Radio Shack 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

international subsidiaries deemed to be permanently

invested are used to invest in the growth of these

operations.

Revenue Recognition: Our revenue is derived principally

from the sale of name brand and private brand products

and services to consumers. Revenue is recognized, net of

an estimate for customer refunds and product returns,

when persuasive evidence of an arrangement exists,

delivery has occurred or services have been rendered, the

sales price is fixed or determinable, and collectability is

reasonably assured.

Certain products, such as wireless telephone handsets,

require the customer to use the services of a third-party

service provider. The third-party service provider pays us

an upfront commission and, in some cases, a monthly

recurring residual amount based upon the ongoing

arrangement between the service provider and the

customer. Our sale of an activated wireless handset is the

single event required to meet the delivery criterion for both

the upfront commission and the recurring residual revenue.

Upfront commission revenue, net of estimated service

deactivations, is generally recognized at the time an

activated wireless handset is sold to the customer at the

point-of-sale. Based on our extensive history in selling

activated wireless handsets, we have been able to

establish reliable deactivation estimates. Recurring residual

income is recognized as earned under the terms of our

contracts with the service providers, which is typically as

the service provider bills its customer, generally on a

monthly basis. Sales of wireless handsets and the related

commissions and residual income are approximately 45

percent of our total revenue. Our three largest third-party

wireless service providers are AT&T, Sprint, and Verizon.

Cost of Products Sold: Cost of products sold primarily

includes the total cost of merchandise inventory sold, direct

costs relating to merchandise acquisition and distribution

(including depreciation and excise taxes), costs of services

provided, in-bound freight expenses to our distribution

centers, out-bound freight expenses to our retail outlets,

physical inventory valuation adjustments and losses,

customer shipping and handling charges, and certain

vendor allowances (see “Vendor Allowances” below).

Vendor Allowances: We receive allowances from third-

party service providers and product vendors through a

variety of promotional programs and arrangements as a

result of purchasing and promoting their products and

services in the normal course of business. We consider

vendor allowances received to be a reduction in the price of

a vendor's products or services and record them as a

component of inventory until the product is sold, at which

point we record them as a component of cost of products

sold unless the allowances represent reimbursement of

specific, incremental and identifiable costs incurred to

promote a vendor's products and services. In this case, we

record the vendor reimbursement when earned as an offset

to the associated expense incurred to promote the

applicable products and/or services.

Advertising Costs: Our advertising costs are expensed

the first time the advertising takes place. We receive

allowances from certain third-party service providers and

product vendors that we record when earned as an offset to

advertising expense incurred to promote the applicable

products and/or services only if the allowances represent

reimbursement of specific, incremental and identifiable

costs (see “Vendor Allowances” above). Advertising

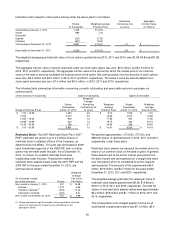

expense was $182.9 million, $208.9 million and $205.9

million for the years ended December 31, 2012, 2011 and

2010, respectively.

Stock-Based Compensation: We measure all employee

stock-based compensation awards using a fair value

method and record this expense in the consolidated

financial statements. Our stock-based compensation

relates to stock options, restricted stock awards, and other

equity-based awards issued to our employees and

directors. On the date that an award is granted, we

determine the fair value of the award and recognize the

compensation expense over the requisite service period,

which typically is the period over which the award vests.

Fair Value Measurements: Certain assets and liabilities are

required to be measured at fair value either on a recurring or

non-recurring basis. We estimate fair values based on one or

more of the following valuation techniques: the market

approach (comparable market prices), the income approach

(present value of future income or cash flow), or the cost

approach (cost to replace the service capacity of an asset or

replacement cost). See Note 13 - “Fair Value Measurements”

for additional disclosures of our fair value measurements.

Derivative Instruments and Hedging Activities: We

recognize all financial instruments that qualify for derivative

instrument accounting at fair value in the Consolidated

Balance Sheets. Changes in the fair value of derivative

financial instruments that qualify for hedge accounting are

recorded in stockholders’ equity as a component of

comprehensive income or as an adjustment to the carrying

value of the hedged item. Changes in fair values of

derivatives not qualifying for hedge accounting are reported

in earnings. Since the expiration of our interest rate swaps

in May 2011, we have not held any derivative instruments.

We maintain internal controls over our hedging activities,

which include policies and procedures for risk assessment

and the approval, reporting and monitoring of all derivative

financial instrument activities. We monitor our hedging

positions and creditworthiness of our counter-parties and

do not anticipate losses due to our counter-parties’

nonperformance. We do not hold or issue derivative