Radio Shack 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

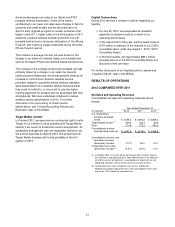

Contractual Obligations

The table below contains our known contractual commitments as of December 31, 2012.

(In millions) Payments Due by Period

Contractual Obligations

Total

Less Than

1 Year

1-3 Years

3-5 Years

More than

5 Years

Long-term debt obligations

(1)

$ 787.9 $ 286.9 $ 9.4 $ 166.6 $ 325.0

Interest obligations 209.7 42.1 73.0 65.2 29.4

Operating lease obligations

(2)

598.9 202.8 260.2 106.7 29.2

Purchase obligations

(3)

313.0 301.7 11.3 -- --

Other long-term liabilities reflected on the balance sheet

(4)

167.9 6.4 33.5 128.0

Total $ 2,077.4 $ 833.5 $ 360.3 $ 372.0 $ 511.6

(1) For more information regarding long-term debt, refer to Note 5 – “Indebtedness and Borrowing Facilities” of our Notes to Consolidated Financial Statements

included elsewhere in this Annual Report on Form 10-K.

(2) For more information regarding lease commitments, refer to Note 14 – “Commitments and Contingencies” of our Notes to Consolidated Financial Statements

included elsewhere in this Annual Report on Form 10-K.

(3) Purchase obligations primarily include our product commitments and marketing agreements.

(4) These long-term liabilities reflected on our Consolidated Balance Sheet represented contractual obligations for which we could reasonably estimate the timing of

cash payments. Additionally, we had a $21.2 million non-current deferred tax liability that we are not able to reasonably estimate the amount by which this liability

will increase or decrease over time; therefore, this amount has not been

included in the table. The remaining non-current liabilities reflected on our Consolidated

Balance Sheet did not represent contractual obligations for future cash payments.

In 2012 we entered into a $50 million secured term loan

due in January 2016, a $100 million secured term loan due

in September 2017, and a $25 million secured term loan

due in September 2017. We borrowed these amounts in

advance of the maturity of our 2013 Convertible Notes.

These new loans represented approximately 47% of the

original $375 million principal amount of the 2013

Convertible Notes. We repurchased $88.1 million principal

amount of the 2013 Convertible Notes at a discount in

2012. We plan to repay the remaining $286.9 million of

2013 Convertible Notes with cash on hand and borrowings

from our 2016 Credit Facility, if necessary. For more

information regarding our long-term debt, refer to Note 5 –

“Indebtedness and Borrowing Facilities” of our Notes to

Consolidated Financial Statements included elsewhere in

this Annual Report on Form 10-K.

LIQUIDITY OUTLOOK

As of December 31, 2012, we had $535.7 million in cash

and cash equivalents, compared with $591.7 million in

2011. Additionally, we had a credit facility of $450 million

with availability of $390.6 million as of December 31, 2012.

This resulted in a total liquidity position of $926.3 million at

December 31, 2012.

We experienced a loss of $139.4 million in 2012, and our

cash flows from operating activities declined from cash

provided by operations of $217.9 million in 2011 to cash

used in operations of $43.0 million in 2012. Although we do

not anticipate borrowing under our 2016 Credit Facility

during 2013, we may cause letters of credit to be issued

under this credit facility, which would reduce our total

liquidity position.

If our results of operations for 2013 are significantly worse

than 2012, or if our trade payables decrease, we could be

required to utilize more of our 2016 Credit Facility in the

form of borrowings or additional letters of credit. However,

in this event, we could implement cash conservation

activities such as reducing our spending for professional

fees, reducing our capital expenditures, reducing our

spending for advertising, lowering our inventory balances or

not taking advantage of discounts for early payments to

vendors.

We have considered the impact of our financial projections

on our liquidity analysis and have evaluated the

appropriateness of the key assumptions in our forecast

such as sales, gross profit and SG&A expenses. We have

analyzed our cash requirements, including our inventory

position, other working capital changes, capital

expenditures and borrowing availability under our credit

facility. Based upon these evaluations and analyses, we

expect that our anticipated sources of liquidity will be

sufficient to meet our obligations without disposition of

assets outside the ordinary course of business or significant

revisions of our planned operations through 2013.

If the trend in our results of operations continues or

worsens after 2013, we may be required to borrow more

under our 2016 Credit Facility, or to take additional actions

to improve our liquidity that would be outside the ordinary

course of business. These actions could include: incurring

additional debt at higher interest rates, reducing our capital

expenditures to amounts below those required to support

our current level of operations, closing a significant number

of stores, further reducing our employee headcount, or

selling one or more subsidiaries.