Radio Shack 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

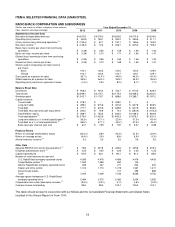

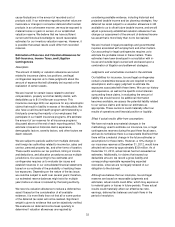

Selling, General and Administrative Expense

Our consolidated SG&A expense decreased 3.1%, or $48.4 million, in 2012. SG&A as a percentage of net sales and operating

revenues was essentially flat when compared with 2011. The table below summarizes the breakdown of various components

of our consolidated SG&A expense and their related percentages of total net sales and operating revenues.

Year Ended December 31,

2012 2011 2010

Dollars

% of

Sales &

Revenues

Dollars

% of

Sales &

Revenues

Dollars

% of

Sales &

Revenues

(In millions)

Compensation $ 696.4 16.4% $ 693.4 15.8% $ 663.1 15.5%

Rent and occupancy 252.3 5.9 261.5 6.0 265.3 6.2

Advertising 182.9 4.3 208.9 4.8 205.9 4.8

Other taxes (excludes income taxes) 108.7 2.6 108.3 2.5 97.7 2.3

Utilities 53.5 1.3 56.0 1.3 54.4 1.3

Insurance 46.6 1.1 49.6 1.1 45.9 1.1

Credit card fees 35.9 0.8 35.6 0.8 34.9 0.8

Professional fees 30.5 0.7 26.7 0.6 21.3 0.5

Repairs and maintenance 22.9 0.5 25.7 0.6 20.1 0.5

Licenses 14.5 0.3 14.9 0.3 13.2 0.3

Printing, postage and office supplies 9.3 0.2 9.0 0.2 6.9 0.2

Recruiting, training and employee relations 6.3 0.1 6.5 0.1 5.4 0.1

Travel 6.1 0.1 6.4 0.1 4.9 0.1

Matching contributions to savings plans 5.1 0.1 4.9 0.1 5.4 0.1

Other 58.0 1.5 70.0 1.7 39.4 1.0

$ 1,529.0 35.9% $ 1,577.4 36.0% $ 1,483.8 34.8%

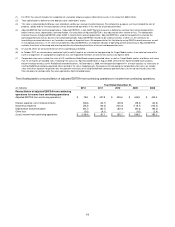

The decrease in SG&A expense was driven by decreased

advertising expense, decreased rent and occupancy

expense, and decreased compensation expense in the

second half of 2012. Additionally, SG&A in 2012 was lower

due to a one-time $23.4 million charge in 2011 related to

our transition from T-Mobile to Verizon and a one-time $9.5

million charge in 2011 related to the closure of our Chinese

manufacturing plant. These decreases were partially offset

by increased costs in the first half of 2012 to support

additional Target Mobile centers that were not open in the

same period last year and severance costs of $8.5 million

in connection with the departure of our Chief Executive

Officer combined with the termination of employment of

certain corporate headquarters support staff in the third

quarter of 2012.

We announced on September 25, 2012, that our Board of

Directors and Mr. James F. Gooch had agreed that Mr.

Gooch would step down from his position as Chief

Executive Officer and as a director of the Company,

effective immediately. Under Mr. Gooch’s employment

agreement, he was entitled to a specified cash payment

and the accelerated vesting of certain stock awards. During

the third quarter ended September 30, 2012, we recorded

$5.6 million of employee separation charges in connection

with Mr. Gooch’s departure. This included a cash charge of

$4.0 million and a non-cash charge of $1.6 million related to

the accelerated vesting of stock awards.

During the third quarter ended September 30, 2012, we

recorded $2.9 million of employee separation charges in

connection with the termination of the employment of

approximately 150 employees, who worked primarily at our

corporate headquarters.

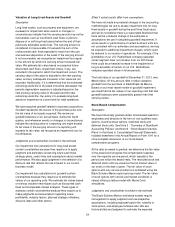

Depreciation and Amortization

The table below provides a summary of our total

depreciation and amortization by segment.

Year Ended December 31,

(In millions) 2012 2011

2010

U.S. RadioShack

company-operated stores

$ 31.8

$ 37.9

$ 45.4

Target Mobile centers 6.4 4.7 1.5

Other 3.8 4.0 3.7

Unallocated 38.7 36.1 32.8

Total depreciation and

amortization from continuing

operations

$ 80.7

$ 82.7

$ 83.4

The table below provides an analysis of total depreciation

and amortization.

Year Ended December 31,

(In millions) 2012 2011

2010

Depreciation and

amortization expense

$ 72.3

$ 75.2

$ 75.7

Depreciation and

amortization included

in cost of products sold

8.4

7.5

7.7

Total depreciation and

amortization from continuing

operations

$ 80.7

$ 82.7

$ 83.4