Radio Shack 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

financial instruments for trading or speculative purposes. To

qualify for hedge accounting, derivatives must meet defined

correlation and effectiveness criteria, be designated as a

hedge and result in cash flows and financial statement

effects that substantially offset those of the position being

hedged.

Foreign Currency Translation: The functional currency of

substantially all operations outside the U.S. is the

applicable local currency. Translation gains or losses

related to net assets located outside the United States are

included as a component of accumulated other

comprehensive loss and are classified in the stockholders’

equity section of the accompanying Consolidated Balance

Sheets.

Discontinued Operations: We account for closed retail

locations as discontinued operations when the operations

and cash flows of a retail location being disposed of are

eliminated from ongoing operations and we do not have

any significant continuing involvement in its operations. In

reaching the determination as to whether the cash flows of

a retail location will be eliminated from our ongoing

operations, we consider whether it is likely that customers

will migrate to our other retail locations in the same

geographic market.

Reclassifications: Certain amounts in the December 31,

2011 and 2010, financial statements have been reclassified

to conform to the December 31, 2012, presentation. These

reclassifications had no effect on net income, total assets,

total liabilities, or total stockholders’ equity as previously

reported. The most significant reclassification was a change

to our presentation of certain deferred rent in the amount of

$27.5 million from a current liability to a non-current liability

in our 2011 Consolidated Balance Sheet to be more

consistent with retail industry practice.

New Accounting Standards: In June 2011 the Financial

Accounting Standards Board (“FASB”) issued new

accounting guidance to update the presentation of

comprehensive income in consolidated financial

statements. Under this new guidance, an entity has the

option to present the total of comprehensive income, the

components of net income, and the components of other

comprehensive income either in a single continuous

statement of comprehensive income or in two separate but

consecutive statements in its annual financial statements.

This guidance is effective for fiscal years beginning after

December 15, 2011. We adopted this guidance effective

January 1, 2012. See our Consolidated Statements of

Comprehensive Income for the required disclosure. In

addition to net income, the other components of our

comprehensive income were foreign currency translation

adjustments and defined benefit pension plan adjustments.

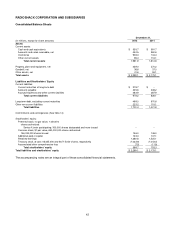

NOTE 3 – SUPPLEMENTAL BALANCE SHEET

DISCLOSURES

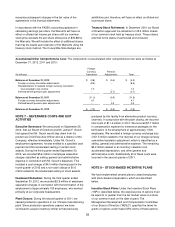

Accounts and Notes Receivable, Net: As of December

31, 2012 and 2011, we had the following accounts and

notes receivable outstanding in the accompanying

Consolidated Balance Sheets:

December 31,

(In millions) 2012 2011

Receivables from vendors

and service providers, net

$ 315.3

$ 273.8

Income tax receivable 64.4 6.9

Trade accounts receivable 49.9 53.5

Other receivables 24.1 27.8

Allowance for doubtful accounts (1.2) (1.4)

Accounts and notes receivable, net $ 452.5 $ 360.6

Receivables from vendors and service providers relate to

earned wireless activation commissions, rebates, residual

income, promotions, marketing development funds and

other payments from our third-party service providers and

product vendors, after taking into account estimates for

service providers’ customer deactivations and non-

activations, which are factors in determining the amount of

wireless activation commissions and residual income

earned.

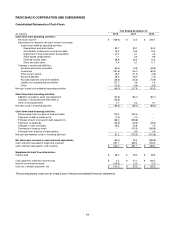

The change in the allowance for doubtful accounts is as

follows:

December 31,

(In millions) 2012 2011 2010

Balance at the beginning

of the year

$ 1.4

$ 1.4

$ 1.8

Provision for bad debts

included in selling,

general and

administrative expense

0.1

0.1

0.1

Uncollected receivables

written off, net

(0.3)

(0.1)

(0.5)

Balance at the end of the year $ 1.2 $ 1.4 $ 1.4

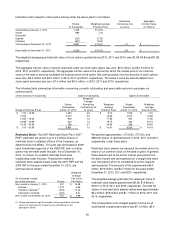

Other Current Assets, Net:

December 31,

(In millions) 2012 2011

Restricted cash $ 26.5 $ --

Deferred income taxes 23.9 54.4

Prepaid income taxes -- 26.8

Other 35.0 34.9

Total other current assets, net $ 85.4 $ 116.1