Radio Shack 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

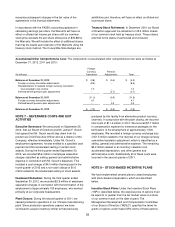

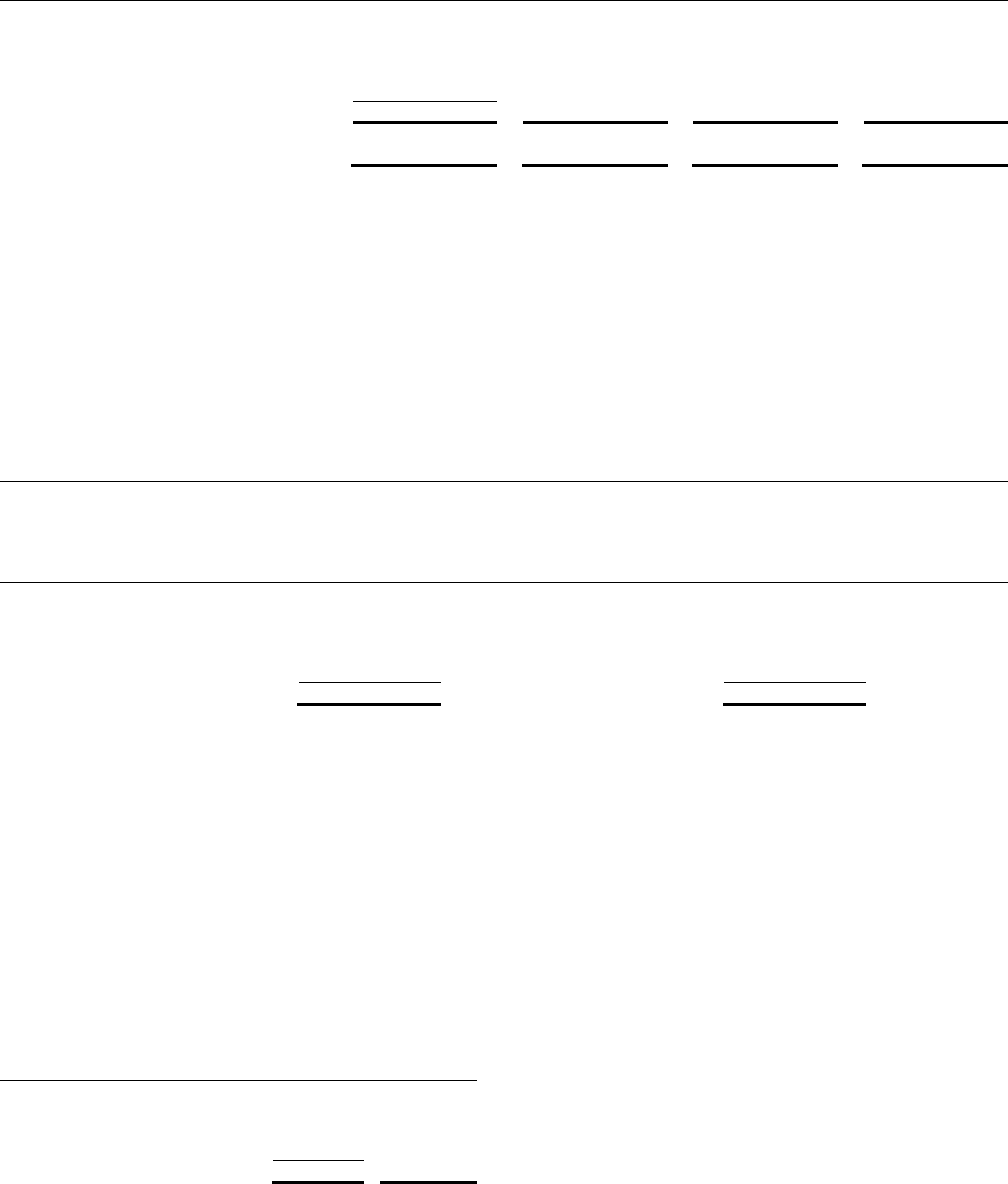

Information with respect to stock option activity under the above plans is as follows:

Shares

(In thousands)

Weighted-average

Exercise Price

Remaining

Contractual Life

(in years)

Aggregate

Intrinsic Value

(in millions)

Outstanding at January 1, 2012 7,349 $ 14.94

Grants 690 7.24

Exercised -- --

Expired (251) 27.82

Forfeited (927) 12.90

Outstanding at December 31, 2012 6,861 $ 13.97 1.0 $ --

Exercisable at December 31, 2012

6,529

$ 14.18

0.8

$ --

The weighted-average grant-date fair value of stock options granted during 2012, 2011 and 2010, was $2.38, $4.84 and $7.08,

respectively.

