Radio Shack 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

had been made under the facility, and letters of credit

totaling $3.1 million had been issued, resulting in $390.6

million of availability for revolving borrowings under the

2016 Credit Facility. We believe that we will not meet the

consolidated fixed charge coverage ratio for at least the

next twelve months.

If at any time the outstanding revolving borrowings and

term loans under the 2016 Credit Facility exceed the sum of

the revolving borrowing base and the term loan borrowing

base, we will be required to repay an amount equal to such

excess. No payments (whether optional or mandatory) may

be made in respect of the principal amount of these term

loans unless all revolving borrowings have been repaid, any

outstanding letters of credit have been cash collateralized,

and all other commitments under the Restated 2016 Credit

Facility have been repaid or otherwise satisfied. The

revolving borrowing base and term loan borrowing base are

subject to customary reserves that may be implemented by

the administrative agent at its permitted discretion.

The Restated 2016 Credit Facility contains customary

affirmative and negative covenants and events of default

that are substantially consistent with those contained in the

Original 2016 Credit Facility. These covenants could,

among other things, restrict certain payments, including

dividends and share repurchases. We do not believe the

limitations contained in the credit facility will, in the

foreseeable future, adversely affect our ability to use the

credit facility and execute our business plan.

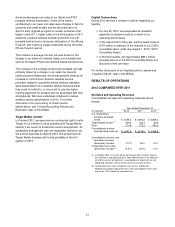

CASH REQUIREMENTS

Capital Expenditures: The nature of our capital

expenditures is comprised of a base level of investment

required to support our current operations and a

discretionary amount related to our strategic initiatives. The

base level of capital expenditures required to support our

operations ranges from $40 million to $50 million. The

remaining amount of anticipated capital expenditures

relates to strategic initiatives as reflected in our annual

plan. These capital expenditures are discretionary and,

therefore, may not be spent if we decide not to pursue one

or more of our strategic initiatives. We estimate that our

capital expenditures for 2013 will range from $70 million to

$90 million based on our operating performance during the

year. U.S. RadioShack company-operated store remodels

and relocations and information systems projects will

account for the majority of our anticipated 2013 capital

expenditures. Cash and cash equivalents and cash

generated from operating activities will be used to fund

future capital expenditure needs. Additionally, our 2016

Credit Facility could be utilized to fund capital expenditures.

Restricted Cash: Restricted cash totaled $26.5 million at

December 31, 2012, and is included in other current assets

in our Consolidated Balance Sheets. This cash is pledged

as collateral for a standby letter of credit issued to our

general liability insurance provider. We have the ability to

withdraw this cash at any time and instead provide a letter

of credit issued under our 2016 Credit Facility similar to the

letter of credit that was issued under our 2016 Credit

Facility at December 31, 2011. We have elected to pledge

this cash as collateral to reduce our costs associated with

our general liability insurance.

Seasonal Inventory Buildup: Typically, our annual cash

requirements for pre-seasonal inventory buildup from

August to November range between $150 million and $250

million. The funding required for this buildup will be

primarily from cash and cash equivalents and any cash

generated from operating activities. Additionally, our 2016

Credit Facility could be utilized to fund the inventory

buildup, if necessary.

Operating Leases: We use operating leases, primarily for

our retail locations and our corporate campus, to lower our

capital requirements.