Radio Shack 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

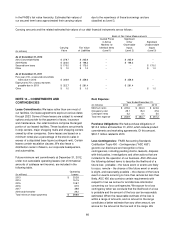

Our evaluation of our loss contingencies involves subjective

assessments, assumptions, and judgments, and actual

losses incurred in future periods may differ significantly

from our estimates. Accordingly, although occasional

adverse resolutions may occur and negatively affect our

consolidated financial statements in the period of the

resolution, we believe that the ultimate resolution of our

loss contingencies for which we have not accrued losses

will not materially adversely affect our financial condition.

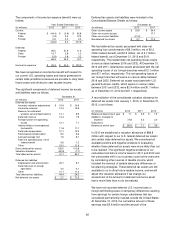

NOTE 15 – WIRELESS SERVICE PROVIDER

SETTLEMENT AGREEMENT

The business terms of our relationships with our wireless

service providers are governed by our wireless reseller

agreements. These contracts are complex and include

provisions determining our upfront commission revenue,

net of chargebacks for wireless service deactivations; our

acquisition and return of wireless handsets; and, in some

cases, future residual revenue, performance targets and

marketing development funds. Disputes occasionally arise

between the parties regarding the interpretation of these

contract provisions.

Certain disputes arose with one of the Company’s wireless

service providers pertaining to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks for wireless service deactivations.

Negotiations regarding resolution of these disputes

culminated in the signing of a settlement agreement in July

2010. In connection with the decision to settle these

disputes, the Company considered the following: the timing

of cash outflows and inflows in connection with the disputed

upfront commission revenue and related chargebacks, and

the estimated future residual revenue; the benefits of

settling the disputes and agreeing to enter into good faith

negotiations with the wireless service provider in the third

quarter of 2010 to modify the commission and chargeback

provisions of our wireless reseller agreement; and the risks

associated with the ultimate realization of the estimated

future residual revenue. Key elements of the settlement

agreement include the following:

• All disputes relating to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks were settled.

• The wireless service provider agreed to pay $141

million to the Company on or before July 30, 2010.

• The Company and the wireless service provider

agreed to enter into good faith negotiations in the

third quarter of 2010 to modify the commission and

chargeback provisions of our wireless reseller

agreement.

• Beginning July 1, 2010, the wireless service provider

was no longer obligated to pay future residual

revenue amounts to the Company for a period of

time for customers activated on or before June 30,

2010. For the first six months of 2010, these residual

revenue amounts averaged approximately $9 million

per quarter. Based on this average, we would

receive no residual revenue payments from this

wireless service provider for eight quarters beginning

with the third quarter of 2010 under the terms of the

settlement agreement.

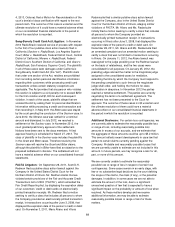

The effects of the settlement agreement have been

reflected in net sales and operating revenues for 2010.

In the third quarter of 2010 and in the first quarter of 2012,

we reached agreements with this wireless service provider

to modify the commission, chargeback, and other

compensation provisions of our wireless reseller

agreement. Based on the terms of the settlement

agreement, the terms of the amended wireless reseller

agreement, and the performance of our business with this

wireless service provider, these events did not have a

material effect on our results of operations in subsequent

periods.

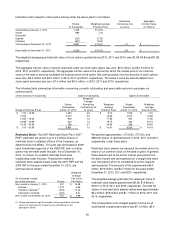

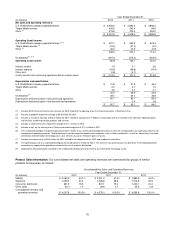

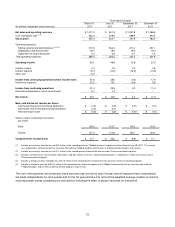

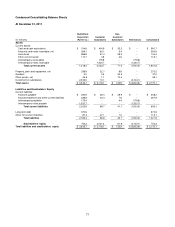

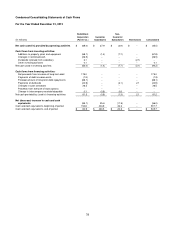

NOTE 16 – SEGMENT REPORTING

We have two reportable segments, U.S. RadioShack

company-operated stores and Target Mobile centers. The

U.S. RadioShack company-operated stores segment

consists solely of our 4,395 U.S. company-operated retail

stores, all operating under the RadioShack brand name.

Our Target Mobile centers segment consists of our network

of 1,522 Target Mobile centers located in Target locations.

We evaluate the performance of our segments based on

operating income, which is defined as sales less cost of

products sold and certain direct operating expenses,

including labor, rent, and occupancy costs. Asset balances

by segment have not been included in the segment table

below, as these are managed on a company-wide level and

are not fully allocated to each segment for management

reporting purposes. Amounts in the other category reflect

our business activities that are not separately reportable,

which include sales to our independent dealers, sales

generated by our Mexican subsidiary and our

www.radioshack.com website, sales to commercial

customers, and sales to other third parties through our

global sourcing operations. In October 2012, we exercised

our contractual right to notify Target of our intention to stop

operating the Target Mobile centers if we could not amend

the current arrangement. An acceptable arrangement was

not negotiated; therefore, we will exit this business by April

8, 2013.