Radio Shack 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

driven by decreased unit sales in our Sprint and AT&T

postpaid wireless businesses. Some of the factors

contributing to our lower unit sales were changes in Sprint’s

customer and credit models and the discontinuation of

Sprint’s early upgrade program for certain customers that

began in mid-2011; higher sales in the third quarter of 2011

related to a special wireless handset promotion; the soft

postpaid market due to consumer anticipation of the iPhone

5 launch; and inventory supply constraints during the initial

iPhone 5 launch period.

The increase in average cost per unit was driven by the

change in our sales mix towards higher cost smartphones

such as the Apple iPhone and Android-based smartphones.

The increase in the average revenue per postpaid unit was

primarily driven by a change in our sales mix towards

higher-priced smartphones, which was partially offset by an

increase in commissions repaid to wireless service

providers related to customers whose wireless handsets

were deactivated from a wireless network because either

they could not afford to, or chose not to, pay the higher

monthly payments for wireless service associated with their

smartphones. We have undertaken initiatives to reduce

wireless service deactivations in 2013. For further

discussion of our accounting for these service

deactivations, see “Critical Accounting Policies and

Estimates” later in this MD&A.

Target Mobile Centers

In October 2012, we exercised our contractual right to notify

Target of our intention to stop operating the Target Mobile

centers if we could not amend the current arrangement. An

acceptable arrangement was not negotiated; therefore, we

will exit this business by April 8, 2013. We project that our

Target Mobile business will not be profitable in the first

quarter of 2013.

Capital Transactions

During 2012 we took a number of actions regarding our

liquidity:

• On July 25, 2012, we suspended our dividend

payments to preserve cash as a result of our

operating performance

• In the second half of the year, we borrowed a total of

$175 million in advance of the maturity of our 2.50%

convertible senior notes due August 1, 2013 (“2013

Convertible Notes”)

• In the third quarter, we repurchased $88.1 million

principal amount of the 2013 Convertible Notes at a

discount to their par value

For further discussion of our liquidity position, please see

“Liquidity Outlook” later in this MD&A.

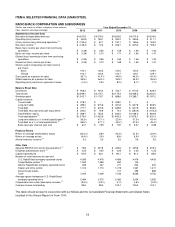

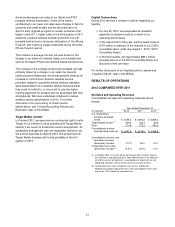

RESULTS OF OPERATIONS

2012 COMPARED WITH 2011

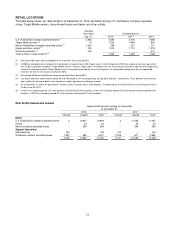

Net Sales and Operating Revenues

Consolidated net sales and operating revenues are as

follows:

Year Ended December 31,

(In millions) 2012 2011

2010

U.S. RadioShack

company-operated

stores

$ 3,456.5

$ 3,663.3

$ 3,808.2

Target Mobile centers

(1

)

426.5 342.4 64.6

Other 374.8 372.3 393.0

Consolidated net sales

and operating revenues

$ 4,257.8

$ 4,378.0

$ 4,265.8

Consolidated net sales and

operating revenues

(decrease) increase

(2.7%)

2.6%

4.7%

Comparable store sales

(decrease) increase (2)

(3.5%)

(2.2%)

4.1%

(1)

In October 2012, we exercised our contractual right to notify Target of

our intention to stop operating the Target Mobile centers if we could not

amend the current arrangement. An acceptable arrangement was not

negotiated; therefore, we will exit this business by April 8, 2013.

(2)

Comparable store sales include the sales of U.S. and Mexico

RadioShack company-operated stores and Target Mobile centers with

more than 12 full months of recorded sales.