Royal Caribbean Cruise Lines 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

PART II

• Income on our investments in unconsolidated sub-

sidiaries of $22.2 million in 2011 as compared to

income of $0.2 million in 2010, for a net increase

of $22.0 million when comparing these periods;

• A gain on our fuel call options of $18.9 million in

2011 as compared to a loss of $2.8 million in 2010,

for a net change of $21.7 million.

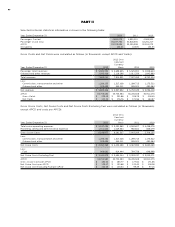

Net Yields

Net Yields increased 4.1% in 2011 compared to 2010

primarily due to an increase in ticket prices and the

favorable impact of changes in exchange rates, as dis-

cussed above. Net Yields per APCD increased 2.4% in

2011 compared to 2010 on a Constant Currency basis.

Net Cruise Costs

Net Cruise Costs increased 11.4% in 2011 compared to

2010 due to the 7.5% increase in capacity and a 3.7%

increase in Net Cruise Cost per APCD. The increase in

Net Cruise Costs per APCD was primarily driven by an

increase in fuel and other hotel and vessel expenses,

and to a lesser extent, the unfavorable impact of

changes in exchange rates, as discussed above. Net

Cruise Costs per APCD increased 2.7% in 2011 com-

pared to 2010 on a Constant Currency basis. Net

Cruise Costs Excluding Fuel per APCD increased 2.3%

in 2011 compared to 2010. Net Cruise Costs Excluding

Fuel per APCD increased 1.3% in 2011 compared to

2010 on a Constant Currency basis.

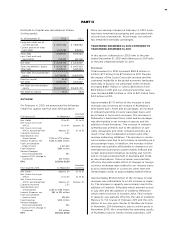

RECENTLY ADOPTED, AND FUTURE APPLICATION

OF, ACCOUNTING STANDARDS

Refer to Note 2. Summary of Significant Accounting

Policies to our consolidated financial statements under

Item 8. Financial Statements and Supplementary Data

for further information on Recently Adopted Account-

ing Standards and Recent Accounting Pronouncements.

LIQUIDITY AND CAPITAL RESOURCES

Sources and Uses of Cash

Cash flow generated from operations provides us with

a significant source of liquidity. Net cash provided by

operating activities decreased $74.0 million to $1.4

billion for 2012 compared to $1.5 billion for 2011. This

decrease was primarily a result of a decrease in net

income after adjusting for non-cash items and to the

timing of collections on our trade accounts receivable

partially offset by a higher rate of increase in cus-

tomer deposits and an increase in cash received on

the settlement of derivative financial instruments.

Net cash used in investing activities was $1.3 billion for

2012 compared to $924.6 million for 2011. The change

was primarily due to $290.0 million of proceeds

received from the sale of Celebrity Mercury and $55.0

million of proceeds received from the sale of Bleu de

France during 2011 which did not recur in 2012. During

2012, our use of cash was primarily related to capital

expenditures of $1.3 billion, up from $1.2 billion for

2011. The increase in capital expenditures was pri-

marily attributable to an increase in payments related

to our ship revitalization projects in 2012. We also

provided $110.7 million under a debt facility to one of

our unconsolidated affiliates during 2011 which did

not recur in 2012.

Net cash used in financing activities was $179.6 million

for 2012 compared to $676.5 million for 2011, primarily

as a result of our refinancing strategy for our upcom-

ing 2013 and 2014 maturities. The change was due

to a net increase in debt facility drawings of $980.1

million during 2012 as compared to 2011. The net

increase in debt facility drawings was primarily due to

proceeds received from the issuance of $650.0 mil-

lion unsecured senior notes and amounts borrowed

under an unsecured term loan of $290.0 million dur-

ing 2012 which did not occur in 2011. The change in

net cash used in financing activities was also due to

an increase in repayments of debt of approximately

$382.2 million. The increase in repayments of debt

was primarily due to an increase of $590.0 million in

repayments on our unsecured revolving credit facili-

ties from $885.0 million during 2011 to $1.5 billion dur-

ing 2012. The increase in repayments of debt was also

due $344.6 million paid in conjunction with the repur-

chase of €255.0 million or approximately $328.0 mil-

lion in aggregate principal amount of our €1.0 billion

5.625% unsecured senior notes and the prepayment

of a $100.0 million unsecured term loan during 2012

as compared to the repayment of a $500.0 million

unsecured senior note and a prepayment of $200.0

million on our Allure of the Seas unsecured term loan

during 2011. The change was also due to cash divi-

dends paid on our common stock of $117.7 million for

2012 as compared to $21.7 million for 2011.

FUTURE CAPITAL COMMITMENTS

Our future capital commitments consist primarily of

new ship orders. As of December 31, 2012, we had

two Quantum-class ships and one Oasis-class ship on

order for our Royal Caribbean International brand

with an aggregate capacity of approximately 13,600

berths. The agreement for our Oasis-class ship is sub-

ject to certain closing conditions and is expected to

become effective in the first quarter of 2013. We also

have an option to construct a fourth Oasis-class ship

which will expire five days prior to the first anniversary

of the effective date of the contract.

As of December 31, 2012, the aggregate cost of our

ships on order was approximately $3.6 billion, of

which we had deposited $131.0 million as of such

date. Approximately 49.7% of the aggregate cost was

exposed to fluctuations in the euro exchange rate at