Panera Bread 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and the straight-line rent as a lease obligation. Many of our leases contain provisions that require additional rental

payments based upon bakery-cafe sales volume (“contingent rent”). Contingent rent is accrued each period as the

liability is incurred, in addition to the straight-line rent expense noted above. This results in variability in occupancy

expense as a percentage of revenues over the term of the lease in bakery-cafes where we pay contingent rent.

In addition, we record landlord allowances for non-structural tenant improvements as deferred rent, which is

included in accrued expenses or deferred rent in the Consolidated Balance Sheets based on their short-term or long-

term nature. These landlord allowances are amortized over the reasonably assured lease term as a reduction of rent

expense. Also, leasehold improvements are amortized using the straight-line method over the shorter of their

estimated useful lives or the related reasonably assured lease term.

Management makes judgments regarding the probable term for each lease, which can impact the classification

and accounting for a lease as capital or operating, the rent holiday and/or escalations in payments that are taken into

consideration when calculating straight-line rent and the term over which leasehold improvements for each bakery-

cafe and fresh dough facility is amortized. These judgments may produce materially different amounts of

depreciation, amortization and rent expense than would be reported if different assumed lease terms were used.

Stock-Based Compensation

We account for stock-based compensation in accordance with the accounting standard for share based

payment, which requires us to measure and record compensation expense in our consolidated financial statements

for all stock-based compensation awards using a fair value method. We maintain several stock-based incentive plans

under which we may grant incentive stock options, non-statutory stock options and stock settled appreciation rights,

referred to collectively as option awards, to certain directors, officers, employees and consultants. We also may

grant restricted stock and restricted stock units and we offer a stock purchase plan through which employees may

purchase our Class A common stock each calendar quarter through payroll deductions at 85 percent of market value

on the purchase date and we recognize compensation expense on the 15 percent discount.

For option awards, fair value is determined using the Black-Scholes option pricing model, while restricted

stock is valued using the closing stock price on the date of grant. The Black-Scholes option pricing model requires

the input of subjective assumptions including the estimate of the following:

•Expected term — The expected term of the option awards represents the period of time between the grant

date of the option awards and the date the option awards are either exercised or canceled, including an

estimate for those option awards still outstanding, and is derived from historical terms and other factors.

•Expected volatility — The expected volatility is based on an average of the historical volatility of our stock

price, for a period approximating the expected term, and the implied volatility of externally traded options of

our stock that were entered into during the period.

•Risk-free interest rate — The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the

time of grant and with a maturity that approximates the option awards expected term.

•Dividend yield — The dividend yield is based on our anticipated dividend payout over the expected term of

the option awards.

Additionally, we use historical experience to estimate the expected forfeiture rate in determining the stock-

based compensation expense for these awards. Changes in these assumptions could produce significantly different

estimates of the fair value of stock-based compensation and consequently, the related amount of stock-based

compensation expense recognized in the Consolidated Statements of Operations. The fair value of the awards is

amortized over the vesting period. Option awards and restricted stock generally vest ratably over a four-year period

beginning two years from the date of grant and option awards generally have a six-year term.

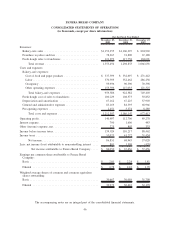

Contractual Obligations and Other Commitments

We currently anticipate 80 to 90 system-wide bakery-cafe openings in fiscal 2010. We expect to fund our

capital expenditures principally through internally generated cash flow and available borrowings under our existing

credit facility, if needed.

39