Rosetta Stone 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

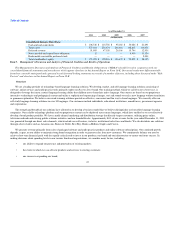

Income Tax Expense (Benefit)

Income tax expense (benefit) consists of federal, state and foreign income taxes. For the year ended December 31, 2011, our worldwide effective tax rate

was approximately 29%. We expect our worldwide rate to be approximately 32-37% in 2012 assuming no general increase in federal, state or foreign income

tax rates applicable to companies such as ours.

Critical Accounting Policies and Estimates

In presenting our financial statements in conformity with accounting principles generally accepted in the United States, we are required to make

estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and expenses and related disclosures.

Some of the estimates and assumptions we are required to make relate to matters that are inherently uncertain as they pertain to future events. We base

these estimates and assumptions on historical experience or on various other factors that we believe to be reasonable and appropriate under the circumstances.

On an ongoing basis, we reconsider and evaluate our estimates and assumptions. Our future estimates may change if the underlying assumptions change.

Actual results may differ significantly from these estimates.

We believe that the critical accounting policies listed below involve our more significant judgments, assumptions and estimates and, therefore, could

have the greatest potential impact on our consolidated financial statements. In addition, we believe that a discussion of these policies is necessary to

understand and evaluate the consolidated financial statements contained in this annual report on Form 10-K.

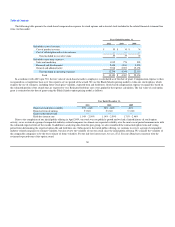

Revenue Recognition

Revenue is primarily derived from the sale of packaged software and audio practice products, online software subscriptions and professional services.

Professional services include training, implementation services and dedicated conversational coaching associated with Rosetta Stone TOTALe. Rosetta Stone

TOTALe online, which was released in July 2009, combines dedicated conversational coaching and an online software subscription. Rosetta Stone Version 4

TOTALe, which was released in September 2010, combines packaged software and dedicated conversational coaching. We recognize revenue for software

products and related services in accordance with Accounting Standards Codification subtopic 985-605, Software: Revenue Recognition("ASC 985-605").

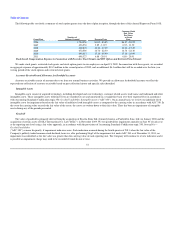

Revenue is recognized when all of the following criteria are met: there is persuasive evidence of an arrangement; the product has been delivered or

services have been rendered; the fee is fixed and determinable; and collectability is probable. Revenues from packaged software and audio practice products

and online software subscriptions are recorded net of discounts.

Revenue is recognized from the sale of packaged software and audio practice products when the product has been delivered, assuming the remaining

revenue recognition criteria have been met. Software products include sales to end-user customers and resellers. In most cases, revenue from sales to resellers

is not contingent upon resale of the software to the end user and is recorded in the same manner as all other product sales. Revenue from sales of packaged

software products are recognized as the products are shipped and title passes and risks of loss have been transferred. For most of our product sales, these

criteria are met at the time the product is shipped. For some sales to resellers and certain other sales, we defer revenue until the customer receives the product

because we legally retain a portion of the risk of loss on these sales during transit. A limited amount of packaged software products are sold to resellers on a

consignment basis. Revenue is recognized for these consignment transactions once the end-user sale has occurred, assuming the remaining revenue

recognition criteria have been met. In accordance with Accounting Standards Codification subtopic 985-605-50,

47