Panera Bread 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

investment and their subsequent distribution of cash. The Company then utilized this assessment of the underlying

collateral from multiple indicators of fair value, which were then adjusted to reflect the expected timing of

disposition and market risks to arrive at an estimated fair value of the Columbia Portfolio units. During fiscal 2009,

the Company received $5.5 million of cash redemptions, which fully redeemed the Company’s remaining units in

the Columbia Portfolio. The Columbia Portfolio units had an estimated fair value of $0.650 per unit, or $4.1 million,

as of December 30, 2008, and $0.960 per unit, or $23.2 million, as of the date of adopting the fair value accounting

standard, December 26, 2007. Based on the valuation methodology used to determine the fair value, the Columbia

Portfolio was classified within Level 3 of the fair value hierarchy. Realized and unrealized gains/(losses) relating to

the Columbia Portfolio were classified in other (income) expense, net in the Consolidated Statements of Operations.

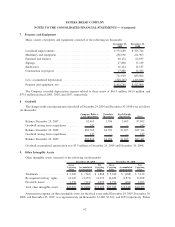

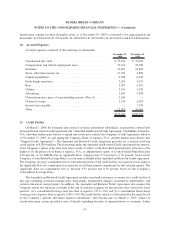

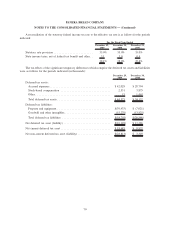

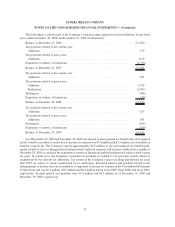

The following table sets forth a summary of the changes in the fair value of the Company’s Level 3 financial asset

for the periods indicated (in thousands):

December 29,

2009

December 30,

2008

For the Fiscal Year Ended

Beginning balance ..................................... $4,126 $23,198

Net realized and unrealized gains (losses)(1) .................. 1,339 (1,910)

Redemptions ......................................... (5,465) (17,162)

Ending balance ....................................... $ — $ 4,126

(1) Includes $2.0 million of losses attributable to the change in unrealized losses relating to the units of the

Columbia Portfolio still held as of December 30, 2008.

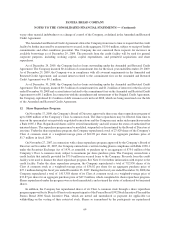

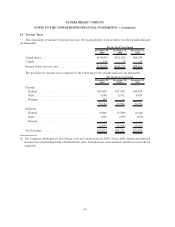

6. Inventories

Inventories consisted of the following (in thousands):

December 29,

2009

December 30,

2008

Food:

Fresh dough facilities:

Rawmaterials........................................ $ 2,573 $ 3,040

Finished goods ....................................... 275 319

Bakery-cafes:

Rawmaterials........................................ 7,304 6,533

Paper goods ............................................. 2,143 2,021

Retail merchandise ........................................ — 46

$12,295 $11,959

61

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)