Royal Caribbean Cruise Lines 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd.

Annual Report

2012

Table of contents

-

Page 1

2012 Royal Caribbean Cruises Ltd. Annual Report -

Page 2

...Ltd. is the world's second largest cruise company and also offers unique land-tour vacations in Alaska, Asia, Australia/New Zealand, Canada, Dubai, Europe and South America. The company owns six brands, Royal Caribbean International, Celebrity Cruises, Pullmantur, Azamara Club Cruises and CDF Croisi... -

Page 3

...immersive cruisetour experiences in Alaska, Australia/New Zealand, Canada, Europe and South America. For more information, dial 1-800-437-3111, visit www.celebritycruises.com, or call your travel agent. azamaRa Club CRuises is a destination-immersive cruise line for up-market travelers who want to... -

Page 4

... is the cruise industry's market leader. There is a relaxed and comfortable atmosphere onboard its four ships, which visit the Mediterranean, Baltic, Caribbean, Mexico, and South America. Acquired by Royal Caribbean Cruises Ltd. in 2006, the company also provides tour operations in Europe and Africa... -

Page 5

... 5 million incredible vacation experiences. Dear Fellow Shareholders: Although 2012 presented us with a number of significant challenges, I am proud of the way our team responded, enabling us to end the year on a positive note. On our ships and in our destination ports around the world, our 62... -

Page 6

...for these charges, net income for the year was $432.2 million or $1.97 per diluted share. We continue to deliver strong cash flows, and cash provided by operating activities was $1.4 billion in 2012. We have always considered the safety of our guests and crew as a "sine qua non" as our vessels ply... -

Page 7

... superb dining and entertainment in an upscale and chic environment. Guests and travel agents alike are providing rave reviews of the product. It will be almost two years from the Celebrity Reflection delivery to our next vessel introduction, Royal Caribbean International's Quantum of the Seas in... -

Page 8

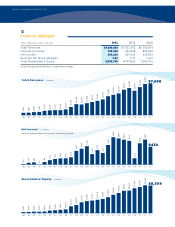

...432,219 1.97 8,308,749 2011 $7,537,263 931,628 607,421 2.77 8,407,823 2010 $6,752,504 802,633 515,653 2.37 7,900,752 Total Revenues Operating Income1 Net Income1 Earnings Per Share (diluted)1 Total Shareholders' Equity 1 2012 Excludes $413.9 million in impairment charges. $6,149 $6,533 $2,636... -

Page 9

5 Royal Caribbean Cruises Ltd. Form 10-K -

Page 10

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 11

... (I.R.S. Employer Identification No.) 1050 Caribbean Way, Miami, Florida 33132 (Address of principal executive offices) (zip code) (305) 539-6000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, par... -

Page 12

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 13

... Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accounting Fees and Services ... item ITEM ITEM ITEM ITEM ITEM... -

Page 14

... 31, 2012. Our ships operate on a selection of worldwide itineraries that call on approximately 455 destinations on all seven continents. In addition to our headquarters in Miami, Florida, we have offices and a network of international representatives around the world which focus on our global guest... -

Page 15

...destinations worldwide, including Alaska, Asia, Australia, Bahamas, Bermuda, Canada, the Caribbean, Europe, the Middle East, the Panama Canal, South America, South Pacific and New Zealand. Royal Caribbean International is positioned at the upper end of the contemporary segment of the cruise vacation... -

Page 16

... product for German guests. All onboard activities, services, shore excursions and menu offerings are designed to suit the preferences of this target market. TUI Cruises operates two ships, Mein Schiff I and Mein Schiff II, with an aggregate capacity of approximately 3,800 berths. In addition, TUI... -

Page 17

...: Cruise Line International Association based on cruise guests carried for at least two consecutive nights for years 2008 through 2011. Year 2012 amounts represent our estimates (see number 1 above). (3) Source: CLIA Europe, formerly European Cruise Council, for years 2008 through 2011. Year 2012... -

Page 18

...media, social media, brand websites and travel agencies. Our brands engage past and potential guests by collaborating with travel partners and through call centers, international offices and international representatives. In addition, Royal Caribbean International, Celebrity Cruises and Azamara Club... -

Page 19

..., including our 50% joint venture TUI Cruises, have signed agreements for the construction of five new ships. These consist of our recently ordered third Oasis-class ship which is scheduled to enter service in the second quarter of 2016, two ships of a new generation of Royal Caribbean International... -

