Panera Bread 2009 Annual Report Download - page 47

Download and view the complete annual report

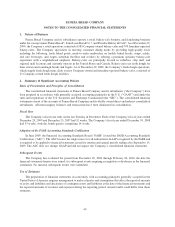

Please find page 47 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.employees. Rather, we will record a liability for these amounts when an amount becomes due to an employee in

accordance with the appropriate authoritative literature. As of December 29, 2009, the total amount potentially

owed employees under these Non-Compete Agreements was $12.0 million.

Related Party Credit Agreement

In order to facilitate the opening of the first Panera Bread bakery-cafes in Canada, on September 10, 2008, our

Canadian subsidiary, Panera Bread ULC, as lender, entered into a Cdn.$3.5 million secured revolving credit facility

agreement with Millennium Bread Inc., or Millennium, as borrower, and certain of Millennium’s present and future

subsidiaries, which we refer to as Franchisee Guarantors, who have entered into franchise agreements with Panera

Bread ULC to operate three Panera Bread bakery-cafes in Canada. Covenants under the credit agreement require

Millennium to maintain a certain level of cash equity contributions or subordinated loans from its shareholders in

relation to the principal outstanding under the credit agreement. The borrowings under the credit agreement bear

interest at the per annum rate of 7.58 percent, calculated daily and payable monthly in arrears on the last business

day of each of Panera Bread ULC’s fiscal month. The credit facility, which is collateralized by present and future

property and assets of Millennium and the Franchisee Guarantors, as well as the personal guarantees of certain

individuals, became due on September 9, 2009. On September 9, 2009 the maturity date was extended to

December 9, 2009, on December 10, 2009 the maturity date was extended to February 19, 2010, and on

February 22, 2010 the maturity date was extended to March 30, 2010. The credit facility is subject to acceleration

upon certain specified events of default, including breaches of representations or covenants, failure to pay other

material indebtedness or a change of control of Millennium, as defined in the credit agreement. The proceeds from

the credit facility may be used by Millennium to pay costs and expenses to develop and construct the Franchisee

Guarantors bakery-cafes and for their day-to-day operating requirements.

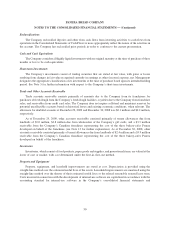

As part of the franchise agreement between Millennium and Panera Bread ULC, Panera Bread ULC developed

and equipped three bakery-cafes as typical Panera Bread bakery-cafes in accordance with our then current design

and construction standards and specifications as applied by Panera Bread ULC, in its sole discretion. Millennium

was required to pay Panera Bread ULC an amount equal to the total cost of development of the bakery-cafes, which

included any and all costs and expenses incurred by Panera Bread ULC in connection with selection and

development of the bakery-cafes, excluding overhead expenses of Panera Bread ULC. On September 15, 2008,

October 27, 2008, and December 16, 2008, Panera Bread ULC delivered possession of the three bakery-cafes in

Canada to Millennium, which bakery-cafes subsequently opened on October 6, 2008, November 10, 2008, and

January 26, 2009, respectively. The total development cost billed to Millennium for these three bakery-cafes was

approximately Cdn.$3.7 million. On April 7, 2009, Millennium requested a Cdn.$3.5 million advance under the

Credit Agreement, which was applied against the outstanding receivable as previously described. The remaining

Cdn.$0.2 million receivable was resolved during fiscal 2009. The Cdn.$3.5 million note receivable from Millen-

nium is included in other accounts receivable in the Consolidated Balance Sheets as of December 29, 2009.

Impact of Inflation

Our profitability depends in part on our ability to anticipate and react to changes in food, supply, labor,

occupancy and other costs. In the past, we have been able to recover a significant portion of inflationary costs and

commodity price increases, including, among other things, fuel, proteins, dairy, wheat, tuna, and cream cheese

costs, through increased menu prices. There have been, and there may be in the future, delays in implementing such

menu price increases, and competitive pressures may limit our ability to recover such cost increases in their entirety.

Historically, the effects of inflation on our net income have not been materially adverse. However, the volatility

recently experienced in fiscal 2008 in certain commodity markets, such as those for wheat, fuel, and proteins, such

as chicken or turkey, may have an adverse effect on us in the future. The extent of the impact will depend on our

ability and timing to increase food prices.

A majority of our associates are paid hourly rates related to federal and state minimum wage laws. Although

we have and will continue to attempt to pass along any increased labor costs through food price increases, there can

be no assurance that all such increased labor costs can be reflected in our prices or that increased prices will be

absorbed by consumers without diminishing to some degree consumer spending at the bakery-cafes. However, we

41