Radio Shack 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

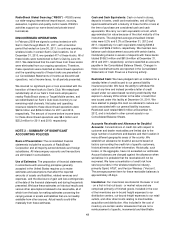

As with the Original 2016 Credit Facility, revolving

borrowings under the Restated 2016 Credit Facility bear

interest at our choice of a bank’s prime rate plus 1.25% to

1.75% or LIBOR plus 2.25% to 2.75%. The applicable rates

in these ranges are based on the aggregate average

availability under the facility. The Restated 2016 Credit

Facility also contains a $200 million sub-limit for the

issuance of standby and commercial letters of credit. The

issuance of letters of credit reduces the amount available

under the facility. Letter of credit fees are 2.25% to 2.75%

for standby letters of credit and 1.125% to 1.375% for

commercial letters of credit. We pay commitment fees to

the lenders at an annual rate of 0.50% of the unused

amount of the facility.

The maximum availability for revolving borrowings under

the 2016 Credit Facility is determined at the end of each

month and is calculated as the lesser of:

• $450 million, or

• Our borrowing base for revolving borrowings less

$45 million (calculated as $597.8 million at

December 31, 2012), or

• Our borrowing base for revolving borrowings up to a

maximum amount of $450 million less the greater of

12.5% (currently $56.3 million) or $45 million if we

do not meet a specified consolidated fixed charge

coverage ratio during a trailing twelve-month period

(calculated as $393.7 million at December 31, 2012).

As of December 31, 2012, our maximum availability for

revolving borrowings under the 2016 Credit Facility was

$393.7 million as a result of us not meeting the

consolidated fixed charge coverage ratio at December 31,

2012. As of December 31, 2012, no revolving borrowings

had been made under the facility, and letters of credit

totaling $3.1 million had been issued, resulting in $390.6

million of availability for revolving borrowings under the

2016 Credit Facility. We believe that we will not meet the

consolidated fixed charge coverage ratio for at least the

next twelve months.

If at any time the outstanding revolving borrowings and

term loans under the 2016 Credit Facility exceed the sum of

the revolving borrowing base and the term loan borrowing

base, we will be required to repay an amount equal to such

excess. No payments (whether optional or mandatory) may

be made in respect of the principal amount of term loans

unless all revolving borrowings have been repaid, any

outstanding letters of credit have been cash collateralized,

and all other commitments under the Restated 2016 Credit

Facility have been repaid or otherwise satisfied. The

revolving borrowing base and term loan borrowing base are

subject to customary reserves that may be implemented by

the administrative agent at its permitted discretion.

The Restated 2016 Credit Facility contains customary

affirmative and negative covenants and events of default

that are substantially consistent with those contained in the

Original 2016 Credit Facility. These covenants could,

among other things, restrict certain payments, including

dividends and share repurchases. We do not believe the

limitations contained in the credit facility will, in the

foreseeable future, adversely affect our ability to use the

credit facility and execute our business plan.

Credit Facility Term Loan Due January 2016: The

Restated 2016 Credit Facility allowed us to borrow $50.0

million in August of 2012 under a term loan agreement,

which is subject to the term loan borrowing base and bears

interest at our choice of a bank’s prime rate plus 3.5% or

LIBOR plus 4.5%. For this term loan, interest is payable on

the interest rate reset dates, which will be on at least a

quarterly basis. This term loan is secured by the same

assets that secure the Restated 2016 Credit Facility and

matures on January 4, 2016. Net proceeds from this term

loan were $48.5 million, after fees and expenses of $1.5

million incurred in connection with the Restated 2016 Credit

Facility, and will be used for working capital and general

corporate purposes. This term loan may not be repaid until

all revolving borrowings, letters of credit, or other

commitments under the Restated 2016 Credit Facility have

been repaid or otherwise satisfied.

Credit Facility Term Loan Due September 2017: The

Restated 2016 Credit Facility allowed us to borrow $25.0

million in October 2012 under a term loan agreement,

which is subject to the term loan borrowing base and bears

interest at our choice of a bank’s prime rate plus 3.5% or

LIBOR plus 4.5%. For this term loan, interest is payable on

the interest rate reset dates, which will be on at least a

quarterly basis. This term loan is secured by the same

assets that secure the Restated 2016 Credit Facility and

matures on September 27, 2017. Net proceeds from this

term loan were $24.0 million, after fees and expenses of

$1.0 million, and will be used for working capital and

general corporate purposes.

Term Loan Due September 2017: In September 2012 we

borrowed $100 million, due on September 27, 2017, under

a new term loan credit agreement (“2017 Term Loan”) with

two lenders and Wells Fargo, N. A., as administrative and

collateral agent. The 2017 Term Loan bears interest at a

rate of 10.0% plus adjusted LIBOR for a one, two, or three

month interest period, but never less than 11.0%. Interest is

payable on a monthly basis.

Net proceeds of the 2017 Term Loan were $95.2 million,

after fees and expenses of $4.8 million, and will be used for

working capital and general corporate purposes. Beginning

with the fiscal quarter ending December 31, 2014, the term

loan is subject to quarterly principal payments of

$1,667,500.