Page 20

... Azamara Club Cruises' strategic positioning as global cruise brands. In 2012, Royal Caribbean International continued its global expansion by seasonally adding a second ship in Asia and a third ship in Australia, adding new departure ports in Southern Europe in order to target guests in key source... -

Page 21

...consumers 24 hour access to our certified vacation planners, group vacation planners and customer service agents in our call centers throughout the world. In addition, we maintain and invest in our websites, including mobile applications and mobile websites, which allow guests to directly plan, book... -

Page 22

...in 2013 under our six cruise brands, including our 50% joint venture TUI Cruises, and their geographic areas of operation based on 2013 itineraries (subject to change). Ship (1) royal caribbean international Allure of the Seas Oasis of the Seas Independence of the Seas Liberty of the Seas Freedom of... -

Page 23

... will be built in France by STX France. The expected dates that our ships on order will enter service and their approximate berths are as follows: Ship royal caribbean international- Quantum-class: Quantum of the Seas Anthem of the Seas Oasis-class(1): Unnamed tui cruises- Mein Schiff... -

Page 24

...to offer these programs more globally in 2013. Onboard and other revenues accounted for approximately 27% of total revenues in 2012, 2011 and 2010. seGment RePoRtinG We operate five wholly-owned cruise brands, Royal Caribbean International, Celebrity Cruises, Azamara Club Cruises, Pullmantur and CDF... -

Page 25

...operating costs. tRaDemaRKs We own a number of registered trademarks related to the Royal Caribbean International, Celebrity Cruises, Azamara Club Cruises, Pullmantur and CDF Croisières de France cruise brands. The registered trademarks include the name "Royal Caribbean International" and its crown... -

Page 26

...international compliance certificates relating to oil, sewage and air pollution prevention for all of our ships. The MARPOL Regulations impose global limitations on the sulfur content of fuel used by ships operating worldwide. Permitted sulfur content was reduced from 4.5% to 3.5% on January 1, 2012... -

Page 27

... which will be effective starting in August 2013, reflects a broad range of standards and conditions to govern all aspects of crew management for ships in international commerce, including additional requirements not previously in effect relating to the health, safety, repatriation, entitlements and... -

Page 28

... tonnage tax company. Regulations under Section 883 list activities that are not considered by the Internal Revenue Service to be incidental to the international operation of ships including the sale of air and land transportation, shore excursions and pre- and post-cruise tours. Our income from... -

Page 29

... states taxation We and Celebrity Cruises, Inc. earn United States source income from activities not considered incidental to international shipping. The tax on such income is not material to our results of operation for all years presented. state taxation We, Celebrity Cruises Inc. and certain of... -

Page 30

... Chief Executive Officer of Celebrity Cruises since August 2012. Mr. Bayley has been employed by Royal Caribbean for over 30 years, having started as a Purser onboard one of the company's ships. He has served in a number of roles including, most recently, as Executive Vice President, Operations from... -

Page 31

27 PaRt i including Executive Vice President, Revenue Performance. In such capacity, Mr. Rice was responsible for revenue management, air/sea, groups, international operations, decision support, reservations and customer service for both Royal Caribbean International and Celebrity Cruises. Harri U.... -

Page 32

... sales and results of operations. The operation of cruise ships, airplanes, land tours, port facilities and shore excursions involves the risk of accidents, illnesses, environmental incidents and other incidents which may bring into question guest safety, health, security and vacation satisfaction... -

Page 33

... vacation operators, which provide other leisure options including hotels, resorts and package holidays and tours. We face significant competition from other cruise lines on the basis of cruise pricing, travel agent preference and also in terms of the nature of ships and services we offer to guests... -

Page 34

... of cruise ships and have generated negative publicity about the cruise vacation industry and its environmental impact. See "Item 1. Business-Regulation-Environmental Regulations." An increase in fuel prices not only impacts our fuel costs, but also some of our other expenses, such as crew travel... -

Page 35

... cruise or on a cruise vacation. The availability of ports is affected by a number of factors, including existing capacity constraints, constraints related to the size of certain ships, security concerns, adverse weather conditions and natural disasters, financial limitations on port development... -

Page 36

... our financial condition and results of operations. Disruptions in our shoreside operations or our information systems may adversely affect our results of operations. Our principal executive office and principal shoreside operations are located at the Port of Miami, Florida and we have call centers... -

