Radio Shack 2012 Annual Report Download - page 68

Download and view the complete annual report

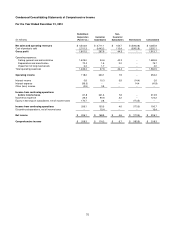

Please find page 68 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

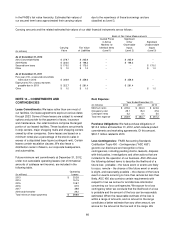

in the FASB’s fair value hierarchy. Estimated fair values of

our secured term loans approximated their carrying values

due to the recentness of these borrowings and are

classified as Level 3.

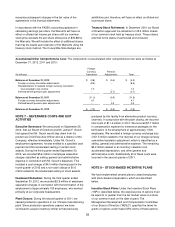

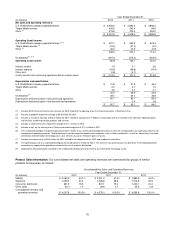

Carrying amounts and the related estimated fair values of our debt financial instruments are as follows:

Basis of Fair Value Measurements

Carrying

Value

Fair Value

of Liabilities

Quoted Prices

in Active

Markets for

Identical Items

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(In millions)

As of December 31, 2012

2013 Convertible Notes $ 278.7 $ 265.9 -- $ 265.9 --

2019 Notes $ 323.0 $ 198.3 -- $ 198.3 --

Secured term loans $ 175.0 $ 175.0 -- -- $ 175.0

Other $ 1.0 $ 1.0 -- -- $ 1.0

As of December 31, 2011

Five year 2.5% unsecured convertible

notes due in 2013

$ 346.9

$ 358.6

--

$ 358.6

--

Eight year 6.75% unsecured notes

payable due in 2019

$ 322.7

$ 281.4

--

$ 281.4

--

Other $ 1.0 $ 1.0 -- -- $ 1.0

NOTE 14 – COMMITMENTS AND

CONTINGENCIES

Lease Commitments: We lease rather than own most of

our facilities. Our lease agreements expire at various dates

through 2023. Some of these leases are subject to renewal

options and provide for the payment of taxes, insurance

and maintenance. Our retail locations comprise the largest

portion of our leased facilities. These locations are primarily

in strip centers, major shopping malls and shopping centers

owned by other companies. Some leases are based on a

minimum rental plus a percentage of the store's sales in

excess of a stipulated base figure (contingent rent). Certain

leases contain escalation clauses. We also lease a

distribution center in Mexico, our corporate headquarters,

and automobiles.

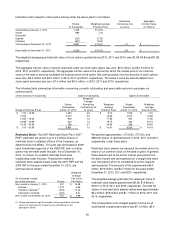

Future minimum rent commitments at December 31, 2012,

under non-cancelable operating leases (net of immaterial

amounts of sublease rent income), are included in the

following table.

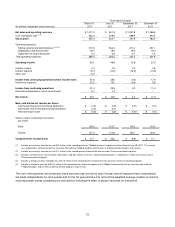

(In millions)

Operating

Leases

2013 $ 202.8

2014 151.5

2015 108.7

2016 67.9

2017 38.8

2018 and thereafter 29.2

Total minimum lease payments $ 598.9

Rent Expense:

Year Ended December 31,

(In millions) 2012 2011 2010

Minimum rents $ 220.6

$ 224.3

$ 224.6

Occupancy cost 29.1

35.3

37.6

Contingent rents 4.2

4.1

5.0

Total rent expense $ 253.9

$ 263.7

$ 267.2

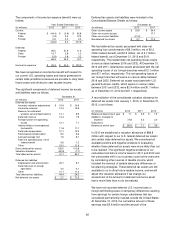

Purchase Obligations: We had purchase obligations of

$313.0 million at December 31, 2012, which include product

commitments and marketing agreements. Of this amount,

$301.7 million related to 2013.

Loss Contingencies: FASB Accounting Standards

Codification Topic 450 - Contingencies (“ASC 450”)

governs our disclosure and recognition of loss

contingencies, including pending claims, lawsuits, disputes

with third parties, investigations and other actions that are

incidental to the operation of our business. ASC 450 uses

the following defined terms to describe the likelihood of a

future loss: probable – the future event or events are likely

to occur, remote – the chance of the future event or events

is slight, and reasonably possible – the chance of the future

event or events occurring is more than remote but less than

likely. ASC 450 also contains certain requirements with

respect to how we accrue for and disclose information

concerning our loss contingencies. We accrue for a loss

contingency when we conclude that the likelihood of a loss

is probable and the amount of the loss can be reasonably

estimated. When the reasonable estimate of the loss is

within a range of amounts, and no amount in the range

constitutes a better estimate than any other amount, we

accrue for the amount at the low end of the range. We