Radio Shack 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

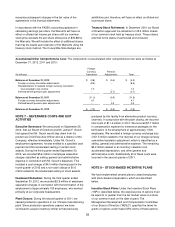

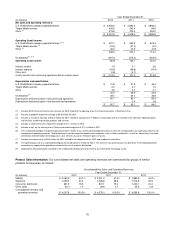

The components of income tax expense (benefit) were as

follows:

Year Ended December 31,

(In millions) 2012 2011 2010

Current:

Federal $ (44.4)

$ (0.4)

$ 92.8

State (1.8)

3.4 12.3

Foreign 2.6 2.0 2.4

(43.6)

5.0 107.5

Deferred:

Federal 56.0 31.6 11.3

State 13.7 2.8 1.2

Foreign (0.8)

0.8 0.2

68.9 35.2 12.7

Income tax expense $ 25.3 $ 40.2 $ 120.2

We have recognized an income tax benefit with respect to

our current U.S. operating losses and losses generated in

certain state jurisdictions because we are able to carry back

those losses and offset prior year taxable income.

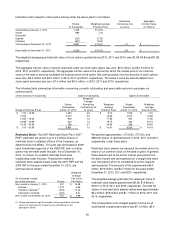

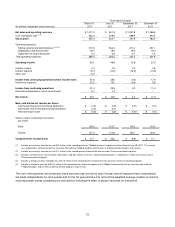

The significant components of deferred income tax assets

and liabilities were as follows:

December 31,

(In millions) 2012 2011

Deferred tax assets:

Inventory valuation adjustments $ 15.9 $ 10.6

Insurance reserves 14.4 14.6

Reserve for estimated

wireless service deactivations

14.1

8.9

Deferred revenue 13.4 7.9

Foreign branch net operating

losses

12.1

7.1

Indirect effect of unrecognized

tax benefits

11.6

11.1

Deferred compensation 10.1 12.2

Stock-based compensation 8.0 8.6

Accrued average rent 7.6 8.7

State net operating loss, net of

federal benefit

5.8

1.2

Other 15.0 11.9

Gross deferred tax assets 128.0 102.8

Valuation allowance (80.9) (7.1)

Total deferred tax assets 47.1 95.7

Deferred tax liabilities:

Depreciation and amortization 29.7 8.7

Deferred taxes on foreign

operations

4.0

4.1

Other 10.7 11.4

Total deferred tax liabilities 44.4 24.2

Net deferred tax assets $ 2.7 $ 71.5

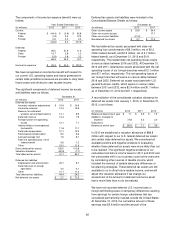

Deferred tax assets and liabilities were included in the

Consolidated Balance Sheets as follows:

December 31,

(In millions) 2012 2011

Other current assets $ 23.9 $ 54.4

Other non-current assets -- 17.1

Other non-current liabilities (21.2) --

Net deferred tax assets $ 2.7 $ 71.5

We had deferred tax assets associated with state net

operating loss carryforwards of $9.0 million, net of $3.2

million federal benefit, and $1.9 million, net of 0.7 million

federal benefit, as of December 31, 2012 and 2011,

respectively. The related state net operating losses expire

at various dates between 2016 and 2032. At December 31,

2012 and 2011, deferred tax assets associated with the net

operating losses of our foreign branches were $12.1 million

and $7.1 million, respectively. The net operating losses of

our foreign branches will expire on various dates between

2016 and 2032. Deferred tax assets associated with U.S.

general business credits, which expire on various dates

between 2031 and 2032, were $2.4 million and $1.1 million

as of December 31, 2012 and 2011, respectively.

A reconciliation of the consolidated valuation allowance for

deferred tax assets from January 1, 2010, to December 31,

2012, is as follows:

(In millions) 2012 2011 2010

Balance at beginning of year $ 7.1 $ 3.9 $ 1.9

Additions, charged to

expense

73.8

3.2

2.0

Deductions -- -- --

Balance at end of year $ 80.9

$ 7.1 $ 3.9

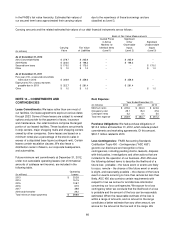

In 2012 we established a valuation allowance of $68.8

million with respect to our U.S. federal deferred tax assets

and certain state deferred tax assets. We considered all

available positive and negative evidence in evaluating

whether these deferred tax assets were more likely than not

to be realized. The significant negative evidence of our

cumulative loss before income taxes for 2011 and 2012 and

the unfavorable shift in our business could not be overcome

by considering other sources of taxable income, which

included the reversal of taxable temporary differences or

tax-planning strategies. These deferred tax assets are still

available to us to offset future taxable income, and we will

adjust this valuation allowance if we change our

assessment of the amount of deferred income tax asset

that is more likely than not to be realized.

We have not recorded deferred U.S. income taxes or

foreign withholding taxes on temporary differences resulting

from earnings for certain foreign subsidiaries that are

considered permanently invested outside the United States.

At December 31, 2012, the cumulative amount of these

earnings was $5.6 million and the amount of the