Panera Bread 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

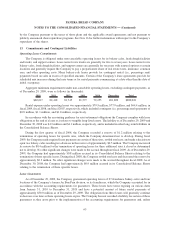

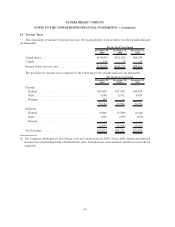

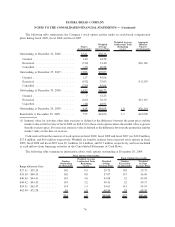

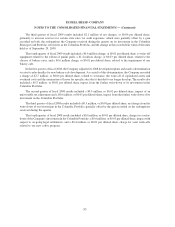

is expected to be recognized over a weighted-average period of approximately 3.6 years. For fiscal 2009, fiscal 2008

and fiscal 2007, restricted stock expense was $5.4 million, $3.8 million and $2.1 million, respectively. A summary

of the status of the Company’s restricted stock activity is set forth below:

Restricted

Stock

(in thousands)

Weighted

Average

Grant-Date

Fair Value

Non-vested at December 25, 2007 ............................. 387 $48.04

Granted ............................................... 228 48.76

Vested ................................................ (55) 51.36

Forfeited .............................................. (55) 47.52

Non-vested at December 30, 2008 ............................. 505 $48.06

Granted ............................................... 202 55.09

Vested ................................................ (102) 47.92

Forfeited .............................................. (36) 48.96

Non-vested at December 29, 2009 ............................. 569 $50.52

Under the deferred annual bonus match award portion of the 2005 LTIP, eligible participants receive an

additional 50 percent of their annual bonus, which is paid three years after the date of the original bonus payment.

For fiscal 2009, fiscal 2008 and fiscal 2007, compensation expense related to the deferred annual bonus match

award was $1.4 million, $1.0 million, and $0.7 million, respectively, and was included in general and administrative

expenses in the Consolidated Statements of Operations.

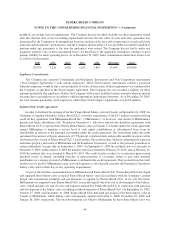

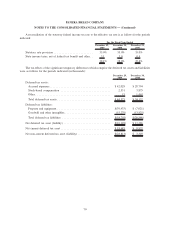

Stock options under the 2005 LTIP are granted with an exercise price equal to the quoted market value of the

Company’s common stock on the date of grant. In addition, stock options generally vest ratably over a four-year

period beginning two years from the date of grant and have a six-year term. As of December 29, 2009, the total

unrecognized compensation cost related to non-vested options was $2.2 million, which is net of a $0.7 million

forfeiture estimate, and is expected to be recognized over a weighted average period of approximately 2.4 years.

The Company uses historical data to estimate pre-vesting forfeiture rates. Stock-based compensation expense

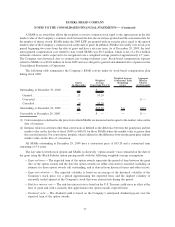

related to stock options was as follows for the periods indicated (in thousands):

December 29,

2009

December 30,

2008

December 25,

2007

For the Fiscal Year Ended

Charged to general and administrative expenses(1) . .... $2,154 $3,212 $3,874

Income tax benefit............................. (821) (1,205) (1,426)

Total stock-based compensation expense, net of tax .... $1,333 $2,007 $2,448

Effect on basic earnings per share ................. 0.04 0.07 0.08

Effect on diluted earnings per share ................ 0.04 0.07 0.08

(1) Net of $0.1 million, $0.2 million, and $0.6 million of capitalized compensation cost related to the acquisition,

development, design, and construction of new bakery-cafe locations and fresh dough facilities for fiscal 2009,

fiscal 2008 and fiscal 2007, respectively.

75

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)