Page 37

... without the consent of our Board of Directors. item 1b. unResolveD staFF Comments None. item 2. PRoPeRties Information about our cruise ships, including their size and primary areas of operation, may be found within the Operating Strategies-Fleet revitalization, maintenance and expansion section... -

Page 38

... a number of international offices throughout Europe, Asia, Mexico, South America and Australia to administer our brand operations globally. We lease an office building in Springfield, Oregon totaling approximately 163,000 square feet, which is used as a call center for reservations. In addition, we... -

Page 39

35 PaRt ii item 5. maRKet FoR ReGistRant's Common equity, RelateD stoCKHolDeR matteRs anD issueR PuRCHases oF equity seCuRities maRKet inFoRmation Our common stock is listed on the New York Stock Exchange ("NYSE") and the Oslo Stock Exchange ("OSE") under the symbol "RCL". The table below sets ... -

Page 40

... for a five year period by measuring the changes in common stock prices from December 31, 2007 to December 31, 2012. $160 140 120 100 80 60 40 20 0 12/07 12/08 12/09 12/10 S&P 500 12/11 12/12 Royal Caribbean Cruises Ltd. Dow Jones US Travel & Leisure 12/07 Royal Caribbean Cruises Ltd. S&P 500... -

Page 41

... Assets under Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for more information regarding the impairment of these assets). (2) Amounts for 2012 include a $33.7 million charge to record a 100% valuation allowance related to our deferred tax assets for... -

Page 42

... business globally and our ability to realize the intended benefits of our investments in new markets; • changes in operating and financing costs, including changes in foreign exchange rates, interest rates, fuel, food, payroll, airfare, insurance and security costs; • vacation industry... -

Page 43

... of our critical accounting policies and review of our financial presentation, including discussion of certain operational and financial metrics we utilize to assist us in managing our business; • a discussion of our results of operations for the year ended December 31, 2012 compared to the same... -

Page 44

...directly related to planned major maintenance activities necessary to maintain Class. The costs deferred are not otherwise routinely periodically performed to maintain a vessel's designed and intended operating capability. Repairs and maintenance activities are charged to expense as incurred. We use... -

Page 45

... independent appraisals, sales price negotiations and projected future cash flows discounted at a rate estimated by management to be commensurate with the business risk. Quoted market prices are often not available for individual reporting units and for indefinite-life intangible assets. Accordingly... -

Page 46

... charge related to these intangible assets, we reduced the deferred tax liability by $5.2 million. The net $28.5 million impact of these adjustments was recognized in earnings during the fourth quarter of 2012 and is reported within Other (expense) income in our statements of comprehensive income... -

Page 47

... and/or services onboard our ships not included in passenger ticket prices, cancellation fees, sales of vacation protection insurance, pre- and post-cruise tours, Pullmantur's land-based tours and hotel and air packages including Pullmantur Air's charter business to third parties. Onboard and other... -

Page 48

...'s land-based tours and Pullmantur Air's charter business to third parties, vessel related insurance and entertainment. We do not allocate payroll and related costs, food costs, fuel costs or other operating costs to the expense categories attributable to passenger ticket revenues or onboard and... -

Page 49

... from our net income and earnings per share, and accordingly, we have elected to also present non-GAAP net income and non-GAAP EPS excluding these impairment related charges for the year ended December 31, 2012. We believe Net Yields, Net Cruise Costs and Net Cruise Costs Excluding Fuel are our... -

Page 50

... on order for our joint venture TUI Cruises which are scheduled for delivery in the second quarter of 2014 and second quarter of 2015, respectively. As part of our vessel revitalization program, five ships were revitalized for the Royal Caribbean International brand during 2012. By the end of 2013... -

Page 51

...the second quarter of 2015. TUI Cruises has entered into a credit agreement providing financing for up to 80% of the contract price of the ship. We reported historical total revenues, operating income, net income, non-GAAP net income (excluding the impairment related charges), earnings per share and... -

Page 52

...54 Year Ended December 31, Total cruise operating expenses Marketing, selling and administrative expenses Gross Cruise Costs Less: Commissions, transportation and other Onboard and other Net Cruise Costs Less: Fuel Net Cruise Costs Excluding Fuel APCD Gross Cruise Costs per APCD Net Cruise Costs... -

