Radio Shack 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

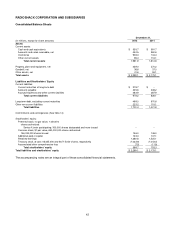

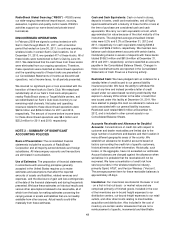

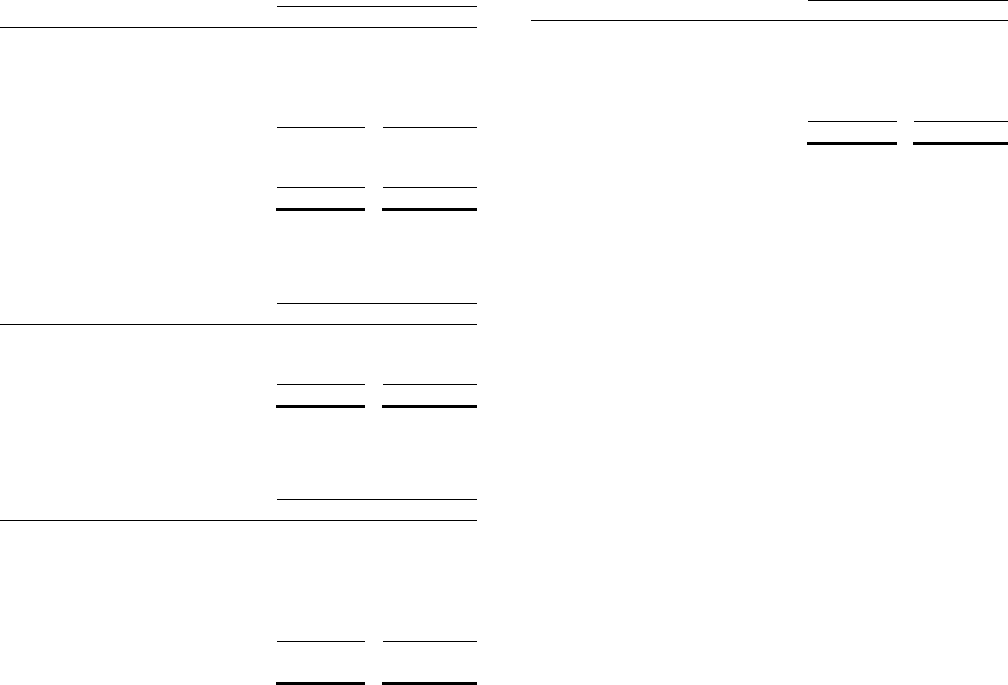

Property, Plant and Equipment, Net:

December 31,

(In millions) 2012 2011

Land $ 2.5 $ 2.5

Buildings 62.9 62.4

Furniture, fixtures, equipment

and software

685.9

663.0

Leasehold improvements 355.7 360.9

Total PP&E 1,107.0 1,088.8

Less accumulated depreciation

and amortization

(868.0)

(818.6)

Property, plant and equipment, net $ 239.0 $ 270.2

Other Assets, Net:

December 31,

(In millions) 2012 2011

Notes receivable $ 12.2 $ 8.9

Deferred income taxes -- 17.1

Other 29.4 29.1

Total other assets, net $ 41.6 $ 55.1

Accrued Expenses and Other Current Liabilities:

December 31,

(In millions) 2012 2011

Insurance $ 58.7 $ 65.3

Payroll and bonuses 49.5 45.7

Sales and payroll taxes 41.6 41.1

Advertising 21.6 30.8

Gift card deferred revenue 21.9 20.6

Other 70.6 84.4

Total accrued expenses and

other current liabilities

$ 263.9

$ 287.9

Other Non-Current Liabilities:

December 31,

(In millions) 2012 2011

Liability for unrecognized tax benefits $ 135.8 $ 33.6

Deferred compensation 27.0 28.9

Deferred rent 24.7 28.7

Deferred income taxes 21.2 --

Other 14.5 23.9

Total other non-current liabilities $ 223.2 $ 115.1

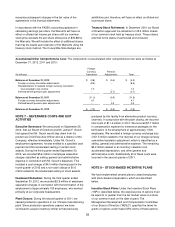

NOTE 4 – GOODWILL

For the first half of 2012, we experienced a significant

decline in the market capitalization of our common stock,

which was driven primarily by lower than expected

operating results. Our market capitalization was lower than

our consolidated net book value for much of this period. We

determined that these facts were an indicator that we

should conduct an interim goodwill impairment test in the

third quarter.

After reviewing our reporting units, we determined that the

fair value of our U.S. RadioShack company-operated stores

reporting unit could not support its $3.0 million of goodwill

due to our lower market capitalization. This resulted in a

$3.0 million impairment charge that was included in our

operating results for the third quarter of 2012. Our U.S.

RadioShack company-operated stores reporting unit is

comprised of our U.S. RadioShack company-operated

stores operating segment, our overhead and corporate

expenses that are not allocated to our operating segments,

and all of our interest expense.

As a result of our fourth quarter impairment analyses, we

determined that no additional impairment charges to

goodwill were required.