Radio Shack 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

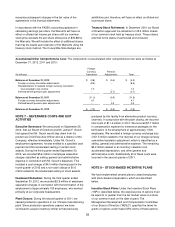

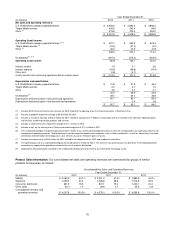

The following table includes common stock equivalents that

were not included in the calculation of diluted net (loss)

income per share for the periods presented:

(In millions)

2012

2011

2010

Employee stock

options (1) (2)

6.9

6.3

1.8

Warrants to purchase

common stock (3)

15.8

15.8

15.5

Convertible debt

Instruments (4)

15.8

15.8

15.5

(1)

For 2012 these common stock equivalents were excluded because the

effect of their inclusion would reduce our net loss per share in thi

s period

and would be antidilutive. In addition, the exercise prices of these

common stock equivalents exceeded the average market price of our

common stock during this period.

(2)

For 2011 and 2010, these common stock equivalents were excluded

because their exercise prices exceeded the average market price of our

common stock during this period, and the effect of their inclusion would

be antidilutive.

(3)

These common stock equivalents were excluded because their exercise

prices ($35.88, $35.88, and $36.60 per share for the warrants in 2012,

2011, and 2010, respectively) exceeded the average market price of our

common stock during these periods, and the effect of their inclusion

would be antidilutive.

(4)

These common stock equivalents were excluded because the

conversion prices ($23.77, $23.77, and $24.25 per share in 2012, 2011,

and 2010, respectively) exceeded the average market price of our

common stock during these periods, and the effect of their inclusion

would be antidilutive.

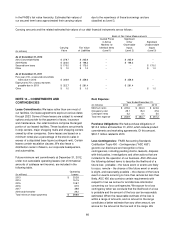

NOTE 12 – DERIVATIVE FINANCIAL

INSTRUMENTS

We enter into derivative instruments for risk management

purposes only, including derivatives designated as hedging

instruments under the FASB accounting guidance on the

accounting for derivative instruments and hedging activities.

We do not hold or issue derivative financial instruments for

trading or speculative purposes. To qualify for hedge

accounting, derivatives must meet defined correlation and

effectiveness criteria, be designated as a hedge and result

in cash flows and financial statement effects that

substantially offset those of the position being hedged.

By using these derivative instruments, we expose

ourselves, from time to time, to credit risk and market risk.

Credit risk is the potential failure of the counterparty to

perform under the terms of the derivative contract. When

the fair value of a derivative contract is positive, the

counterparty owes us, which creates credit risk for us. We

minimize this credit risk by entering into transactions with

high quality counterparties and do not anticipate significant

losses due to our counterparties’ nonperformance. Market

risk is the adverse effect on the value of a financial

instrument that results from a change in the rate or value of

the underlying item being hedged. We minimize this market

risk by establishing and monitoring internal controls over

our hedging activities, which include policies and

procedures that limit the types and degree of market risk

that may be undertaken.

Interest Rate Swap Agreements: We previously used

interest rate-related derivative instruments to manage our

exposure to fluctuations of interest rates. In June and

August 2003, we entered into interest rate swap agreements

with underlying notional amounts of debt of $100 million and

$50 million, respectively, and both matured in May 2011.

These swaps effectively converted a portion of our long-term

fixed rate debt to a variable rate. We entered into these

agreements to balance our fixed versus floating rate debt

portfolio to continue to take advantage of lower short-term

interest rates. Under these agreements, we contracted to pay

a variable rate of LIBOR plus a markup and to receive fixed

rates of 7.375%.

In September 2009 we repurchased $43.2 million of our

7.375% unsecured notes payable due in 2011. A portion of

these notes were hedged by our interest rate swaps. Upon

repurchase of these notes, we were required to discontinue

the hedge accounting treatment associated with these

derivative instruments which used the short-cut method.

We held these instruments until their maturities. Changes in

fair value of these instruments were recorded in earnings

as an adjustment to interest expense. These adjustments

resulted in increases in interest expense of $1.9 million and

$3.4 million in 2011 and 2010, respectively.