Radio Shack 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

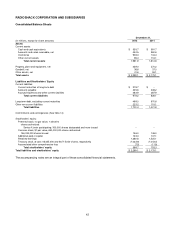

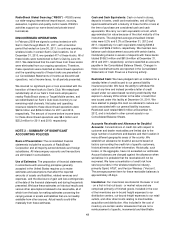

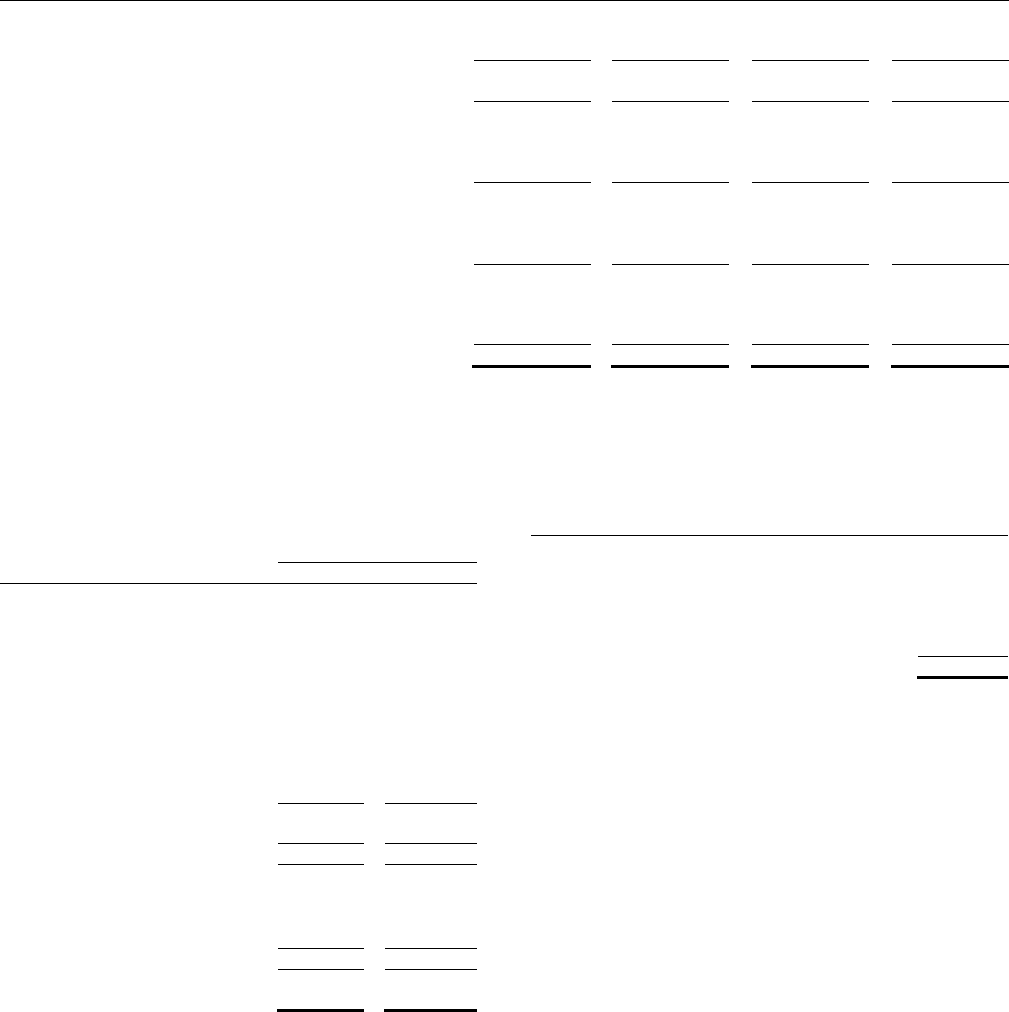

The changes in the carrying amount of goodwill by reportable segment were as follows for the years ended December 31,

2012 and 2011:

(In millions)

U.S.

RadioShack

Stores

Target

Mobile

Other (1)

Total

Balances at December 31, 2010

Goodwill $ 2.9 $ -- $ 38.3 $ 41.2

Accumulated impairment losses -- -- -- --

2.9 -- 38.3 41.2

Foreign currency translation adjustment -- -- (4.2) (4.2)

Balances at December 31, 2011

Goodwill 2.9 -- 34.1 37.0

Accumulated impairment losses -- -- -- --

2.9 -- 34.1 37.0

Acquisition of dealer 0.1 -- -- 0.1

Goodwill impairment (3.0) -- -- (3.0)

Foreign currency translation adjustment -- -- 2.5 2.5

Balances at December 31, 2012

Goodwill 3.0 -- 36.6 39.6

Accumulated impairment losses (3.0) -- -- (3.0)

$ -- $ -- $ 36.6 $ 36.6

(1) Goodwill classified as Other in the above table primarily relates to goodwill recorded on our Mexican subsidiary reporting unit.

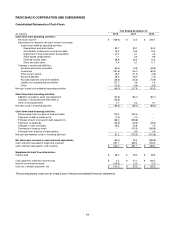

NOTE 5 – INDEBTEDNESS AND BORROWING

FACILITIES

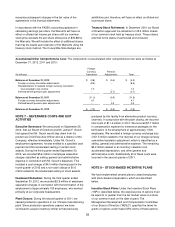

Long-Term Debt:

December 31,

(In millions) 2012 2011

Five year 2.5% unsecured

convertible notes due in

August 2013

$ 286.9

$ 375.0

Credit facility term loan due in

January 2016

50.0

--

Credit facility term loan due in

September 2017

25.0

--

Term loan due in September 2017 100.0 --

Eight year 6.75% unsecured

notes payable due in May 2019

325.0

325.0

Other 1.0 1.0

787.9 701.0

Unamortized debt discounts (10.2) (30.4)

777.7 670.6

Less current portion of:

Notes payable 286.9 --

Unamortized debt discount (8.2) --

278.7 --

Total long-term debt $ 499.0 $ 670.6

Long-term borrowings outstanding at December 31, 2012,

mature as follows:

Long-Term

Borrowings

(In millions)

2013 $ 286.9

2014 2.7

2015 6.7

2016 56.7

2017 109.9

2018 and thereafter 325.0

Total $ 787.9

2016 Credit Facility: In August 2012 we entered into an

amended and restated credit agreement (“Restated 2016

Credit Facility” or “2016 Credit Facility”) with a group of

lenders with Bank of America, N.A., as the administrative

and collateral agent. The Restated 2016 Credit Facility

amends and restates the Company’s existing asset-based

revolving credit agreement (the “Original 2016 Credit

Facility”). The Restated 2016 Credit Facility revised the

terms of the Original 2016 Credit Facility to, among other

things, provide for $75 million of term loans.

Like the Original 2016 Credit Facility, the Restated 2016

Credit Facility matures on January 4, 2016, and provides

for an asset-based revolving credit line of $450 million,

subject to a borrowing base, which was $642.8 million at

December 31, 2012. As with the Original 2016 Credit

Facility, obligations under the Restated 2016 Credit Facility

are secured by substantially all of our inventory, accounts

receivable, cash, and cash equivalents. Obligations under

the Restated 2016 Credit Facility are also secured by

certain real estate.