The aggregate intrinsic value of options exercised under our stock option plans was zero, $3.5 million, and $1.3 million for

2012, 2011 and 2010, respectively. The aggregate intrinsic value is the amount by which the market price of our common

stock on the date of exercise exceeded the exercise price of the option. Net cash proceeds from the exercise of stock options

were zero, $6.0 million and $4.0 million in 2012, 2011 and 2010, respectively. The actual income tax benefit realized from

stock option exercises was zero, $1.4 million and $0.5 million, in 2012, 2011 and 2010, respectively.

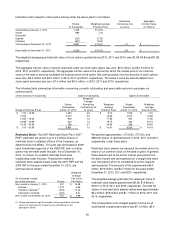

The following table summarizes information concerning currently outstanding and exercisable options to purchase our

common stock:

(Share amounts in thousands) Options Outstanding Options Exercisable

Range of Exercise Prices

Shares

Outstanding

at Dec. 31, 2012

Weighted-

Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise Price

Shares

Exercisable

at Dec. 31, 2012

Weighted

Average

Exercise Price

$ 7.05 – 13.58 1,333 2.6 $ 8.12 1,008 $ 7.61

13.82 4,000 0.5 13.82 4,000 13.82

14.80 – 18.52 905 1.2 17.83 900 17.85

18.69 – 19.39 324 1.0 19.15 322 19.15

19.43 – 30.99 299 0.7 24.84 299 24.84

$ 7.05 – 30.99 6,861 1.0 $ 13.97 6,529 $ 14.18

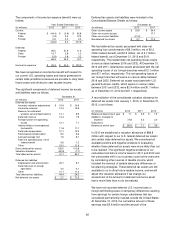

Restricted Stock: The 2007 Restricted Stock Plan (“2007

RSP”) permitted the grant of up to 0.5 million shares of

restricted stock to selected officers of the Company, as

determined by the MD&C. This plan was terminated in 2009

upon shareholder approval of the 2009 ISP, and no further

grants may be made under this plan. As of December 31,

2012, no shares of unvested restricted stock were

outstanding under this plan. Transactions related to

restricted stock awards issued under the 2007 RSP and the

2009 ISP for the year ended December 31, 2012, are

summarized as follows:

(In thousands, except

per share amounts)

Shares

Weighted-

Average

Fair Value

Per Share

Non-vested at January 1, 2012 407 $ 14.48

Granted 1,073 5.26

Vested or released

(1)

(459) 11.42

Canceled or forfeited (270) 9.41

Non-vested at December 31, 2012 751 $ 4.99

(1)

For plan participants age 55 and older, certain granted but unvested

shares are released from the plan for tax withholdings on the

participants’ behalf.

We granted approximately 1,073,000, 277,000, and

298,000 shares of restricted stock in 2012, 2011 and 2010,

respectively, under these plans.

Restricted stock awards are valued at the market price of a

share of our common stock on the date of grant. In general,

these awards vest at the end of a three-year period from

the date of grant and are expensed on a straight-line basis

over that period, which is considered to be the requisite

service period. The amounts of this expense were $4.4

million, $2.9 million, and $4.7 million for the years ended

December 31, 2012, 2011 and 2010, respectively.

The weighted-average grant-date fair values per share of

restricted stock awards granted were $5.26, $14.68 and

$19.21 in 2012, 2011 and 2010, respectively. The total fair

values of restricted stock awards vested were approximately

$5.2 million, $3.8 million and $1.7 million in 2012, 2011 and

2010, respectively.

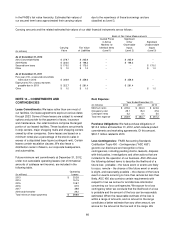

The compensation cost charged against income for all

stock-based compensation plans was $7.1 million, $5.4