Radio Shack 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

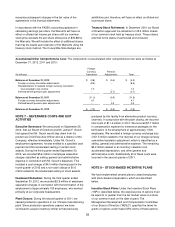

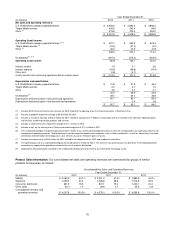

NOTE 13 – FAIR VALUE MEASUREMENTS

The FASB’s accounting guidance utilizes a fair value hierarchy that prioritizes the inputs to the valuation techniques used to

measure fair value into three broad levels:

• Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities

• Level 2: Inputs, other than quoted prices, that are observable for the asset or liability, either directly or indirectly; these

include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or

liabilities in markets that are not active

• Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions

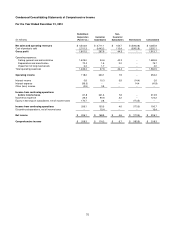

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Basis of Fair Value Measurements

Fair Value

of Assets

(Liabilities)

Quoted Prices

in Active

Markets for

Identical Items

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(In millions)

Year Ended December 31, 2012

Long-lived assets held and used $3.2 -- -- $3.2

Year Ended December 31, 2011

Long-lived assets held and used $1.3 -- -- $1.3

Year Ended December 31, 2010

Long-lived assets held and used $0.9 -- -- $0.9

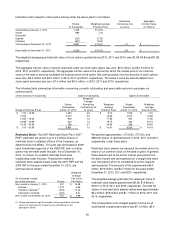

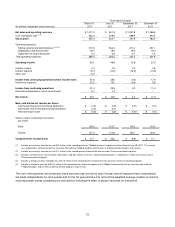

U.S. RadioShack Company-Operated Stores: In 2012

long-lived assets held and used in certain stores with a total

carrying value of $8.8 million were written down to their fair

value of $2.1 million, resulting in an impairment charge of

$6.7 million that was included in our operating results for

the period.

In 2011 long-lived assets held and used in certain stores

with a total carrying value of $4.4 million were written down

to their fair value of $1.3 million, resulting in an impairment

charge of $3.1 million that was included in our operating

results for the period.

In 2010 long-lived assets held and used in certain locations

of our U.S. RadioShack company-operated stores segment

and certain test store formats classified as other operations

with a total carrying value of $4.9 million were written down

to their fair value of $0.9 million, resulting in an impairment

charge of $4.0 million that was included in our operating

results for the period.

The inputs used to calculate the fair value of these long-

lived assets included the projected cash flows and a risk-

adjusted rate of return that we estimated would be used by

a market participant in valuing these assets. The projected

cash flows for a particular store are based on average

historical cash flows for that store and are projected

through the remainder of its lease. The risk-adjusted rate of

return used to discount these cash flows ranges from 15%

to 20%.

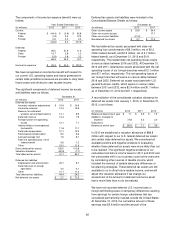

Target Mobile Centers: In October 2012 we exercised our

contractual right to notify Target of our intention to stop

operating the Target Mobile centers by no later than April

2013 if we could not amend the current arrangement.

We concluded that the cash flows generated by our Target

Mobile centers under our current contractual arrangements

would not recover the net book value of our long-lived

assets held and used in these locations. Therefore, the

long-lived assets at these locations with a total carrying

value of $12.8 million were written down to their fair value

of $1.1 million, resulting in an impairment charge of $11.7

million that was included in our operating results for the

third quarter of 2012. We will exit this business by April 8,

2013.

The fair value of these “in-use” assets was based on the

projected cash flows at each location under our current

contractual arrangements.

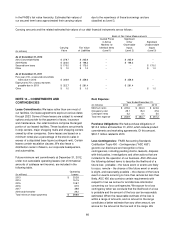

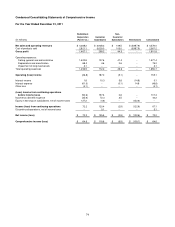

Fair Value of Financial Instruments

Financial instruments not measured at fair value on a

recurring basis include cash and cash equivalents,

accounts receivable, accounts payable, accrued liabilities,

and long-term debt. With the exception of long-term debt,

the financial statement carrying amounts of these items

approximate their fair values due to their short-term nature.

Estimated fair values for our 2013 Convertible Notes and

our 2019 Notes were determined using recent trading

activity and/or bid-ask spreads and are classified as Level 2