Panera Bread 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

modified, are exempt from its requirements. The Company has not recorded a liability for those guarantees issued

after the effective date of the accounting requirements because the fair value of each such lease guarantee was

determined by the Company to be insignificant based on analysis of the facts and circumstances of each such lease

and each such franchisee’s performance, and the Company did not believe it was probable it would be required to

perform under any guarantees at the time the guarantees were issued. The Company has not had to make any

payments related to any of these guaranteed leases. Au Bon Pain or the applicable franchisees continue to have

primary liability for these operating leases. As of December 29, 2009, future commitments under these leases were

as follows (in thousands):

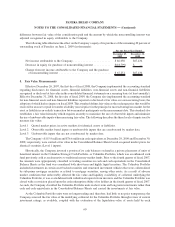

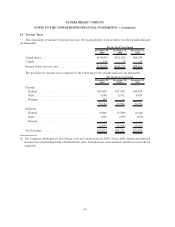

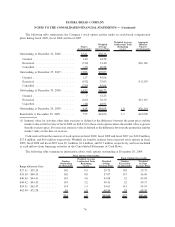

2010 2011 2012 2013 2014 Thereafter Total

$3,975 3,226 3,020 3,013 2,897 13,909 $30,040

Employee Commitments

The Company has executed Confidential and Proprietary Information and Non-Competition Agreements

(“Non-Compete Agreements”) with certain employees. These Non-Compete Agreements contain a provision

whereby employees would be due a certain number of weeks of their salary if their employment was terminated by

the Company as specified in the Non-Compete Agreement. The Company has not recorded a liability for these

amounts potentially due employees. Rather, the Company will record a liability for these amounts when an amount

becomes due to an employee in accordance with the appropriate authoritative literature. As of December 29, 2009,

the total amount potentially owed employees under these Non-Compete Agreements was $12.0 million.

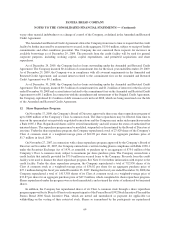

Related Party Credit Agreement

In order to facilitate the opening of the first Panera Bread bakery-cafes in Canada, on September 10, 2008, the

Company’s Canadian subsidiary, Panera Bread ULC, as lender, entered into a Cdn.$3.5 million secured revolving

credit facility agreement with Millennium Bread Inc., (“Millennium”), as borrower, and certain of Millennium’s

present and future subsidiaries (the “Franchisee Guarantors”), who have entered into franchise agreements with

Panera Bread ULC to operate three Panera Bread bakery-cafes in Canada. Covenants under the credit agreement

require Millennium to maintain a certain level of cash equity contributions or subordinated loans from its

shareholders in relation to the principal outstanding under the credit agreement. The borrowings under the credit

agreement bear interest at the per annum rate of 7.58 percent, calculated daily and payable monthly in arrears on the

last business day of each of Panera Bread ULC’s fiscal months. The credit facility, which is collateralized by present

and future property and assets of Millennium and the Franchisee Guarantors, as well as the personal guarantees of

certain individuals, became due on September 9, 2009. On September 9, 2009 the maturity date was extended to

December 9, 2009, on December 10, 2009 the maturity date was extended to February 19, 2010, and on February 22,

2010 the maturity date was extended to March 30, 2010. The credit facility is subject to acceleration upon certain

specified events of default, including breaches of representations or covenants, failure to pay other material

indebtedness or a change of control of Millennium, as defined in the credit agreement. The proceeds from the credit

facility may be used by Millennium to pay costs and expenses to develop and construct the Franchisee Guarantors

bakery-cafes and for their day-to-day operating requirements.

As part of the franchise agreement between Millennium and Panera Bread ULC, Panera Bread ULC developed

and equipped three bakery-cafes as typical Panera Bread bakery-cafes in accordance with the Company’s current

design and construction standards and specifications as applied by Panera Bread ULC, in its sole discretion.

Millennium was required to pay Panera Bread ULC an amount equal to the total cost of development of the bakery-

cafes, which includes any and all costs and expenses incurred by Panera Bread ULC in connection with selection

and development of the bakery-cafes, excluding overhead expenses of Panera Bread ULC. On September 15, 2008,

October 27, 2008, and December 16, 2008, Panera Bread ULC delivered possession of the three bakery-cafes in

Canada to Millennium, which bakery-cafes subsequently opened on October 6, 2008, November 10, 2008, and

January 26, 2009, respectively. The total development cost billed to Millennium for these three bakery-cafes was

66

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)