Radio Shack 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

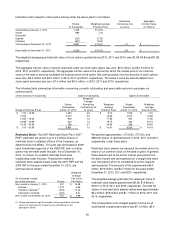

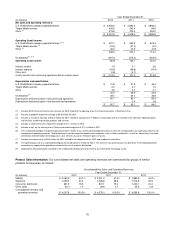

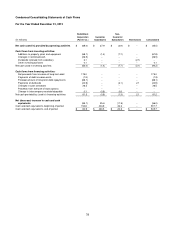

Year Ended December 31,

(In millions) 2012 2011 2010

Net sales and operating revenues:

U.S. RadioShack company-operated stores $ 3,456.5 $ 3,663.3 $ 3,808.2

Target Mobile centers 426.5 342.4 64.6

Other

(1)

374.8 372.3 393.0

$ 4,257.8 $ 4,378.0 $ 4,265.8

Operating (loss) income:

U.S. RadioShack company-operated stores

(

2

)

(3)

$ 337.7 $ 530.2 $ 675.4

Target Mobile centers

(4)

(37.5) (21.0) (4.0)

Other

(

5

)

36.3 20.9 41.8

336.5 530.1 713.2

Unallocated

(

6

)

(

7

)

(

8

)

(397.4) (375.0) (363.0)

Operating (loss) income (60.9) 155.1 350.2

Interest income 1.9 3.1 2.6

Interest expense (54.5) (46.8) (41.9)

Other loss (0.6) (4.1) --

(Loss) income from continuing operations before income taxes $ (114.1) $ 107.3 $ 310.9

Depreciation and amortization:

U.S. RadioShack company-operated stores $ 31.8 $ 37.9 $ 45.4

Target Mobile centers 6.4 4.7 1.5

Other 3.8 4.0 3.7

42.0 46.6 50.6

Unallocated

(

9

)

38.7 36.1 32.8

Depreciation and amortization from continuing operations 80.7 82.7 83.4

Depreciation and amortization from discontinued operations -- 0.4 0.8

$ 80.7 $ 83.1 $ 84.2

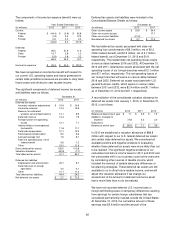

(1) Includes $3.0 million of franchise fee revenue for 2012 related to the opening of our first franchised stores in Southeast Asia.

(2) Includes a goodwill impairment charge of $3.0 million for 2012.

(3) Includes a charge to earnings of $23.4 million for 2011 related to a payment to T-Mobile in conjunction with our transition from offering T-Mobile products

and services to offering Verizon products and services.

(4) Includes a long-lived assets impairment charge of $11.7 million in 2012.

(5) Includes a loss on the closing of our Chinese manufacturing plant of $11.4 million in 2011.

(6) The unallocated category included in operating income relates to our overhead and corporate expenses that are not allocated to our operating segments for

management reporting purposes. Unallocated costs include corporate departmental expenses such as labor and benefits, as well as advertising, insurance,

distribution and information technology costs, plus certain unusual or infrequent gains or losses.

(7) Includes severance costs of $8.5 million for 2012 related to the departure of our CEO and headcount reductions.

(8) The operating loss for our unallocated category increased by $22.4 million for 2012. This increase was primarily due to a decrease in intercompany profits

earned by our supply chain operations related to the mix of products distributed.

(9) Depreciation and amortization included in the unallocated category primarily relate to our information technology assets.

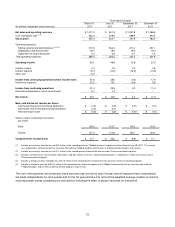

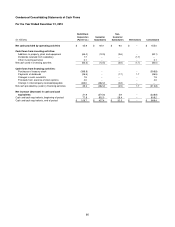

Product Sales Information: Our consolidated net sales and operating revenues are summarized by groups of similar

products and services, as follows:

Consolidated Net Sales and Operating Revenues

Year Ended December 31,

(In millions) 2012 2011 2010

Mobility $ 2,260.2 53.1% $ 2,251.2 51.4% $ 1,884.9 44.2%

Signature 1,293.3 30.4 1,265.8 28.9 1,314.9 30.8

Consumer electronics 661.9 15.5 831.1 19.0 1,030.7 24.2

Other sales 42.4 1.0 29.9 0.7 35.3 0.8

Consolidated net sales and

operating revenues

$ 4,257.8

100.0%

$ 4,378.0

100.0%

$ 4,265.8

100.0%