Rosetta Stone 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

appropriate consideration is given to all positive and negative evidence related to the realization of the deferred tax assets. This assessment considers, among

other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory carryforward

periods, our experience with operating loss and tax credit carryforwards not expiring unused, and tax planning alternatives.

We believe that the accounting estimate for the valuation of deferred tax assets is a critical accounting estimate because judgment is required in assessing

the likely future tax consequences of events that have been recognized in our financial statements or tax returns. We base our estimate of deferred tax assets

and liabilities on current tax laws and rates and, in certain cases, business plans and other expectations about future outcomes. Changes in existing tax laws or

rates could affect actual tax results and future business results may affect the amount of deferred tax liabilities or the valuation of deferred tax assets over

time. Our accounting for deferred tax consequences represents our best estimate of future events. Although it is possible there will be changes that are not

anticipated in our current estimates, we believe it is unlikely such changes would have a material period-to-period impact on our financial position or results

of operations.

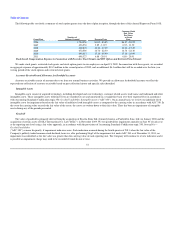

Our analysis of the need for a valuation allowance on our U.S. deferred tax assets recognizes that while we have not incurred a cumulative loss over our

evaluation period after adjusting for nonrecurring expenses related to our initial public offering in 2009, a substantial loss was incurred in the current year as a

result of difficult market conditions. Consideration has also been given to the lengthy period over which these net deferred assets can be realized, and our

history of not having tax loss carryforwards in any jurisdiction expire unused.

In 2010, we recognized a tax benefit of $2.4 million due to the release of the valuation allowance on deferred tax assets of non-US subsidiaries which we

believe are more likely than not to be realized. Our effective income tax rate in 2010 benefited from the availability of previously unrealized deferred tax

assets which we utilized to reduce tax expense for United Kingdom and Japanese income tax purposes. The release of our valuation allowance was

determined in accordance with the provisions of ASC 740, which requires an assessment of both positive and negative evidence when determining whether it

is more likely than not that deferred tax assets are recoverable; such assessment is required on a jurisdiction by jurisdiction basis. Historical operating income

and continuing projected income represented sufficient positive evidence that we used to conclude that it is more likely than not that our deferred tax assets

will be realized and accordingly, a release of our valuation allowance was recorded in the fourth quarter of 2010.

At December 31, 2011 and 2010, our net deferred tax asset was $19.0 million and $17.7 million, respectively. Based on our assessment, it appears more

likely than not that the net deferred tax asset will be realized through future taxable earnings. If future results fail to provide objectively verifiable evidence to

support the realization of our deferred tax asset, a valuation allowance may be required to reduce the deferred tax assets. However, currently no valuation

allowance has been established for the Company's net deferred tax assets. We will continue to assess the need for a valuation allowance in the future.

53