Page 53

... in Pullmantur's land-based tours, hotel and air packages was attributable to an increase in guests and the addition of new itineraries. The increase in onboard spending was primarily due to the addition of specialty restaurants and other onboard activities as a result of our ship revitalization... -

Page 54

... expenses, and expenses related to Pullmantur's land-based tours, hotel and air packages. Fuel expenses, which are net of the financial impact of fuel swap agreements accounted for as hedges, increased 15.2% per metric ton in 2012 as compared to 2011 primarily as a result of increasing fuel prices... -

Page 55

...air and other hotel and vessel expenses and head taxes, as well as the unfavorable effect of changes in foreign currency exchange rates related to our cruise operating expenses denominated in currencies other than the United States dollar. Fuel expenses, which are net of the financial impact of fuel... -

Page 56

... of new ship orders. As of December 31, 2012, we had two Quantum-class ships and one Oasis-class ship on order for our Royal Caribbean International brand with an aggregate capacity of approximately 13,600 berths. The agreement for our Oasis-class ship is subject to certain closing conditions and... -

Page 57

..., services and maintenance contracts. (5) Amounts represent contractual obligations with initial terms in excess of one year. Amounts include our third Oasis-class ship which was ordered under a conditional agreement in December 2012 and is expected to become effective in the first quarter of 2013... -

Page 58

...would have on our financial condition and results of operations. In connection with the sale of Celebrity Mercury in February 2011, we and TUI AG each guaranteed repayment of 50% of an â,¬180.0 million 5-year amortizing bank loan provided to TUI Cruises. As of December 31, 2012, â,¬153.0 million, or... -

Page 59

... statements under Item 8. Financial Statements and Supplementary Data.) interest Rate Risk Our exposure to market risk for changes in interest rates relates to our long-term debt obligations, including future interest payments, and our operating lease for Brilliance of the Seas. At December 31, 2012... -

Page 60

... expense by approximately $2.7 million, based on the exchange rate at December 31, 2012. Foreign Currency exchange Rate Risk Our primary exposure to foreign currency exchange rate risk relates to our ship construction contracts denominated in euro and our growing international business operations... -

Page 61

...an increase to depreciation expense over the estimated useful life of the vessel. During 2012, we entered into foreign currency collar options to hedge a portion of our foreign currency exposure on the construction contract price for Anthem of the Seas. These options mature in April 2015 and have an... -

Page 62

... that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to management, including our Chairman and Chief Executive Officer and our Vice Chairman and Chief Financial Officer, as appropriate, to allow timely item 9b... -

Page 63

...Copies of the Proxy Statement will become available when filed through our Investor Relations website at www.rclinvestor.com (please see "Financial Reports" under "Financial Information"); by contacting our Investor Relations department at 1050 Caribbean Way, Miami, Florida 33132-telephone (305) 982... -

Page 64

..., thereunto duly authorized. ROYAL CARIBBEAN CRUISES LTD. (Registrant) By: /s/ BRIAN J. RICE Brian J. Rice Vice Chairman and Chief Financial Officer (Principal Financial Officer and duly authorized signatory) February 25, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this... -

Page 65

...dated as of January 25, 2007 among the Company, as issuer, The Bank of New York, as trustee, transfer agent, principal paying agent and security registrar, and AIB/ BNY Fund Management (Ireland) Limited, as Irish paying agent (incorporated by reference to Exhibit 10.1 to the Company's Current Report... -

Page 66

... Company's 2011 Annual Report on Form 10-K). -Assignment and Amendment No. 4 to Credit Agreement, dated as of March 26, 2012, among Oasis of the Seas Inc., Royal Caribbean Cruises Ltd., the various financial institutions as are parties to the Credit Agreement and BNP Paribas, as administrative agent... -

Page 67

... to the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2005 and Exhibit 10.12 to the Company's 2007 Annual Report on Form 10-K). 10.18 -Form of Royal Caribbean Cruises Ltd. 2008 Equity Incentive Plan Stock Option Award Agreement-Nonqualified shares (incorporated by... -

Page 68

... financial statements from Royal Caribbean Cruises Ltd.'s Annual Report on Form 10-K for the year ended December 31, 2012, as filed with the SEC on February 25, 2013, formatted in XBRL, as follows: (i) the Consolidated Statements of Comprehensive Income (Loss) for the years ended December 31, 2012... -

