Radio Shack 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

entail significant risks and uncertainties, however, including

without limitation:

• Economic, social and political instability in any

particular country or region

• Changes in currency exchange rates

• Changes in government restrictions on converting

currencies or repatriating funds

• Changes in U.S. or foreign laws and regulations or in

trade, monetary or fiscal policies

• High inflation and monetary fluctuations

• Changes in restrictions on imports and exports

• Difficulties in hiring, training and retaining qualified

personnel, particularly finance and accounting

personnel with expertise in generally accepted

accounting principles in the United States

• Inability to obtain access to fair and equitable

political, regulatory, administrative and legal systems

• Changes in government tax policy

• Difficulties in enforcing our contractual rights or

enforcing judgments or obtaining a just result in

foreign jurisdictions

• Potentially adverse tax consequences of operating in

multiple jurisdictions

• Managing our relationship and contractual rights with

any partner we enter into business with in a foreign

country

• Access to sufficient capital

Any of these factors, by itself or in combination with others,

could materially adversely affect our results of operations

and financial condition.

We may be unable to keep existing retail locations or

open new retail locations in desirable places, which

could materially adversely affect our sales and

profitability.

We may be unable to keep existing retail locations or open

new retail locations in desirable places in the future. We

compete with other retailers and businesses for suitable

retail locations. Local land use, local zoning issues,

environmental regulations and other regulations may affect

our ability to find suitable retail locations and also influence

the cost of leasing, building or buying them. We also may

have difficulty negotiating real estate leases and purchase

agreements on acceptable terms. Further, to relocate or

open new retail locations successfully, we must hire and

train employees for them. Construction, environmental,

zoning and real estate delays may negatively affect retail

location openings and increase costs and capital

expenditures. In addition, when we open new retail

locations in markets where we already have a presence,

our existing locations may experience a decline in sales as

a result, and when we open retail locations in new markets,

we may encounter difficulties in attracting customers due to

a lack of customer familiarity with our brand, our lack of

familiarity with local customer preferences, competition with

new competitors or with existing competitors with a large,

established market presence, and seasonal differences in

the market. We cannot be certain that new or relocated

retail locations will produce the anticipated sales or return

on investment or that existing retail locations will not be

materially adversely affected by new or expanded

competition in their market areas.

Terrorist activities and governmental efforts to thwart

them could materially adversely affect our results of

operations and financial condition.

A terrorist attack or series of attacks on the United States

could have a significant adverse effect on its economy. This

downturn in the economy could, in turn, materially

adversely affect our results of operations and financial

condition. The potential for future terrorist attacks, the

national and international responses to terrorist attacks,

and other acts of war or hostility could cause greater

uncertainty and cause the economy to suffer in ways that

we cannot predict.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

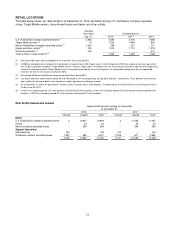

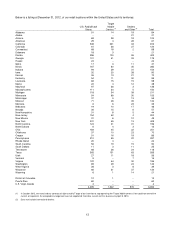

ITEM 2. PROPERTIES.

Information on our properties is presented in our MD&A and

financial statements included in this Annual Report on Form

10-K and is incorporated into this Item 2 by reference.

The following items are discussed further in the Notes to

Consolidated Financial Statements:

Summary of Significant Accounting Policies –

Property, Plant and Equipment

Note 2

Supplemental Balance Sheet Disclosures –

Property, Plant and Equipment, Net

Note 3

Commitments and Contingencies Note 14

We lease, rather than own, most of our retail facilities. Our

stores are located in shopping malls, stand-alone buildings

and shopping centers owned by other entities. We lease

administrative offices throughout the United States and in

Mexico, Hong Kong, and Taiwan. We own the property on

which our three distribution centers and two manufacturing

facilities are located within the United States. Previously,

we leased a manufacturing plant in China. Our lease for

this plant ended on December 31, 2011. We ceased

manufacturing operations in this plant in 2011.