Radio Shack 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

sales for many of these categories has been driven by the

migration of the capabilities of these products into

smartphones.

Target Mobile Centers

Sales in our Target Mobile centers segment increased

$84.1 million or 24.6% in 2012. This sales increase was

driven primarily by increased sales at our Target Mobile

centers in the first half of 2012, when compared with the

same period in 2011. This increase in Target Mobile center

sales was driven by the additional 646 Target Mobile

centers that were open for the full first six months of 2012

but were not open for the full first six months of 2011. In

October 2012, we exercised our contractual right to notify

Target of our intention to stop operating the Target Mobile

centers if we could not amend the current arrangement. An

acceptable arrangement was not negotiated; therefore, we

will exit this business by April 8, 2013.

Other Sales

Amounts in other sales reflect our business activities that

are not separately reportable, including sales to our

independent dealers, sales generated by our

www.radioshack.com website, and sales at our Mexican

subsidiary. Each of these business activities accounted for

less than 5% of our consolidated net sales and operating

revenues in 2012. Other sales were essentially flat for

2012, when compared with last year. Our sales increased

at our Mexican subsidiary due to new store openings, but

this increase was substantially offset by decreased sales to

our U.S. independent dealers. Additionally, we recognized

$3.0 million of franchise fee revenue in the third quarter

related to the opening of our first franchised stores in

Southeast Asia.

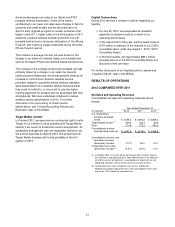

Gross Profit

Consolidated gross profit and gross margin are as follows:

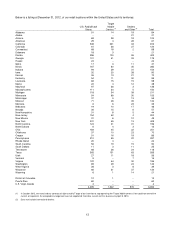

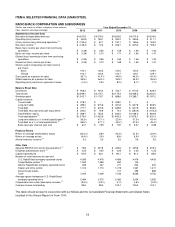

Year Ended December 31,

(In millions) 2012

2011

2010

Gross profit $1,561.8

$1,810.8

$1,913.7

Gross profit (decrease) increase (13.8%)

(5.4%)

2.2%

Gross margin rate 36.7%

41.4%

44.9%

Consolidated gross profit and gross margin for 2012 were

$1,561.8 million and 36.7%, respectively, compared with

$1,810.8 million and 41.4%, respectively, in 2011, resulting

in a 13.8% decrease in gross profit dollars and a 4.7

percentage point decrease in our gross margin. These

decreases were primarily driven by decreased gross profit

of the postpaid wireless business in our U.S. RadioShack

company-operated stores.

The decrease in gross profit dollars of the postpaid wireless

business in our U.S. RadioShack company-operated stores

was the result of decreases in 2012 in the number of units

sold and in the average gross profit dollars per unit sold,

when compared with 2011. Average gross profit dollars per

unit sold decreased because our average cost per unit

increased from last year at a higher rate than the increase

in our average revenue per unit. The increase in average

cost per unit was driven by the change in our sales mix

towards higher cost smartphones such as the Apple iPhone

and Android-based smartphones.

The decrease in our consolidated gross margin rate was a

result of the decrease in the gross margin rate of the

postpaid wireless business in our U.S. RadioShack

company-operated stores and Target Mobile centers. The

decrease in the gross margin rate of our postpaid wireless

business was driven by a change in our sales mix towards

lower-margin smartphones and a decrease in the average

gross profit dollars per unit sold.

When excluding the postpaid wireless business, the gross

margin rate for the balance of our business was

comparable to 2011.