Page 69

... to ConsoliDateD FinanCial statements Page Report of Independent Registered Certified Public Accounting Firm...66 Consolidated Statements of Comprehensive Income (Loss) ...67 Consolidated Balance Sheets ...68 Consolidated Statements of Cash Flows ...69 Consolidated Statements of Shareholders' Equity... -

Page 70

...related consolidated statements of comprehensive income (loss), shareholders' equity and cash flows present fairly, in all material respects, the financial position of Royal Caribbean Cruises, Ltd. and its subsidiaries at December 31, 2012 and 2011, and the results of their operations and their cash... -

Page 71

...Other (expense) income (including in 2012 $28.5 million net deferred tax expense related to the Pullmantur impairment) net income basic earnings per share: Net income Diluted earnings per share: Net income Comprehensive income (loss) net income Other comprehensive income (loss): Foreign currency... -

Page 72

... of long-term debt Accounts payable Accrued interest Accrued expenses and other liabilities Customer deposits Total current liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 14) Shareholders' equity Preferred stock ($0.01 par value; 20,000,000 shares... -

Page 73

... 756,960 3,249 135,310 284,619 419,929 operating activities Net income Adjustments: Depreciation and amortization Impairment of Pullmantur related assets Net deferred tax expense related to Pullmantur impairment Loss (gain) on fuel call options Loss on extinguishment of unsecured senior notes... -

Page 74

... at December 31, 2011 Issuance under employee related plans Common Stock dividends Dividends declared by Pullmantur Air, S.A.1 Changes related to cash flow derivative hedges Change in defined benefit plans Foreign currency translation adjustments Net income balances at December 31, 2012 $ 182,733... -

Page 75

... to tHe ConsoliDateD FinanCial statements note 1. GeneRal Description of business We are a global cruise company. We own Royal Caribbean International, Celebrity Cruises, Pullmantur, Azamara Club Cruises, CDF Croisières de France and a 50% joint venture interest in TUI Cruises. Together, these six... -

Page 76

... operating capability. Repairs and maintenance activities are charged to expense as incurred. Goodwill Goodwill represents the excess of cost over the fair value of net tangible and identifiable intangible assets acquired. We review goodwill for impairment at the reporting unit level annually... -

Page 77

... last date at which it was determined to be effective is recognized in earnings. In addition, the ineffective portion of our highly effective hedges is recognized in earnings immediately and reported in other income (expense) in our consolidated statements of comprehensive income (loss). Cash flows... -

Page 78

...awards and the related tax effects are recognized as they vest. We use the estimated amount of expected forfeitures to calculate compensation costs for all outstanding awards. segment Reporting We operate five wholly-owned cruise brands, Royal Caribbean International, Celebrity Cruises, Azamara Club... -

Page 79

... (e.g., the release due to cash flow hedges from interest rate contracts) and the income statement line items affected by the reclassification (e.g., interest income or interest expense). This guidance must be applied prospectively and will be effective for our interim and annual reporting periods... -

Page 80

...for Spain to a contraction of 1.3% during the fourth quarter of 2012 and further reduced it to a contraction of 1.5% in January of 2013. During the latter half of 2012 new austerity measures, such as increases to the Value Added Tax, cuts to benefits, the phasing out of exemptions and the suspension... -

Page 81

... Oasis-class ship for Royal Caribbean International. The agreement is subject to certain closing conditions and is expected to become effective in the first quarter of 2013. The ship will have a capacity of approximately 5,400 berths and is expected to enter service in the second quarter of 2016... -

Page 82

... period. In addition, the credit agreement extends this restriction through 2019. In 2012, TUI Cruises exercised their option under the agreement with STX Finland to construct their second newbuild ship, scheduled for delivery in the second quarter of 2015. TUI Cruises has secured a bank financing... -

Page 83

... to 100% of the financing, the lenders have the ability to exit the facility in October 2017. During 2012, the credit facility we obtained in connection with our purchase of Celebrity Solstice was assigned from Celebrity Solstice Inc., our subsidiary which owns the ship, to Royal Caribbean Cruises... -

Page 84

... certain series may be redeemed upon the payment of a makewhole premium. Following is a schedule of annual maturities on longterm debt including capital leases as of December 31, 2012 for each of the next five years (in thousands): Year 2013 2014 2015 2016 2017 Thereafter $1,519,483 1,549,057 1,063... -

