Rosetta Stone 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241

|

|

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

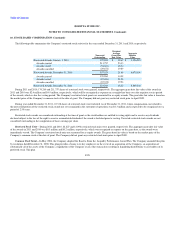

15. INCOME TAXES (Continued)

The Company is subject to taxation in the United States and various states and foreign jurisdictions. The Company's tax years 2010, 2009, 2008 and 2007

are subject to examination by the tax authorities. As of December 31, 2011, the Company is under audit in the United States for the tax year 2008 and Japan

for tax years 2008, 2009 and 2010. While the ultimate results cannot be predicted with certainty, the Company believes that adjustments resulting from

examinations, if any, will not have a material adverse effect on its consolidated financial condition or results of operations, and that the accrued tax liabilities

are adequate for all years. No provision was made in 2011 for United States income taxes on undistributed earnings of the foreign subsidiaries as it is the

Company's intention to utilize those earnings in the foreign operations for an indefinite period of time or to repatriate such earnings only when it is tax

effective to do so.

The Company made income tax payments of $1.7 million, $10.0 million and $6.4 million in 2011, 2010 and 2009, respectively.

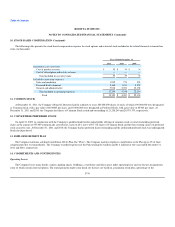

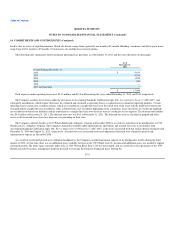

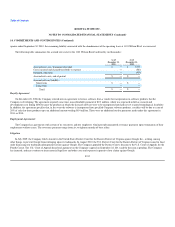

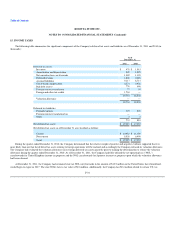

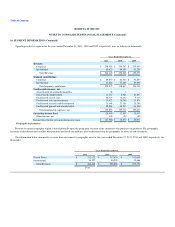

16. SEGMENT INFORMATION

Beginning in 2011, the company was managed in two operating segments—Consumer and Institutional. These segments also represent our reportable

segments. Management, specifically the chief operating decision maker , began to measure the performance of our operating segments in the first quarter of

2011 based upon operating segment revenue and operating segment contribution. Operating segment contribution includes segment revenue and expenses

incurred directly by the segment, including material costs, service costs, research and development and selling, marketing, and administrative expenses. We

do not allocate certain expenses, which include the majority of general and administrative expenses, facilities and communication expenses, purchasing

expenses, manufacturing support and logistic expenses, depreciation and amortization, amortization of capitalized software development costs, and stock-

based compensation. These expenses are included in the unallocated expenses section of the table presented below. Revenue from transactions between our

operating segments is not material.

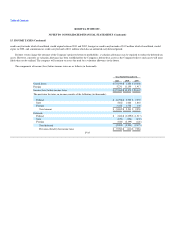

With the exception of goodwill, we do not identify or allocate our assets by operating segment to account for or manage the business. Consequently, we

do not present assets or liabilities by operating segment.

F-37