Radio Shack 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

RadioShack Global Sourcing (“RSGS”) - RSGS serves

our wide-ranging international import/export, sourcing,

evaluation, logistics and quality control needs. RSGS’s

activities support our name brand and private brand

businesses.

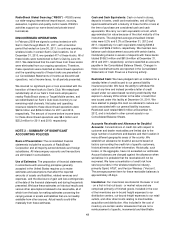

DISCONTINUED OPERATIONS

In February 2009 we signed a contract extension with

Sam’s Club through March 31, 2011, with a transition

period that ended on June 30, 2011, to continue operating

wireless kiosks in certain Sam’s Club locations. As of

December 31, 2010, we operated 417 of these kiosks. All of

these kiosks were transitioned to Sam’s Club by June 30,

2011. We determined that the cash flows from these kiosks

were eliminated from our ongoing operations. Therefore,

these operations were classified as discontinued operations

and the operating results of these kiosks are presented in

our Consolidated Statements of Income as discontinued

operations, net of income taxes, for all periods presented.

We incurred no significant gain or loss associated with the

transition of these kiosks to Sam’s Club. We redeployed

substantially all of our Sam’s Club kiosk employees to

nearby RadioShack stores or Target Mobile centers, and

we redistributed our Sam’s Club kiosk inventory to our

remaining retail channels. Net sales and operating

revenues related to these discontinued operations were

$62.9 million and $206.9 million for 2011 and 2010,

respectively. The amount of income before income taxes

for these discontinued operations was $8.4 million and

$25.2 million for 2011 and 2010, respectively.

NOTE 2 – SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Basis of Presentation: The consolidated financial

statements include the accounts of RadioShack

Corporation and all majority-owned domestic and foreign

subsidiaries. All intercompany accounts and transactions

are eliminated in consolidation.

Use of Estimates: The preparation of financial statements

in accordance with accounting principles generally

accepted in the United States requires us to make

estimates and assumptions that affect the reported

amounts of assets and liabilities, related revenues and

expenses, and the disclosure of gain and loss contingencies

at the date of the financial statements and during the periods

presented. We base these estimates on historical results and

various other assumptions believed to be reasonable, all of

which form the basis for making estimates concerning the

carrying values of assets and liabilities that are not readily

available from other sources. Actual results could differ

materially from those estimates.

Cash and Cash Equivalents: Cash on hand in stores,

deposits in banks, credit card receivables, and all highly

liquid investments with a maturity of three months or less at

the time of purchase are considered cash and cash

equivalents. We carry our cash equivalents at cost, which

approximates fair value because of the short maturity of the

instruments. The weighted-average annualized interest

rates were 0.2% and 0.3% at December 31, 2012 and

2011, respectively, for cash equivalents totaling $408.2

million and $426.2 million, respectively. We maintain zero

balance cash disbursement accounts with certain banks.

Outstanding checks in excess of deposits with these banks

totaled $108.3 million and $81.9 million at December 31,

2012 and 2011, respectively, and are classified as accounts

payable in the Consolidated Balance Sheets. Changes in

these overdraft amounts are reported in the Consolidated

Statements of Cash Flows as a financing activity.

Restricted Cash: We have pledged cash as collateral for a

standby letter of credit issued to our general liability

insurance provider. We have the ability to withdraw this

cash at any time and instead provide a letter of credit

issued under our asset-based revolving credit facility that

expires in January 2016 similar to the letter of credit that

was issued under this facility at December 31, 2011. We

have elected to pledge this cash as collateral to reduce our

costs associated with our general liability insurance.

Restricted cash totaled $26.5 million at December 31,

2012, and is included in other current assets in our

Consolidated Balance Sheets.

Accounts Receivable and Allowance for Doubtful

Accounts: Concentrations of credit risk with respect to

customer and dealer receivables are limited due to the

large number of customers and dealers and their location in

many different geographic areas of the country. We

establish an allowance for doubtful accounts based on

factors surrounding the credit risk of specific customers,

historical trends and other information. Historically, such

losses, in the aggregate, have not exceeded our estimates.

Account balances are charged against the allowance when

we believe it is probable that the receivable will not be

recovered. We have concentration of credit risk from

service providers in the wireless telephone industry,

primarily Sprint, AT&T, and Verizon Wireless (“Verizon”).

The average payment term for these receivable balances is

approximately 45 days.

Inventories: Our inventories are stated at the lower of cost

- on a first-in first-out basis - or market value and are

comprised primarily of finished goods. Included in the cost

of the inventories are in-bound freight expenses to our

distribution centers, out-bound freight expenses to our retail

outlets, and other direct costs relating to merchandise

acquisition and distribution. Also included in the cost of

inventory are certain vendor allowances that are not a

reimbursement of specific, incremental and identifiable