Rosetta Stone 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

become subject to other consequences. In addition, open source licenses generally do not provide warranties or other contractual protections regarding

infringement claims or the quality of the code. Thus, we may have little or no recourse if we become subject to infringement claims relating to the open source

software or if the open source software is defective in any manner.

Risks Related to Owning Our Common Stock

Some of our stockholders could together exert significant influence over our company.

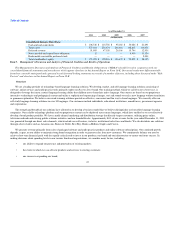

As of December 31, 2011, funds affiliated with ABS Capital Partners beneficially owned in the aggregate shares representing approximately 25% of our

outstanding voting power. Two managing members of the general partner of ABS Capital Partners currently serve on our board of directors. Additionally, as

of December 31, 2011, Norwest Equity Partners VIII, LP, or Norwest, beneficially owned in the aggregate shares representing approximately 16% of our

outstanding voting power. One managing member of the general partner of Norwest currently serves on our board of directors. As a result, these stockholders

could together potentially have significant influence over all matters presented to our stockholders for approval, including election and removal of our

directors and change of control transactions. The interests of these stockholders may not always coincide with the interests of the other holders of our common

stock.

If securities analysts do not publish research or reports about our business or if they publish negative evaluations of our stock, the price of our stock

could decline.

The trading market for our common stock depends in part on the research and reports that industry or financial analysts publish about us or our business.

If one or more of the analysts covering our business downgrade their evaluations of or recommendations regarding our stock, or if one or more of the analysts

cease providing research coverage on our stock, the price of our stock could decline. If one or more of these analysts cease providing research coverage on our

stock, we could lose visibility in the market for our stock, which in turn could cause our stock price to decline.

Provisions in our organizational documents and in the Delaware General Corporation Law may prevent takeover attempts that could be beneficial to our

stockholders.

Provisions in our second amended and restated certificate of incorporation and second amended and restated bylaws, and in the Delaware General

Corporation Law, may make it difficult and expensive for a third party to pursue a takeover attempt we oppose even if a change in control of our company

would be beneficial to the interests of our stockholders. Any provision of our second amended and restated certificate of incorporation or second amended and

restated bylaws or Delaware law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a

premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock. Our board of

directors has the authority to issue up to 10,000,000 shares of preferred stock in one or more series and to fix the powers, preferences and rights of each series

without stockholder approval. The ability to issue preferred stock could discourage unsolicited acquisition proposals or make it more difficult for a third party

to gain control of our company, or otherwise could adversely affect the market price of our common stock. Further, as a Delaware corporation, we are subject

to Section 203 of the Delaware General Corporation Law. This section generally prohibits us from engaging in mergers and other business combinations with

stockholders that beneficially own 15% or more of our voting stock, or with their affiliates, unless our directors or stockholders approve the business

combination in the prescribed manner. However, because funds affiliated with ABS Capital Partners and Norwest acquired their shares prior to our initial

public offering, Section 203 is currently inapplicable to any business combination or transaction with them or their affiliates. In addition, our second amended

and restated certificate of incorporation includes a classified board of directors and requires that any action to be

37