Panera Bread 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

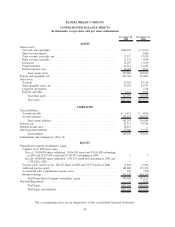

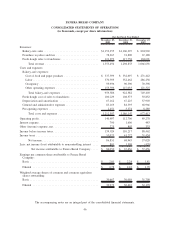

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

December 29,

2009

December 30,

2008

December 25,

2007

For the Fiscal Year Ended

Cash flows from operations:

Net income ....................................... $ 86,851 $ 68,945 $ 57,028

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization ........................ 67,162 67,225 57,903

(Gain) Loss from short-term investments ................ (1,339) 1,910 967

Stock-based compensation expense .................... 8,661 7,954 7,255

Tax benefit from exercise of stock options ............... (5,095) (3,376) (3,731)

Deferred income taxes ............................. 22,950 (4,107) (7,276)

Other.......................................... 2,799 228 725

Changes in operating assets and liabilities, excluding

the effect of acquisitions:

Trade and other accounts receivable ................... (3,554) 11,650 (5,549)

Inventories...................................... (336) (565) (1,798)

Prepaid expenses ................................. (2,224) (8,966) 6,884

Deposits and other ................................ 100 1,042 231

Accounts payable ................................. 2,381 (2,290) (815)

Accrued expenses ................................. 28,901 5,450 32,398

Deferred rent .................................... 3,591 6,211 5,885

Other long-term liabilities ........................... 4,056 6,013 4,138

Net cash provided by operating activities .............. 214,904 157,324 154,245

Cash flows from investing activities:

Additions to property and equipment..................... (54,684) (63,163) (124,133)

Proceeds from sale of assets ........................... — — 1,844

Acquisitions, net of cash acquired ....................... — (2,704) (71,039)

Short-term investments transferred from cash and cash

equivalents ...................................... — — (26,526)

Investment maturities proceeds ......................... 5,465 17,162 22,361

Net cash used in investing activities .................. (49,219) (48,705) (197,493)

Cash flows from financing activities:

Net (payments) borrowing under credit facility ............. — (75,000) 75,000

Repurchase of common stock .......................... (3,453) (48,893) (27,487)

Exercise of employee stock options...................... 22,818 17,621 6,576

Tax benefit from exercise of stock options ................ 5,095 3,376 3,731

Proceeds from issuance of common stock ................. 1,626 1,898 1,782

Purchase of noncontrolling interest ...................... (20,081) — —

Capitalized debt issuance costs ......................... — (1,153) (209)

Net cash provided by (used in) financing activities ....... 6,005 (102,151) 59,393

Net increase in cash and cash equivalents ................... 171,690 6,468 16,145

Cash and cash equivalents at beginning of period ............. 74,710 68,242 52,097

Cash and cash equivalents at end of period .................. $246,400 $ 74,710 $ 68,242

The accompanying notes are an integral part of the consolidated financial statements.

47