Panera Bread 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

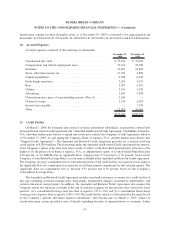

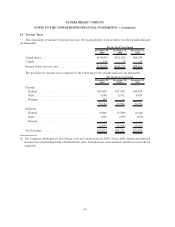

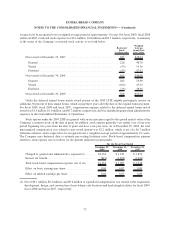

14. Income Taxes

The components of income before income taxes, by tax jurisdiction, were as follows for the periods indicated

(in thousands):

December 29,

2009

December 30,

2008

December 25,

2007

For the Fiscal Year Ended

UnitedStates................................. $139,005 $110,220 $88,399

Canada ..................................... 919 (3) 63

Income before income taxes...................... $139,924 $110,217 $88,462

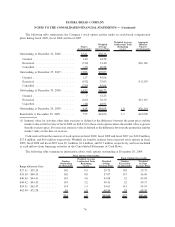

The provision for income taxes consisted of the following for the periods indicated (in thousands):

December 29,

2009

December 30,

2008(1)

December 25,

2007

For the Fiscal Year Ended

Current:

Federal ................................... $24,428 $37,188 $30,438

State..................................... 5,390 8,192 6,453

Foreign ................................... 304 — —

30,122 45,380 36,891

Deferred:

Federal ................................... 20,006 (3,589) (4,624)

State..................................... 2,945 (519) (833)

Foreign ................................... — — —

22,951 (4,108) (5,457)

Tax Provision ................................ $53,073 $41,272 $31,434

(1) The Company developed its first bakery-cafes in Canada in fiscal 2008. Fiscal 2008 current and deferred

income taxes consisted primarily of United States taxes. Canadian taxes were nominal, and thus were not shown

separately.

69

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)