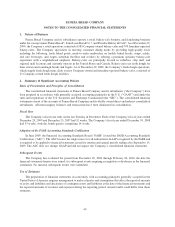

Panera Bread 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

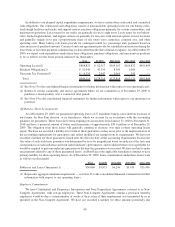

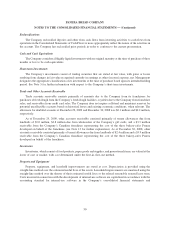

In addition to our planned capital expenditure requirements, we have certain other contractual and committed

cash obligations. Our contractual cash obligations consist of noncancelable operating leases for our bakery-cafes,

fresh dough facilities and trucks, and support centers; purchase obligations primarily for certain commodities; and

uncertain tax positions. Lease terms for our trucks are generally for six to eight years. Lease terms for our bakery-

cafes, fresh dough facilities, and support centers are generally for ten years with renewal options at most locations

and generally require us to pay a proportionate share of real estate taxes, insurance, common area, and other

operating costs. Many bakery-cafe leases provide for contingent rental (i.e. percentage rent) payments based on

sales in excess of specified amounts. Certain of our lease agreements provide for scheduled rent increases during the

lease terms or for rental payments commencing at a date other than the date of initial occupancy. As of December 29,

2009, we expect cash expenditures under these lease obligations, purchase obligations, and uncertain tax positions

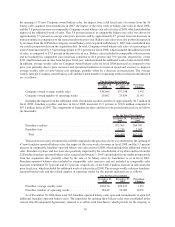

to be as follows for the fiscal periods indicated (in thousands):

Total In 2010 2011-2012 2013-2014 After 2014

Operating Leases(1) ..................... $888,821 $ 82,017 $164,163 $160,832 $481,809

Purchase Obligations(2) .................. $ 52,940 43,350 8,590 1,000 —

Uncertain Tax Positions(3) ................ $ 4,355 2,947 1,065 343 —

Total .............................. $946,116 $128,314 $173,818 $162,175 $481,809

(1) See Note 13 to the consolidated financial statements for further information with respect to our operating leases.

(2) Relates to certain commodity and service agreements where we are committed as of December 29, 2009 to

purchase a fixed quantity over a contracted time period.

(3) See Note 14 to the consolidated financial statements for further information with respect to our uncertain tax

positions.

Off-Balance Sheet Arrangements

As of December 29, 2009, we guaranteed operating leases of 27 franchisee bakery-cafes and four locations of

our former Au Bon Pain division, or its franchisees, which we account for in accordance with the accounting

guidance for guarantees. These leases have terms expiring on various dates from January 31, 2010 to December 31,

2018 and have a potential amount of future rental payments of approximately $30.0 million as of December 29,

2009. The obligation from these leases will generally continue to decrease over time as these operating leases

expire. We have not recorded a liability for certain of these guarantees as they arose prior to the implementation of

the accounting requirements for guarantees and, unless modified, are exempt from its requirements. We have not

recorded a liability for those guarantees issued after the effective date of the accounting requirements because the

fair value of each such lease guarantee was determined by us to be insignificant based on analysis of the facts and

circumstances of each such lease and each such franchisee’s performance, and we did not believe it was probable we

would be required to perform under any guarantees at the time the guarantees were issued. We have not had to make

any payments related to any of these guaranteed leases. Au Bon Pain or the applicable franchisees continue to have

primary liability for these operating leases. As of December 29, 2009, future commitments under these leases were

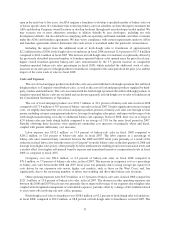

as follows (in thousands):

Total In 2010 2011-2012 2013-2014 After 2014

Subleases and Lease Guarantees(1) .............. $30,040 $3,975 $6,246 $5,910 $13,909

(1) Represents aggregate minimum requirement — see Note 13 to the consolidated financial statements for further

information with respect to our operating leases.

Employee Commitments

We have Confidential and Proprietary Information and Non-Competition Agreements, referred to as Non-

Compete Agreements, with certain employees. These Non-Compete Agreements contain a provision whereby

employees would be due a certain number of weeks of their salary if their employment was terminated by us as

specified in the Non-Compete Agreement. We have not recorded a liability for these amounts potentially due

40