Panera Bread 2009 Annual Report Download - page 62

Download and view the complete annual report

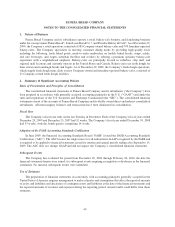

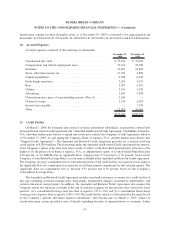

Please find page 62 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company offers a stock purchase plan where employees may purchase the Company’s common stock each calendar

quarter through payroll deductions at 85 percent of market value on the purchase date and the Company recognizes

compensation expense on the 15 percent discount.

For option awards, fair value is determined using the Black-Scholes option pricing model, while restricted

stock is valued using the closing stock price on the date of grant. The Black-Scholes option pricing model requires

the input of subjective assumptions. These assumptions include estimating the expected term until the option

awards are either exercised or canceled, the expected volatility of the Company’s stock price, for a period

approximating the expected term, the risk-free interest rate with a maturity that approximates the option awards

expected term, and the dividend yield based on the Company’s anticipated dividend payout over the expected term

of the option awards. Additionally, the Company uses its historical experience to estimate the expected forfeiture

rate in determining the stock-based compensation expense for these awards. The fair value of the awards is

amortized over the vesting period. Options and restricted stock generally vest ratably over a four-year period

beginning two years from the date of grant and options generally have a six-year term. Stock-based compensation

expense was included in general and administrative expenses in the Consolidated Statements of Operations.

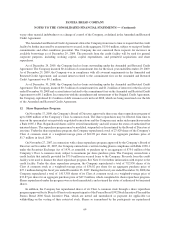

Asset Retirement Obligations

The Company recognizes the future cost to comply with lease obligations at the end of a lease as it relates to

tangible long-lived assets in accordance with the accounting standard for the asset retirement and environmental

obligations in the Company’s consolidated financial statements and accompanying notes. A liability for the fair

value of an asset retirement obligation along with a corresponding increase to the carrying value of the related long-

lived asset is recorded at the time a lease agreement is executed. The Company amortizes the amount added to

property and equipment and recognizes accretion expense in connection with the discounted liability over the life of

the respective lease. The estimated liability is based on experience in closing bakery-cafes and the related external

cost associated with these activities. Revisions to the liability could occur due to changes in estimated retirement

costs or changes in lease term.

Variable Interest Entities

The Company applies the accounting standard for consolidations in the Company’s consolidated financial

statements and accompanying notes to all franchise entities, which operate the Company’s franchise-operated

bakery-cafes, in which the Company holds an interest. Generally a variable interest entity (“VIE”) is an entity with

one or more of the following characteristics: (a) the total equity investment at risk is not sufficient to permit the

entity to finance its activities without additional subordinated financial support; (b) as a group the holders of the

equity investment at risk lack (i) the ability to make decisions about an entity’s activities through voting or similar

rights, (ii) the obligation to absorb the expected losses of the entity; or (c) the equity investors have voting rights that

are not proportional to their economic interests and substantially all of the entity’s activities either involve, or are

conducted on behalf of, an investor that has disproportionately fewer voting rights. The accounting standard for

consolidation requires a VIE to be consolidated in the financial statements of the entity that is determined to be the

primary beneficiary of the VIE.

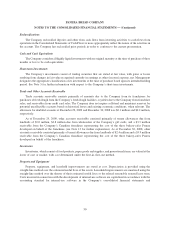

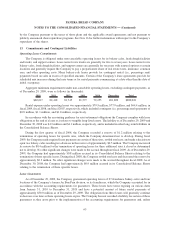

The Company’s determination of the primary beneficiary of each VIE requires judgment and is based on an

analysis of all relevant facts and circumstances including: (a) the existence of a principal-agency relationship

between the Company and the franchisee; (b) the relationship and significance of the activities of the VIE to the

Company and the franchisee; (c) the Company and the franchisee’s exposure to the expected losses of the VIE; and

(d) the design of the VIE. The Company does not posses any ownership interests in franchise entities. The franchise

agreements are designed to provide the franchisee with key decision-making ability to enable it to oversee its

operations and to have a significant impact on the success of the franchise, while the Company’s decision-making

rights are related to protecting its brand. Based upon its analysis of all the relevant facts and considerations of the

56

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)