Rosetta Stone 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

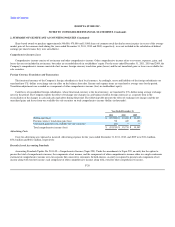

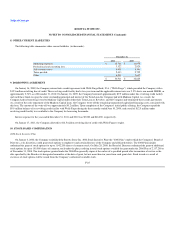

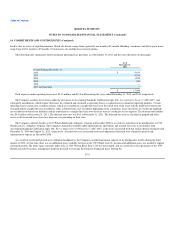

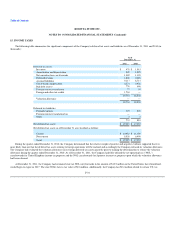

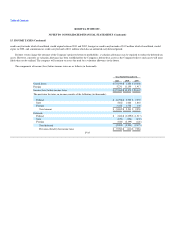

8. OTHER CURRENT LIABILITIES

The following table summarizes other current liabilities (in thousands):

December 31,

2011 2010

Marketing expenses $ 12,726 $ 11,075

Professional and consulting fees 3,322 2,820

Sales return reserve 9,931 8,391

Taxes payable 2,413 2,722

Other 6,519 7,617

$ 34,911 $ 32,625

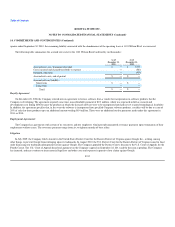

9. BORROWING AGREEMENT

On January 16, 2009, the Company entered into a credit agreement with Wells Fargo Bank, N.A. ("Wells Fargo"), which provided the Company with a

$12.5 million revolving line of credit. This revolving credit facility had a two-year term and the applicable interest rate was 2.5% above one month LIBOR, or

approximately 2.76% as of December 31, 2010. On January 16, 2009, the Company borrowed approximately $9.9 million under this revolving credit facility

and used these funds to repay the entire outstanding principal and interest of the Term Loan the Company had with Madison Capital. As a result, the

Company had no borrowings owed to Madison Capital under either their Term Loan or Revolver, and the Company had terminated these credit agreements.

As a result of the early repayment of the Madison Capital Loan, the Company wrote-off the remaining unamortized capitalized financing costs associated with

this loan. The amount of the write-off was approximately $0.2 million. Upon completion of the Company's initial public offering, the Company repaid the

$9.9 million balance of its revolving credit facility with Wells Fargo during the three months ended June 30, 2009, and a total of $12.5 million under

revolving credit facility was available to the Company for borrowing thereunder.

Interest expense for the year ended December 31, 2011 and 2010 was $5,000 and $66,000, respectively.

On January 17, 2011, the Company allowed its $12.5 million revolving line of credit with Wells Fargo to expire.

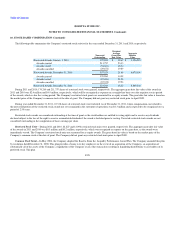

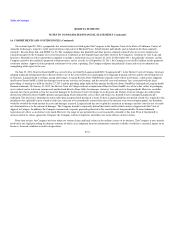

10. STOCK-BASED COMPENSATION

2006 Stock Incentive Plan

On January 4, 2006, the Company established the Rosetta Stone Inc. 2006 Stock Incentive Plan (the "2006 Plan") under which the Company's Board of

Directors, at its discretion, could grant stock options to employees and certain directors of the Company and affiliated entities. The 2006 Plan initially

authorized the grant of stock options for up to 1,942,200 shares of common stock. On May 28, 2008, the Board of Directors authorized the grant of additional

stock options for up to 195,000 shares of common stock under the plan, resulting in total stock options available for grant under the 2006 Plan of 2,137,200 as

of December 31, 2008. The stock options granted under the 2006 Plan generally expire at the earlier of a specified period after termination of service or the

date specified by the Board or its designated committee at the date of grant, but not more than ten years from such grant date. Stock issued as a result of

exercises of stock options will be issued from the Company's authorized available stock.

F-25