Panera Bread 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.franchise entities, the Company has concluded that it is not the primary beneficiary of the entities and therefore,

these entities have not been consolidated.

Accounting Standards Issued Not Yet Adopted

In June 2009, the FASB issued authoritative guidance on accounting for transfers of financial assets, which is

effective for reporting periods beginning after November 15, 2009. This new guidance limits the circumstances in

which a financial asset may be de-recognized when the transferor has not transferred the entire financial asset or has

continuing involvement with the transferred asset. The concept of a qualifying special-purpose entity, which had

previously facilitated sale accounting for certain asset transfers, is removed by this new guidance. The Company

expects that the adoption of this new guidance will not have a material effect on its financial position or results of

operations.

In June 2009, the FASB issued authoritative guidance on accounting for variable interest entities (“VIE”),

which is effective for reporting periods beginning after November 15, 2009, and changes the process for how an

enterprise determines which party consolidates a VIE, to a primarily qualitative analysis. The party that consol-

idates the VIE (the primary beneficiary) is defined as the party with (1) the power to direct activities of the VIE that

most significantly affect the VIE’s economic performance and (2) the obligation to absorb losses of the VIE or the

right to receive benefits from the VIE. Upon adoption, reporting enterprises must reconsider their conclusions on

whether an entity should be consolidated and should a change result, the effect on net assets will be recorded as a

cumulative effect adjustment to retained earnings. The Company expects that the adoption of this new guidance will

not have a material effect on its financial position or results of operations.

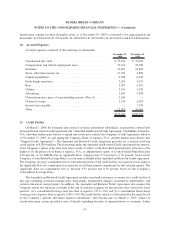

3. Business Combinations

On June 21, 2007, the Company purchased substantially all of the assets of ten bakery-cafes and the area

development rights for certain markets in Illinois from its area developer, SLB of Central Illinois, L.L.C., for a

purchase price of approximately $16.6 million, net of the $0.4 million contractual settlement charge determined in

accordance with the accounting guidance for business combinations, plus approximately $0.1 million in acquisition

costs. Approximately $16.2 million of the acquisition price was paid with cash on hand at the time of closing while

the remaining approximately $0.8 million was paid with interest in fiscal 2008. The Consolidated Statements of

Operations include the results of operations from the operating bakery-cafes from the date of the acquisition. The

pro forma impact of the acquisition on prior periods is not presented, as the impact is not material to reported results.

The Company allocated the purchase price to the tangible and intangible assets acquired in the acquisition at their

estimated fair values with the remainder allocated to tax deductible goodwill as follows: $0.2 million to inventories,

$5.1 million to property and equipment, $7.1 million to intangible assets, which represents the fair value of re-

acquired territory rights and favorable lease agreements, $0.6 million to liabilities, and $4.9 million to goodwill. As

a result of the acquisition, the Company incurred a contractual settlement charge of $0.4 million pursuant to the

accounting guidance on business combinations, reflecting the termination of franchise agreements for certain

bakery-cafes that operated at a royalty rate lower than the Company’s current market royalty rates. The charge is

reported as other (income) expense, net in the Consolidated Statements of Operations.

On June 21, 2007, the Company also purchased substantially all of the assets of 22 bakery-cafes and the area

development rights for certain markets in Minnesota from its area developer, SLB of Minnesota, L.L.C., for a

purchase price of approximately $18.3 million, net of the $0.7 million contractual settlement charge determined in

accordance with the accounting guidance for business combinations, plus approximately $0.1 million in acquisition

costs. Approximately $18.1 million of the acquisition price was paid with cash on hand at the time of closing while

the remaining approximately $0.9 million was paid with interest in fiscal 2008. The Consolidated Statements of

Operations include the results of operations from the operating bakery-cafes from the date of the acquisition. The

pro forma impact of the acquisition on prior periods is not presented, as the impact is not material to reported results.

The Company allocated the purchase price to the tangible and intangible assets acquired in the acquisition at their

57

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)