Panera Bread 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

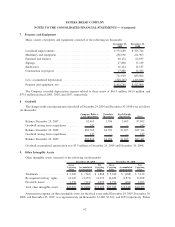

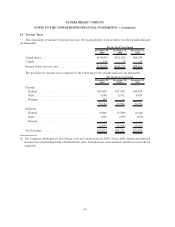

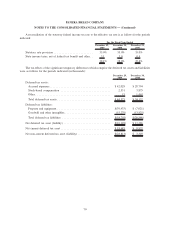

15. Deposits and Other

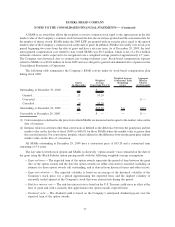

Deposits and other consisted of the following (in thousands):

December 29,

2009

December 30,

2008

Deposits ............................................... $3,800 $2,869

Deferred financing costs .................................... 821 1,125

Deferred income taxes ..................................... — 3,349

Company-owned life insurance program ........................ — 1,031

Note receivable .......................................... — 589

Total deposits and other .................................... $4,621 $8,963

The Company established a company-owned life insurance (“COLI”) program covering a substantial portion

of its employees to help manage long-term employee benefit cost and to obtain tax deductions on interest payments

on insurance policy loans. However, due to tax law changes, the Company froze this program in 1998. Based on

current actuarial estimates, the program is expected to end in 2011.

At December 29, 2009, the cash surrender value of $0.7 million and the insurance policy loans of $0.7 million

related to the COLI program were netted and included in deposits and other assets in the Company’s Consolidated

Balance Sheets. At December 30, 2008, the cash surrender value of $1.7 million, the mortality income receivable of

$1.0 million, and the insurance policy loans $1.7 million, related to the COLI program were netted and included in

deposits and other assets in the Company’s Consolidated Balance Sheets. Mortality income receivable represents

the dividend or death benefits the Company is due from its insurance carrier at the fiscal year end. The insurance

policy loans are collateralized by the cash values of the underlying life insurance policies and required interest

payments at a rate of 9.08 percent for the year ended December 29, 2009. Interest accrued on insurance policy loans

is netted with other COLI related income statement transactions in other (income) expense, net in the Consolidated

Statements of Operations, which netted income of $1.0 million, loss of $0.1 million, and loss of $0.5 million, in

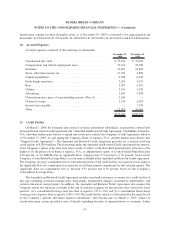

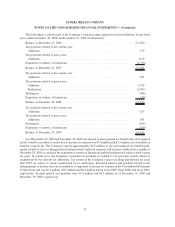

fiscal years 2009, 2008, and 2007, respectively, the components of which are as follows (in thousands):

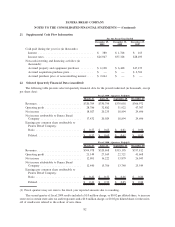

December 29,

2009

December 30,

2008

December 25,

2007

Cash value loss ............................... $1,018 $639 $1,485

Mortlity income .............................. (1,894) (644) (1,283)

Interest (income) expense ....................... (111) 71 292

Total (income) expense, net .................... $ (987) $ 66 $ 494

The cash value loss is the cumulative change in the cash surrender value for the year and is adjusted quarterly.

Mortality income is recorded periodically as charges are deducted from cash value. These amounts are recovered by

the Company through payment of death benefits and mortality dividends received. Interest (income) expense is

recorded on the accrual basis.

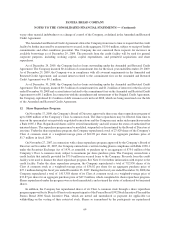

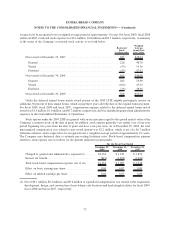

16. Stockholders’ Equity

Common Stock

The holders of Class A common stock are entitled to one vote for each share owned. The holders of Class B

common stock are entitled to three votes for each share owned. Each share of Class B common stock has the same

dividend and liquidation rights as each share of Class A common stock. Each share of Class B common stock is

convertible, at the stockholder’s option, into Class A common stock on a one-for-one basis. At December 29, 2009,

the Company had reserved 2,682,931 shares of its Class A common stock for issuance upon exercise of awards

72

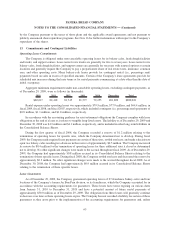

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)