Radio Shack 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

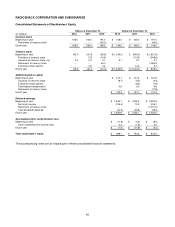

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table provides a summary of information as of December 31, 2012, relating to our equity compensation plans in

which our common stock is authorized for issuance.

Equity Compensation Plan Information

(Share amounts in thousands)

(a)

Number of shares to be

issued upon exercise of

outstanding options,

warrants and rights

(b)

Weighted-average

exercise price of

outstanding options,

warrants and rights

(c)

Number of shares

remaining available for

future issuance under

equity compensation plans

(excluding shares reflected

in column (a))

Equity compensation plans approved by

shareholders (1)

4,860 (2)

$ 13.58

7,719 (3)

Equity compensation plans not approved by

shareholders (4)

3,203

$ 14.42

--

Total 8,063 $ 13.97 7,719

(1) Includes the 1997 Incentive Stock Plan (“ISP”), the 2001 ISP, the 2004 Deferred Stock Unit Plan for Non-Employee Directors, and the 2009 ISP. Refer to

Note 8 - “Stock-Based Incentive Plans” of our Notes to Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K for further

information. The 1997 ISP expired on February 27, 2007, and no further grants may be made under this plan. The 2001 ISP terminated upon shareholder

approval of the 2009 ISP on May 21, 2009. No further grants may be made under the 2001 ISP.

(2) This amount includes approximately 751,000 shares of restricted stock and approximately 451,000 deferred stock units.

(3) This amount includes approximately 464,000 deferred stock units.

(4) Includes the 1999 ISP and options granted as an inducement grant in connection with our former Chief Executive Officer’s employment with RadioShack in

2006. Refer to Note 8 - “Stock-Based Incentive Plans” in the Notes to Consolidated Financial Statements included elsewhere in this Annual Report on Form

10-K for more information concerning the 1999 ISP and the 2006 inducement grant. The 1999 ISP expired on February 23, 2009, and no further grants

may be made under this plan.

ITEM 13. CERTAIN RELATIONSHIPS AND

RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE.

The information called for by this Item with respect to

certain relationships and transactions with management

and others is incorporated by reference from the Proxy

Statement for the 2013 Annual Meeting under the heading

Corporate Governance - Director Independence and -

Review and Approval of Transactions with Related

Persons.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND

SERVICES.

The information called for by this Item with respect to

principal accounting fees and services is incorporated by

reference from the Proxy Statement for the 2013 Annual

Meeting under the headings Item 2 – Ratification of the

Appointment of PricewaterhouseCoopers LLP as

Independent Registered Public Accounting Firm - Fees and

Services of the Independent Registered Public Accounting

Firm and - Policy for Pre-Approval of Audit and Permissible

Non-Audit Services of Independent Registered Public

Accounting Firm.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT

SCHEDULES.

Documents filed as part of this Annual Report on

Form 10-K:

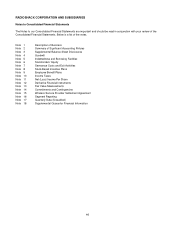

1) The financial statements listed in the "Index to

Consolidated Financial Statements" on page 39.

2) None

3) A list of the exhibits required by Item 601 of Regulation

S-K to be filed as part of this report is set forth in the

Index to Exhibits beginning on page 81, which

immediately precedes such exhibits.

Certain instruments defining the rights of holders of our

long-term debt are not filed as exhibits to this report

because the total amount of securities authorized

thereunder does not exceed ten percent of our total assets

on a consolidated basis. We will furnish the SEC copies of

such instruments upon request.