%, due through 2015

$519 million unsecured term loan, LIBOR plus 0.45%, currently 1.01%, due through 2020

1$420 million unsecured term loan, 5.41%, due through 2021

1$420 million unsecured term loan, LIBOR plus 2.10%, currently 2.65%, due through 2021

1€159.4 million unsecured term loan, EURIBOR plus 1.58%, currently 1.98%, due through 2021

$524.5 million unsecured term loan, LIBOR plus 0.50%, currently 1.23%, due through 2021

$566.1 million unsecured term loan, LIBOR plus 0.37%, currently 0.97%, due through 2022

2$1.1 billion unsecured term loan, LIBOR plus 2.10%, currently 2.65%, due through 2022

$632.0 million unsecured term loan, LIBOR plus 0.40%, currently 1.13%, due through 2023

$673.5 million unsecured term loan, LIBOR plus 0.40%, currently 1.03%, due through 2024 —

$290.0 million unsecured term loan, LIBOR plus 2.5%, currently 2.72%, due through 2016 —

$7.3 million unsecured term loan, LIBOR plus 2.5%, currently 2.81%, due through 2023

$30.3 million unsecured term loan, LIBOR plus 3.75%, currently 4.06%, due through 2021

Capital lease obligations

Less—current portion () ()

Long-term portion

() Corresponds to Oasis of the Seas unsecured term loan. With respect to 60% of the financing, the lenders have the ability to exit the facility in

October 2015.

() Corresponds to Allure of the Seas unsecured term loan. With respect to 100% of the financing, the lenders have the ability to exit the facility in

October 2017.

During 2012, the credit facility we obtained in con-

nection with our purchase of Celebrity Solstice was

assigned from Celebrity Solstice Inc., our subsidiary

which owns the ship, to Royal Caribbean Cruises Ltd.

Similar assignments were simultaneously made from

the ship-owning subsidiary level to Royal Caribbean

Cruises Ltd. for the facilities relating to Celebrity

Equinox, Celebrity Eclipse, Celebrity Silhouette,

Celebrity Reflection, Oasis of the Seas and Allure

of the Seas. Other than the change in borrower, the

economic terms of these facilities remain unchanged.

These amended facilities each contain covenants sub-

stantially similar to the covenants in our other parent-

level ship financing agreements and our revolving

credit facilities.

During 2012, we entered into a credit agreement

which provides an unsecured Euro-denominated term

loan facility in an amount up to €365.0 million, or

approximately $481.2 million based on the exchange

rate at December 31, 2012. We have the ability to

draw on this facility at anytime on or prior to June 30,

2013. As of February 25, 2013, we have not drawn on

this facility. All amounts borrowed under the facility

will be due and payable at maturity in July 2017.

Interest on the loan accrues at a floating rate based

on EURIBOR plus the applicable margin. The applica-

ble margin varies with our debt rating and would have

been 3.0% as of December 31, 2012. In addition, we

are subject to a commitment fee of 1.05% per annum

of the undrawn amount. We anticipate the proceeds

from this loan facility will be used primarily as part of

our refinancing strategy for our maturities in 2013 and

2014. In connection with entering into this facility, we

prepaid our $100.0 million unsecured floating rate

term loan due September 2013.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS