Rosetta Stone 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

During the last three years, inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing

prices will materially affect our business in the foreseeable future.

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing arrangements. We do not have any interest in entities referred to as variable interest entities, which

include special purpose entities and other structured finance entities.

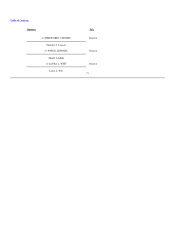

Contractual Obligations

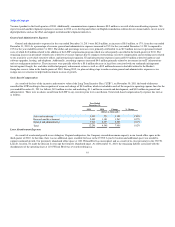

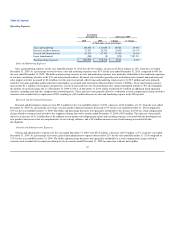

The following table summarizes our contractual obligations at December 31, 2011 and the effect such obligations are expected to have on our liquidity

and cash flow in future periods.

Total Less than

1 Year 1 - 3 Years 3 - 5 Years More than

5 Years

(in thousands)

Long-term debt $ — $ — $ — $ — $ —

Operating lease obligations 13,086 6,616 6,084 386 —

Total $ 13,086 $ 6,616 $ 6,084 $ 386 $ —

The operating lease obligations reflected in the table above include our corporate office leases and site licenses for our kiosks.

Recent Accounting Pronouncements

Accounting Standards Update No. 2011-05—Comprehensive Income (Topic 220). Under the amendments to Topic 220, an entity has the option to

present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous

statement of comprehensive income or in two separate but consecutive statements. In both choices, an entity is required to present each component of net

income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount

for comprehensive income. This Update eliminates the option to present the components of other comprehensive income as part of the statement of changes in

stockholders' equity. The amendments in this update do not change the items that must be reported in other comprehensive income or when an item of other

comprehensive income must be reclassified to net income, thus the adoption of such standard will not have a material impact on our reported results of

operations and financial position.

In September 2011, the FASB issued new guidance on goodwill impairment testing (ASU 2011-08, Intangibles—Goodwill and Other (Topic 350):

Testing Goodwill for Impairment), effective for calendar years beginning after December 15, 2011. Early adoption is permitted. The objective of this standard

is to simplify how an entity tests goodwill for impairment. The amendments in this standard will allow an entity to first assess qualitative factors to determine

whether it is more likely than not that the fair value of a reporting unit is less than its carrying value as a basis for determining whether it needs to perform the

quantitative two-step goodwill impairment test. Only if an entity determines, based on qualitative assessment, that it is more likely than not that a reporting

unit's fair value is less than its carrying value will it be required to calculate the fair value of the reporting unit. We intend to adopt this new guidance

beginning fiscal year 2012.

71