Rosetta Stone 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

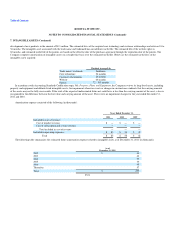

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

The carrying amounts reported in the consolidated balance sheets for cash and cash equivalents, restricted cash, accounts receivable, accounts payable

and other accrued expenses approximate fair value due to relatively short periods to maturity.

On November 1, 2009, the Company acquired certain assets from SGLC International Co. Ltd. ("SGLC"), a software reseller headquartered in Seoul,

South Korea. As the assets acquired constituted a business, this transaction was accounted for under Accounting Standards Codification topic 805, Business

Combination ("ASC 805"). The purchase price consisted of an initial cash payment of $100,000, followed by three annual cash installment payments, based

on revenue performance in South Korea. The terms of the acquisition agreement provide for additional consideration to be paid by the Company in each of the

following three years, if the acquired company's revenues exceed certain targeted levels each of these years. The amount is calculated as the lesser of a

percentage of the revenue generated or a fixed amount for each year, based on the terms of the agreement.

Based on these terms, the minimum additional cash payment is zero if none of the minimum revenue targets are met, and the maximum additional

payment is $1.1 million. In 2011 and 2010, we made additional payments of $350,000 and $400,000 respectively in accordance with the terms of the

purchase.

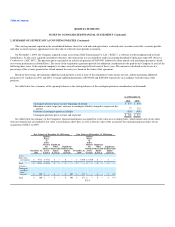

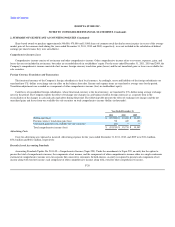

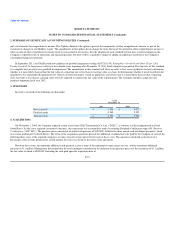

See table below for a summary of the opening balances to the closing balances of the contingent purchase consideration (in thousands):

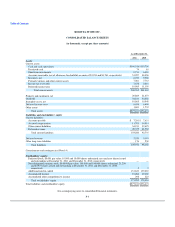

As of December 31,

2011 2010

Contingent purchase price accrual, beginning of period $ 573 $ 850

Minimum revenue target met, increase in contingent liability charged to expense in the

period 77 123

Payment of contingent purchase liability (350) (400)

Contingent purchase price accrual, end of period $ 300 $ 573

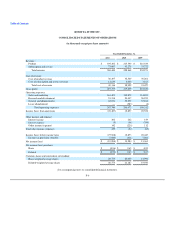

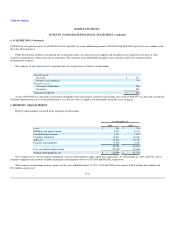

See table below for summary of the Company's financial instruments accounted for at fair value on a recurring basis, which consist only of our short-

term investments that are marked to fair value at each balance sheet date, as well as the fair value of the accrual for the contingent purchase price of our

acquisition of SGLC in 2009:

Fair Value as of December 31, 2011 using: Fair Value as of December 31, 2010 using:

December 31,

2011

Quoted

Prices

in

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) December 31,

2010

Quoted

Prices

in

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Short-term

investments $ 9,711 $ 9,711 $ — $ — $ 6,410 $ 6,410 $ — $ —

Total $ 9,711 $ 9,711 $ — $ — $ — $ — $ — $ —

Liabilities:

Contingent

purchase

price

accrual $ 300 $ — $ — $ 300 $ 573 $ — $ — $ 573

Total $ 300 $ — $ — $ 300 $ 573 $ — $ — $ 573

F-14