Page 85

... award issue date. In February 2013, the Compensation Committee of our Board of Directors set the actual payout level at 94% of target for the performance shares issued in 2012. We also provide an Employee Stock Purchase Plan ("ESPP") to facilitate the purchase by employees of up to 800,000 shares... -

Page 86

... cost of these awards is determined using the fair value of our common stock on the date of the grant, and compensation expense is recognized over the vesting period. Restricted stock activity is summarized in the following table: WeightedAverage Grant Date Fair Value ended December 31, 2012, 2011... -

Page 87

... FinanCial statements As of December 31, 2012, we had $6.2 million of total unrecognized compensation expense, net of estimated forfeitures, related to performance share unit grants, which will be recognized over the weightedaverage period of 2 years. of ships pursuant to Section 883 of the Internal... -

Page 88

... in earnings during the fourth quarter of 2012 and is reported within Other (expense) income in our statements of comprehensive income (loss). Deferred tax assets, related valuation allowances and deferred tax liabilities related to our operations are not material as of December 31, 2012 and 2011... -

Page 89

... Inputs that are unobservable. The Company did not use any Level 3 inputs as of December 31, 2012 and December 31, 2011. (4) Consists of foreign currency forward contracts and collar options, interest rate swaps, cross currency swaps, fuel swaps and purchased fuel call options. Please refer to the... -

Page 90

... risk attributable to changes in interest rates, foreign currency exchange rates and fuel prices. We manage these risks through a combination of our normal operating and financing activities and through the use of derivative financial instruments pursuant to our hedging practices and policies. The... -

Page 91

... 31, 2012 and 2011 was $2.4 billion and $1.3 billion, respectively. Foreign Currency exchange Rate Risk Derivative Instruments Our primary exposure to foreign currency exchange rate risk relates to our ship construction contracts denominated in euros and our growing international business operations... -

Page 92

...expense over the estimated useful life of the vessel. During 2012, we entered into foreign currency collar options to hedge a portion of our foreign currency exposure on the construction contract price of Anthem of the Seas. These foreign currency collar options are accounted for as cash flow hedges... -

Page 93

...to tHe ConsoliDateD FinanCial statements The fair value and line item caption of derivative instruments recorded were as follows: Fair Value of Derivative Instruments Asset Derivatives As of December 31, 2012 (in thousands) Balance Sheet Location Fair Value As of December 31, 2011 Fair Value Balance... -

Page 94

...31, 2011 Amount of Gain (Loss) Recognized in Income on Hedged Item Year Ended December 31, 2012 Year Ended December 31, 2011 The effect of derivative instruments qualifying and designated as hedging instruments in cash flow hedges on the consolidated financial statements was as follows: Location of... -

Page 95

... Quantum-class ship, with approximately 4,100 berths which is expected to enter service in the second quarter of 2015. During 2011, we entered into credit agreements to finance the construction of Quantum of the Seas and Anthem of the Seas. Each facility makes available to us unsecured term loans... -

Page 96

... 2011 against Royal Caribbean Cruises Ltd. in the United States District Court for the Southern District of Florida on behalf of a purported class of stateroom attendants employed onboard Royal Caribbean International cruise vessels alleging that they were required to pay other crew members to help... -

Page 97

... FinanCial statements In addition, we are obligated under other noncancelable operating leases primarily for offices, warehouses and motor vehicles. As of December 31, 2012, future minimum lease payments under noncancelable operating leases were as follows (in thousands): Year 2013 2014 2015 2016... -

Page 98

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 99

...nights. 10 to 13 nights. 6 to 9 nights. 5 nights or less. Onboard credit is valid for any cruise vacation on Royal Caribbean International, Celebrity Cruises, or Azamara Club Cruises (excludes any charter sailings or sailings on the Celebrity Xpeditionâ„¢ Galapagos). Additional terms and conditions... -

Page 100

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 101

... financial reports, press releases and corporate governance documents free of charge through our Investor Relations website at www.rclinvestor.com or by contacting the Investor Relations Department at our corporate headquarters. Corporate office Royal Caribbean Cruises Ltd. 1050 Caribbean Way Miami... -

Page 102

Royal Caribbean Cruises Ltd. 1050 Caribbean Way, Miami, Florida 33132-2096 USA