Rosetta Stone 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. STOCK-BASED COMPENSATION (Continued)

2009 Omnibus Incentive Plan

On February 27, 2009, the Company's Board of Directors approved a new Stock Incentive and Award Plan (the "2009 Plan") that provides for the ability

of the Company to grant up to 2,437,744 new stock incentive awards or options including Incentive and Nonqualified Stock Options, Stock Appreciation

Rights, Restricted Stock, Restricted Stock Units, Performance Units, Performance Shares, Performance based Restricted Stock, Share Awards, Phantom Stock

and Cash Incentive Awards. The stock incentive awards and options granted under the 2009 Plan generally expire at the earlier of a specified period after

termination of service or the date specified by the Board or its designated committee at the date of grant, but not more than ten years from such grant date. On

May 26, 2011 the Board of Directors authorized and the Company's shareholders' approved the allocation of an additional 1,000,000 shares of common stock

to the 2009 Plan.

Concurrent with the approval of the 2009 Plan, the 2006 Plan was terminated for purposes of future grants. At December 31, 2011 there were 1,562,010

shares available for future grant under the 2009 Plan.

In accordance with Accounting Standards Codification topic 718, Compensation—Stock Compensation ("ASC 718"), the fair value of stock-based

awards to employees is calculated as of the date of grant. Compensation expense is then recognized on a straight-line basis over the requisite service period of

the award. The Company uses the Black-Scholes pricing model to value its stock options, which requires the use of estimates, including future stock price

volatility, expected term and forfeitures. Stock-based compensation expense recognized is based on the estimated portion of the awards that are expected to

vest. Estimated forfeiture rates were applied in the expense calculation.

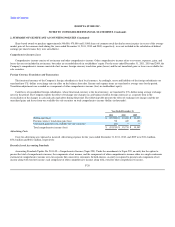

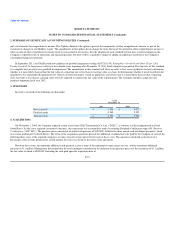

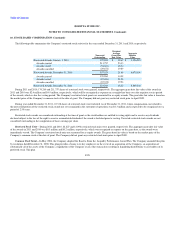

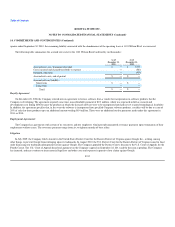

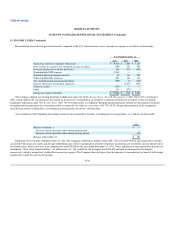

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model as follows:

Year Ended December 31,

2011 2010 2009

Expected stock price volatility 57% - 64% 58% - 66% 61%

Expected term of options 6 years 6 years 6 years

Expected dividend yield — — —

Risk-free interest rate 1.14% - 2.59% 1.14% - 2.59% 1.71% - 2.46%

Prior to the completion of the Company's initial public offering in April 2009, the Company's stock was not publicly quoted and the Company had a

limited history of stock option activity, so the Company reviewed a group of comparable industry-related companies to estimate its expected volatility over

the most recent period commensurate with the estimated expected term of the awards. In addition to analyzing data from the peer group, the Company also

considered the contractual option term and vesting period when determining the expected option life and forfeiture rate. Subsequent to the initial public

offering, the Company continues to review a group of comparable industry-related companies to estimate volatility, but also reviews the volatility of its own

stock since the initial public offering. The Company considers the volatility of the comparable companies to be the best estimate of future volatility. For the

risk-free interest rate, the Company uses a U.S. Treasury Bond rate consistent with the estimated expected term of the option award.

F-26