Radio Shack 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

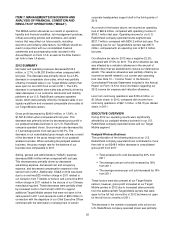

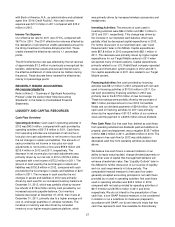

ITEM 7. MANAGEMENT'S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (“MD&A”).

This MD&A section discusses our results of operations,

liquidity and financial condition, risk management practices,

critical accounting policies and estimates, and certain

factors that may affect our future results, including

economic and industry-wide factors. Our MD&A should be

read in conjunction with our consolidated financial

statements and accompanying notes included in this

Annual Report on Form 10-K, as well as the Risk Factors

set forth in Item 1A above.

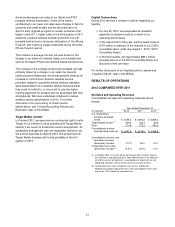

2012 SUMMARY

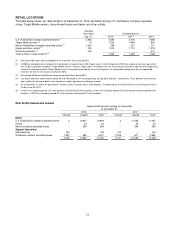

Net sales and operating revenues decreased $120.2

million, or 2.7%, to $4,257.8 million when compared with

last year. This decrease was primarily driven by a 3.5%

decrease in comparable store sales, which was partially

offset by increased sales in our Target Mobile centers that

were open for all of 2012 but not all of 2011. The 3.5%

decrease in comparable store sales was primarily driven by

sales decreases in our consumer electronics and mobility

platforms at our U.S. RadioShack company-operated

stores, which were partially offset by increased sales in our

signature platform and increased comparable store sales at

our Target Mobile centers.

Gross profit decreased by $249.0 million, or 13.8%, to

$1,561.8 million when compared with last year. This

decrease was primarily driven by decreased gross profit in

our postpaid wireless business in our U.S. RadioShack

company-operated stores. Gross margin rate decreased by

4.7 percentage points from last year to 36.7%. The

decrease in our consolidated gross margin rate was a result

of the decrease in the gross margin rate of our postpaid

wireless business. When excluding the postpaid wireless

business, the gross margin rate for the balance of our

business was comparable to 2011.

Selling, general and administrative (“SG&A”) expense

decreased $48.4 million when compared with last year.

This decrease was primarily driven by decreased

advertising expense, decreased rent and occupancy

expense, and decreased compensation expense in the

second half of 2012. Additionally, SG&A in 2012 was lower

due to a one-time $23.4 million charge in 2011 related to

our transition from T-Mobile to Verizon and a one-time $9.5

million charge in 2011 related to the closure of our Chinese

manufacturing plant. These decreases were partially offset

by increased costs in the first half of 2012 to support

additional Target Mobile centers that were not open in the

same period in 2011 and severance costs of $8.5 million in

connection with the departure of our Chief Executive Officer

combined with the termination of employment of certain

corporate headquarters support staff in the third quarter of

2012.

As a result of the factors above, we incurred an operating

loss of $60.9 million, compared with operating income of

$155.1 million last year. Operating income for our U.S.

RadioShack company-operated stores segment was

$337.7 million, compared with $530.2 million last year. The

operating loss for our Target Mobile centers was $37.5

million, compared with an operating loss of $21.0 million

last year.

Our effective tax rate for 2012 was a negative 22.2%,

compared with 37.5% for 2011. The 2012 effective tax rate

was affected by a valuation allowance in the amount of

$68.8 million that we established to reduce our deferred tax

assets. The valuation allowance was partially offset by an

income tax benefit related to our current year operating

loss. See Note 10 – “Income Taxes” in the Notes to

Consolidated Financial Statements included in this Annual

Report on Form 10-K for more information regarding our

2012 income tax expense and valuation allowance.

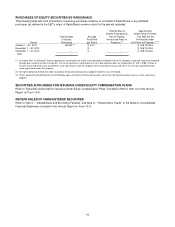

Loss from continuing operations was $139.4 million, or

$1.39 per share, in 2012, compared with income from

continuing operations of $67.1 million, or $0.70 per diluted

share, in 2011.

EXECUTIVE OVERVIEW

During 2012 our operating results were significantly

affected by our postpaid wireless business in our U.S.

RadioShack company-operated stores and our Target

Mobile segment.

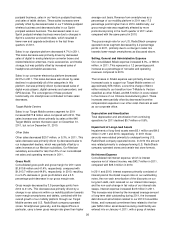

Postpaid Wireless Business

The combination of the following factors at our U.S.

RadioShack company-operated stores contributed to more

than half of our $249.0 million decrease in consolidated

gross profit from 2011:

• Total postpaid units sold decreased by 20% from

2011

• The average cost per unit sold increased by 36%

from 2011

• The average revenue per unit sold increased by 19%

from 2011

These factors were also present at our Target Mobile

centers; however, gross profit increased at our Target

Mobile centers in 2012 due to increased sales primarily

from the additional 646 Target Mobile centers that were

open for the full first six months of 2012 but were not open

for the full first six months of 2011.

The decrease in the number of postpaid units sold at our

U.S. RadioShack company-operated stores was primarily